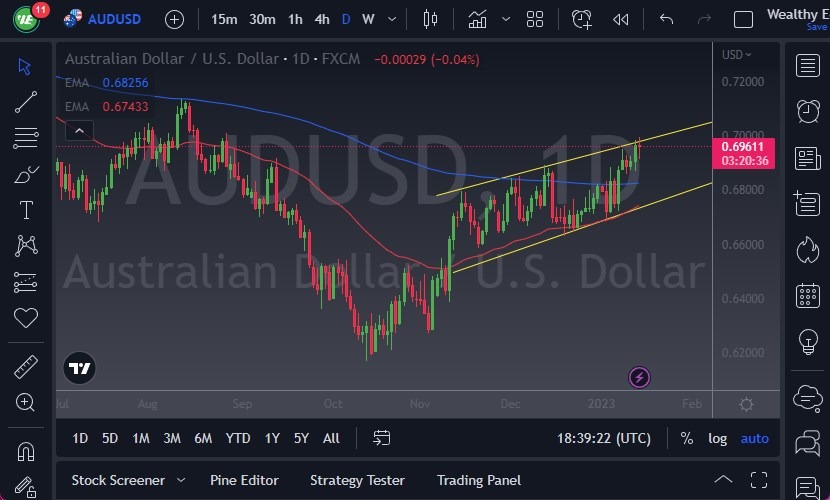

- The AUD/USD has pierced the top of the trading channel it’s been in for a while on Friday, which of course is a bullish sign.

- However, we have given back all the gains to form a relatively unchanged candlestick.

- The question at this point is whether we are running out of momentum, and are getting ready to pull back, or are we just taking a bit of a breather.

At this point, we are more likely than not going to see a lot of noisy behavior, and it would not surprise me at all to see the market pullback to get back into the overall channel, as it has been feeling reliable. It’s probably also worth noting that we try to get above the 0.70 level during the day, and it did of course offer a bit of resistance. You would expect that since it is an area where we see a lot of noise in the past and is also a psychologically important big figure number. In other words, it does make a lot of sense that there would be a bit of a barrier there, so the pullbacks certainly would not have caught many people off guard.

Buyers are Still Underneath

Now that we have formed a neutral candlestick, it becomes a bit of a “binary trade”, meaning that if we break above the top of it, ostensibly the 0.70 level, then the market can take off to the upside. However, if we break down below the bottom of the candlestick, then I do think that we get back down to the channel that we had been in, reaching down toward the 200-Day EMA.

It’s probably worth noting that the 50-Day EMA is hanging around the uptrend line of that channel and is trying to cross above the 200-Day EMA, kicking off the “golden cross” that a lot of longer-term traders will be paying close attention to. With this, the market is likely going to see a lot of buyers underneath just waiting to get involved. As I currently watch the chart, we have been chopping back and forth all day, but it certainly looks as if the buyers are still there underneath this market, especially as there is an idea that the global economy is going to pick back up soon.

Ready to trade our Forex daily forecast? We’ve shortlisted the largest forex brokers in Australia for you.