Today's recommendation on the USD/TRY

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.60 level.

- Place a stop loss point to close below the 18.35 support level

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support levels.

The price of the USD/TRY stabilized, which runs in isolation from the real demand for the dollar. The price of the lira has stabilized despite the discrepancy between the tightening monetary policy in the United States of America and the stimulus policy pursued by the Central Bank of Turkey. Where the central bank, which lowered the interest rate over four consecutive meetings before fixing it in the current December meeting, intervened in direct and indirect ways to control the lira's declines, which do not reflect its true value against the dollar.

The latest of these measures was revealed by a report published by Bloomberg Agency, where it was stated that the Central Bank of Turkey has intensified the demand from commercial banks in the country to refrain from any large purchases in dollars that may be made for the benefit of corporate clients of those banks. This restriction would last until the end of this year, according to several sources that Bloomberg reported informing them of the matter.

The central bank aims to reduce the demand for dollars from companies that are trying to accumulate foreign currencies before the end of the year, amid expectations of new movements in the price of the lira. According to a Bloomberg report, the country's central bank declined to comment. It is noteworthy that the Turkish lira recorded record levels of decline at the beginning of this week.

USD/TRY Technical Analysis

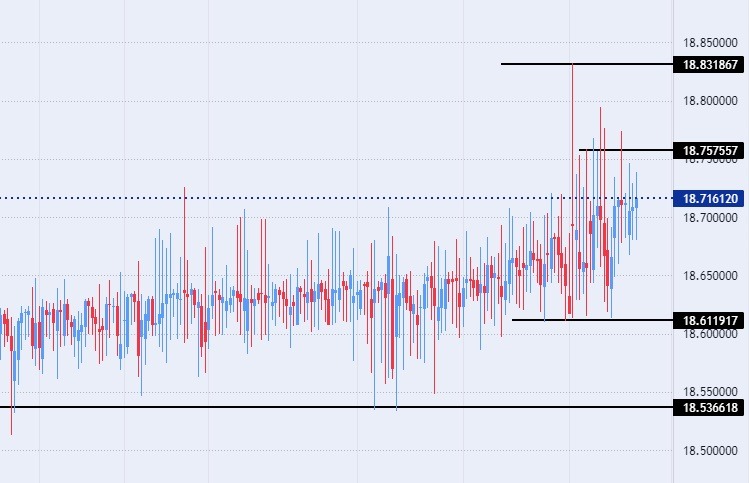

On the technical front, the dollar pair stabilized against the Turkish lira without major changes, after it recorded new highs during this week's trading, as the dollar rose to record 18.83 liras. Before retreating to the same limited trading range in which the pair has settled for a period of more than two months since mid-October.

Currently, the USD/TRY is trading above the support levels of 18.60 and 18.50, respectively. On the other hand, the pair is trading below the resistance level at 18.83, which represents the highest price for the pair recorded in 2022. The pair is also trading below the psychological resistance levels at 19.00.

The TRY/YSD trades above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend of the pair. The price trades between these averages on the four-hour time frame, as well as the lower time frames, in a sign of the divergence recorded by the pair in the medium term.

Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.