Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.50 level.

- Place a stop loss point to close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 18.99.

Best-selling entry points

- Entering a sell order pending order from the 18.99 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The exchange rate of the TRY/USD has maintained its stability without change. Investors followed the statements of the Minister of Finance in the Kingdom of Saudi Arabia, who said that the Kingdom will place a deposit of about $ 5 billion in the Turkish Central Bank during the next few days, as he made clear that the countries are in the last stages of the negotiation. The agreement comes to show a significant improvement in relations between Turkey and Saudi Arabia at the present time.

It is noteworthy that the Central Bank of Turkey is suffering from a decline in the volume of foreign currencies, of which the bank lost a large part in an attempt to preserve the value of the lira from the decline. Meanwhile, reports published early revealed that the lira’s decline during the current year, which exceeded 28%, was not a bad thing for all sectors, as the tourism sector in the country recorded a great recovery during the current year. Turkey recorded the influx of large numbers of tourists that the country had not recorded since the pre-lockdown stage due to Covid-19 in 2020. The weak currency attracted large numbers of middle European economies such as Romania and Bulgaria, which contributed to the recovery of a sector that witnessed great damage during the past two years.

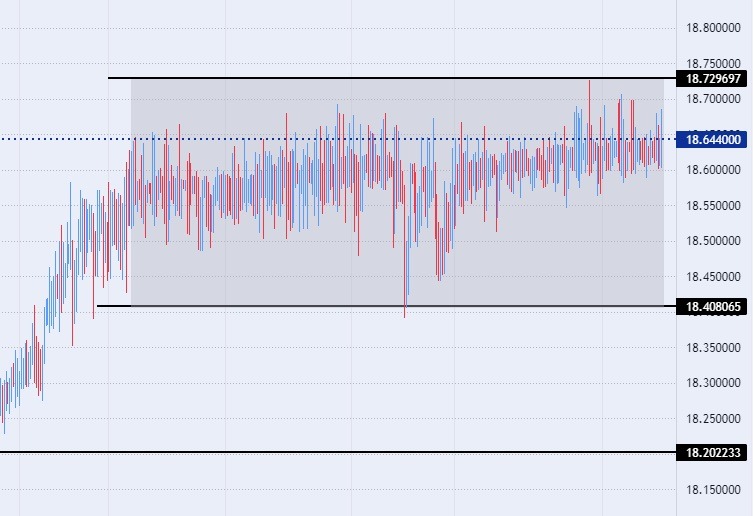

TRY/USD Technical Analysis

On the technical front, the Turkish lira pair stabilized against the dollar, without major changes during today's trading. As the pair did not exit within the narrow trading range that the pair settled more than two months ago. The levels of 18.40 and 18.20 are still the closest support lines for the pair, respectively. While the pair is trading below the resistance level at 18.72, which is the highest recorded peak for the pair, as well as the psychological resistance at 19.00.

In the meantime, the US dollar pair traded against the Turkish lira above the moving averages 50, 100, and 200 on the daily time frame. This indicates the general bullish trend of the viscosity, while the price traded between these averages on the four-hour time frame as well as on the 60-minute time frame, in a sign of the divergence recorded by the pair over the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.