Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.50 level.

- Place a stop loss point to close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 18.99.

Best-selling entry points

- Entering a sell order pending order from the 18.99 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The exchange rate of the TRY/USD has maintained its stability without change. The official institutions of the state are still celebrating the first decline in inflation since the middle of last year. This happened after the data revealed that inflation fell in November to 84.39% compared to 85.51% in October, which is a higher level recorded in 24 years.

The Turkish Central Bank cut the interest rate for the fourth time in a row during the month of November, as it dropped the interest rate to single digits, as the Turkish president was pushing them in this direction. Recep Tayyip Erdogan believes that lowering the interest rate encourages investment without attracting hot money from abroad, in contrast to the usual theories applied by central banks around the world. The Turkish lira had lost about 28% of its value during the current year, before it stopped declining during the past two months, with the support of direct or indirect intervention from the Turkish Central Bank, which maintained the price of the lira at the current levels.

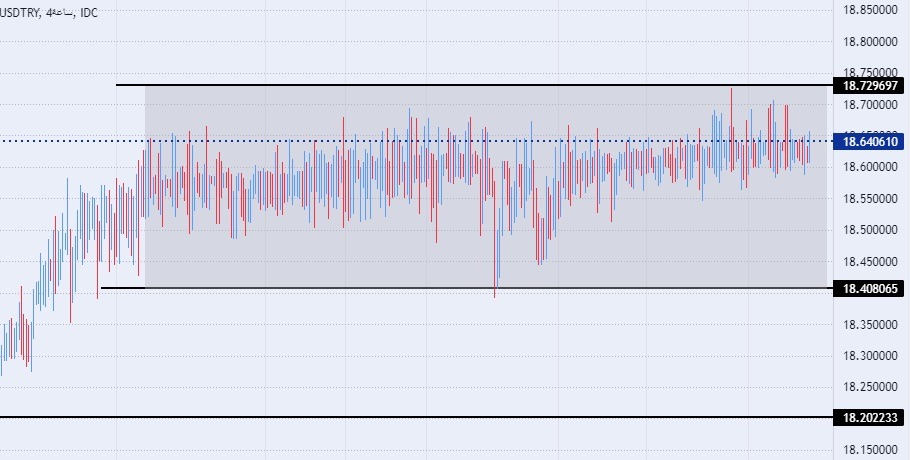

TRY/USD Technical Analysis

On the technical front, the Turkish lira pair against the dollar maintained its stability during today's trading. The pair continues to trade within the narrow trading range in which the pair has settled for nearly two months. The pair is trading above support levels, which are concentrated at 18.40 and 18.20, respectively. On the other hand, the pair is trading below the resistance level at 18.72, which is the highest recorded peak for the pair, as well as the psychological resistance at 19.00.

In the meantime, the US dollar pair against the Turkish lira traded above the moving averages 50, 100, and 200 on the daily time frame, indicating the general bullish trend of the dollar against the lira, while the price traded between these averages on the four-hour time frame as well as on the 50-minute time frame in a sign of the divergence recorded by the pair in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers to check out.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers to check out.