- Since the start of this week's trading, the price of the USD/JPY currency pair is settling lower around the support level 146.08 amid selling operations.

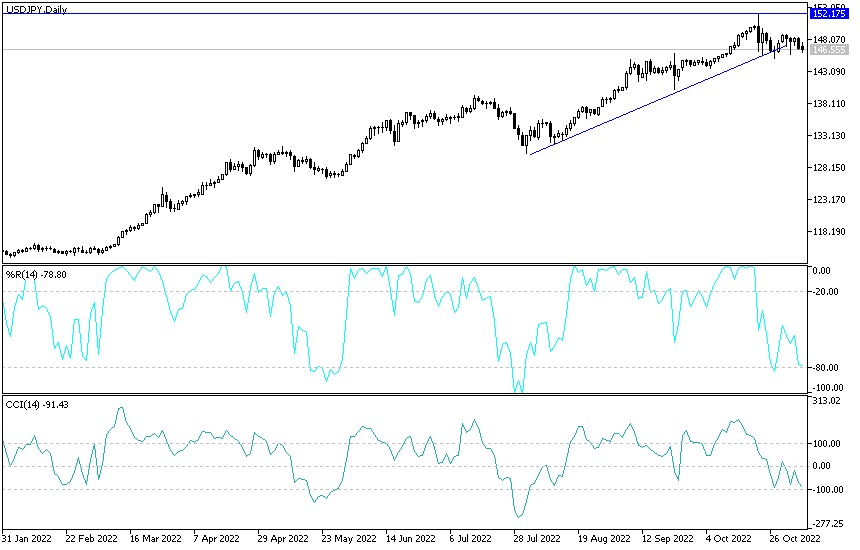

- According to the performance on the daily chart below, the price of the USD/JPY currency pair is in the process of breaking the general upward trend.

- The bears may need to move further downwards, and it will be support levels 145.40 and 142.00 to confirm the break of the general trend to the downside.

- On the other hand, the bulls should move towards the resistance 148.60 to continue the bullish outlook.

I expect the price of the USD/JPY currency pair to remain stable in a narrow range until the US inflation figures are announced and the reaction to the results of the midterm elections in the United States.

On the other hand, after the announcement of the latest US jobs numbers. Former New York Fed President Bill Dudley said the Fed "hasn't done anything" in easing the US labor market even after four consecutive hikes of 75 basis points. Dudley, the chair of the Bretton Woods Committee, said at a conference on the future of finance in Singapore on Monday that Friday's US jobs report showing a 261,000 increase in payrolls and a slight increase in unemployment in October "does not correspond to a labor market decline."

He added, “There is a lot of work to be done, and unfortunately, it will cause a lot of pain for the rest of the world because as the Fed tightens, the dollar is rising, which puts more pressure on other emerging market economies - especially those that have the lots of dollar debt.

The pain of the US dollar has already been evident as currencies across the emerging and developed world are taking a beating, putting pressure on central bankers to rise or intervene in the markets; or both. Meanwhile, growth and debt risks have put many economies on a different policy path, with the United Kingdom, Australia, and Canada among those moving significantly away from the Fed's path. "The Fed's reaction to all of this is, really, really sorry we're causing you all the pain, but we have to take care of our core problem, which is inflation in the US - and get it back to 2%," Dudley added.

Fed Chair Jerome Powell wants to “take enough medication today so that inflation expectations don’t go unchallenged, so he won’t have to do something really harsh later on,” the former Fed official said. Dudley also said the US central bank was "too slow" to tighten, and this was evident in the four massive increases it had to make. "We are at the beginning of that mission" to tighten policy enough to slow the economy and bring down inflation, he said. "The Fed actually hasn't done anything yet in terms of easing the labor market."

Will the Fed boost its 2% target?

Dudley is skeptical, as "people might see that doesn't enhance credibility." Asked about stability in US financial markets, Dudley said "concerns are very low" as there has been a lot of focus on supporting the banking system since the global financial crisis and the balance sheets of households and businesses are in a much better place.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.