The USD/CAD has moved lower after hitting a short-term high on Monday, the downwards momentum has returned the currency pair back to its recent bearish mode.

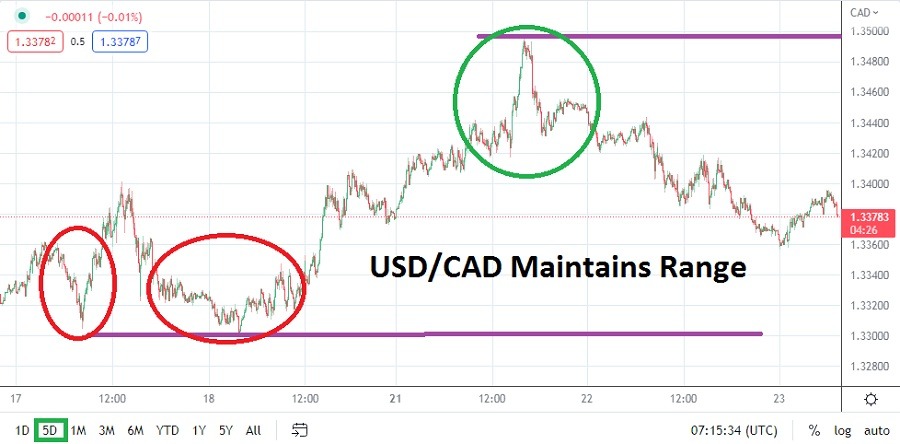

Choppy trading is one way of explaining the USD/CAD over the past week. After touching a low last Wednesday around the 1.32260 ratios, the USD/CAD climbed higher and by this Monday was testing the 1.34970 levers. As of this morning, the USD/CAD is near the 1.33770 mark with a rather quick trading being displayed. The development of lower price action is intriguing in the USD/CAD.

The Move Lower the Past Two Days in the USD/CAD reflects other Major Currencies

The rather up-and-down movement within the USD/CAD the past handful of days reflects many of the major currency pairs. Financial houses are dealing with nervous trading sentiment and a lack of clarity from the U.S. Federal Reserve. Canadian Retail Sales numbers came in weaker than expected yesterday, which gave added ‘life’ to the notion Canada is suffering from recessionary pressures. Today the U.S. will publish important Services and Manufacturing PMI results, along with New Home Sales statistics.

The choppy conditions of the USD/CAD reflect the lack of clarity financial houses have, but also may be part of trying to find a ‘fair’ equilibrium of value. The long-term bullish trend of the USD/CAD has seen sudden bearish momentum certainly developed since the middle of October. However, the ‘new’ bearish trajectory has not been a one-way avenue, reversals have flourished. The ability of the USD/CAD to trade lower the past couple of days after seeing a technical high on Monday shows there is a battle of sentiment still taking place.

Weaker than expected U.S Data today should affect the USD/CAD if it occurs

- If U.S. economic data comes in weaker than forecasted later today, this could fuel the selling of the USD/CAD, but traders need to keep in mind tomorrow’s holiday in the U.S. because trading volumes will become quite thin.

- Traders pursuing the USD/CAD today should be looking for quick-hitting results and not intend on keeping positions open overnight.

Having moved higher early this Monday, the USD/CAD has seemingly run into resistance the past day and a half. The downturn in the USD/CAD may be an indication financial houses still suspect weaker than expected U.S. economic data is likely. They may be proven wrong and this could result in losses for those selling the USD/CAD if stop losses are not used properly. However, if the data is worse than expected, selling the USD/CAD may remain rather enticing considering the lows demonstrated in the past week of trading which may become attractive take profit targets for wagers seeking downward momentum to develop again.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.33975

Current Support: 1.33675

High Target: 1.34610

Low Target: 1.33010

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.