Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Enable a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The Turkish lira stabilized against the US dollar during the early trading this morning, as the price of the Turkish currency did not witness any changes against the US dollar. It fell against the major currencies since yesterday, after the announcement of the minutes of the Federal Reserve meeting. It is expected that the interest rate will be raised by only 50 basis points, compared to about 75 basis points in the previous meeting.

On the other hand, investors are waiting for the Turkish Central Bank to issue the interest decision during today's meeting. Expectations indicate the possibility of reducing the interest rate in the country to reach 9.5%, in response to the desire of Turkish President Recep Tayyip Erdogan, who effectively controls the monetary policy in the country. The Turkish president had previously encouraged a reduction in the interest rate to the single digits, after a series of interest rate cuts followed by the Turkish Central Bank during the past months. There is no expectation that major changes will occur in the exchange rate of the lira against the dollar. This is considering the Turkish Central Bank's intervention in the markets to support the local currency, fixing its price unchanged for nearly two months.

TRY/USD Technical Analysis

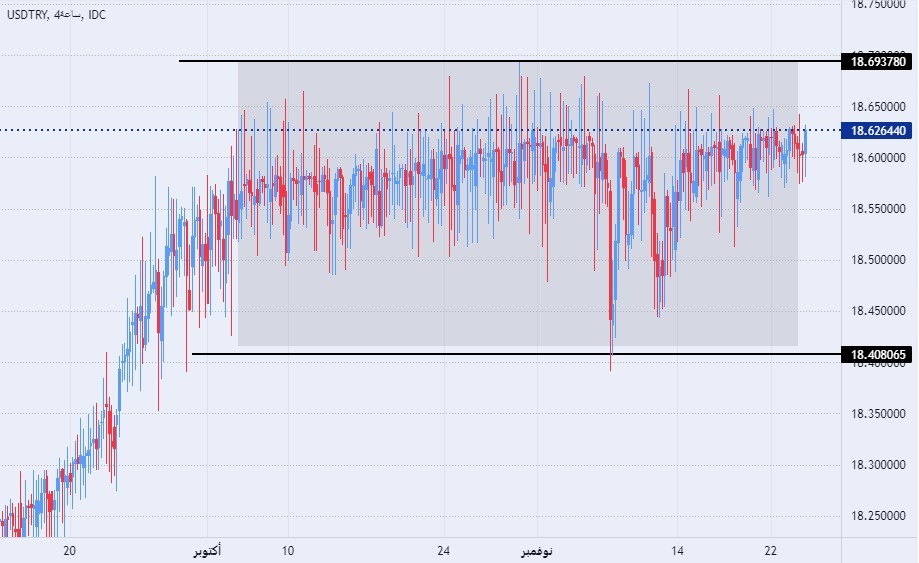

On the technical front, the Turkish lira pair stabilized against the dollar, recording slight changes within a narrow range that has continued for nearly two months. 50 minutes, indicating the divergence that the pair is recording over the medium term. The pair maintained its trading within the rectangle range in the four-hour time frame, which is shown on the attached chart. The price settled on the highest support levels, which are concentrated at 18.40 and 18.20 levels, respectively. On the other hand, the pair is trading below the 18.70 resistance level as well as the psychological resistance at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.