Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50.

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Enable a short position with a pending order from levels of 18.99.

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The price of the Turkish lira varied against the US dollar during early trading this morning, Wednesday. The pair continued trading with limited changes amid the Turkish Central Bank's support for the local currency to prevent its fall.

In the meantime, the price of gold in Turkey recorded its highest level this week, after the price of a gram of gold reached 1056 Turkish liras, despite the current declines in the price of gold in Turkey. Analysts considered these rises a strong indication of the deterioration of the price of the lira and the decline in the confidence of Turkish citizens in their local currency as savings holders are looking for any valuable financial assets as an alternative to holding savings in the local currency.

It is noteworthy that the divergence of fiscal policy between the Turkish Central Bank, which stimulates monetary policy by pumping more money into the markets against the US dollar. This tightens monetary policy and is the most prominent factor in the decline of the lira during this year, with the Turkish President’s insistence to reduce the interest rate to the single digits despite the rate of high inflation.

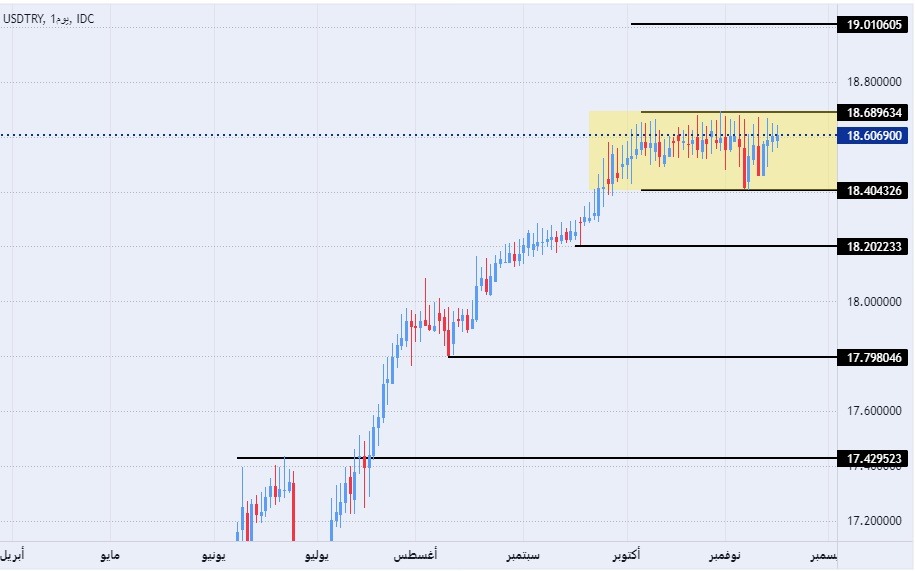

TRY/USD Technical Analysis

On the technical front, the Turkish lira stabilized against the dollar, as the pair maintained its stability within a narrow trading range that has continued for several weeks, as the pair settled within the rectangle range shown on the attached chart on today's time frame. The pair maintained its lowest levels of support, which are concentrated at 18.40 and 18.20 levels, respectively.

On the other hand, the lira is trading below the resistance level of 18.70, which is the highest level recorded by the pair this year, as well as the psychological resistance at 19.00. At the same time, the pair traded above the 50, 100, and 200 moving averages on the daily time frame, as the pair recorded a bounce from the 50 moving average. The price is trading between these averages on the four-hour time frame as well as on the 50-minute time frame, in an indication of the divergence recorded by the pair in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.