Due to the recovery of the US dollar, gold futures settled lower. This is after moving in a narrow range, as investors weighed possible moves by the Federal Reserve regarding raising US interest rates in the coming months. Investors also focused on developments on the geopolitical front in the aftermath of the missile explosion in Poland. Today, the XAU/USD gold price is settling around the $1760 level, after strong recent gains, reaching the $1786 resistance, the highest level of gold price in three months.

For his part, US President Joe Biden said it was "unlikely" that the explosion in Poland was caused by a missile fired from Russian territory. Markets also pointed to the ECB's comments in the Financial Stability Report, as the ECB said in its report that risks to financial stability in the Eurozone increased amid rising inflation and lower economic growth.

Financial Conditions Tighten

The European Central Bank noted that financial conditions were tightening as central banks took action to combat inflation. As inflation rises and economic growth declines, households, businesses, and governments with debt become more vulnerable. Moreover, it increases the pressures of the financial markets and tests the resilience of investment funds. The review added: "All of these vulnerabilities could be exposed simultaneously, potentially reinforcing each other."

In US economic news, Commerce Department data showed US retail sales rose 1.3% in October after remaining unchanged in September. Economists had expected retail sales to jump 1%. Meanwhile, the Federal Reserve released a separate report unexpectedly showing a slight decline in US industrial production in the month of October.

The Fed added that US industrial production fell 0.1% in October after a revised 0.1% increase in September. Economists had expected industrial production to rise by 0.2% compared to the 0.4% increase originally reported for the previous month. The National Association of Home Builders report showed a continued decline in the confidence of US home builders in the month of November. The report showed the NAHB/Wells Fargo housing market index declined for the 11th straight month, falling to 33 in November after dropping to 38 in October. Economists had expected the index to fall to 36.

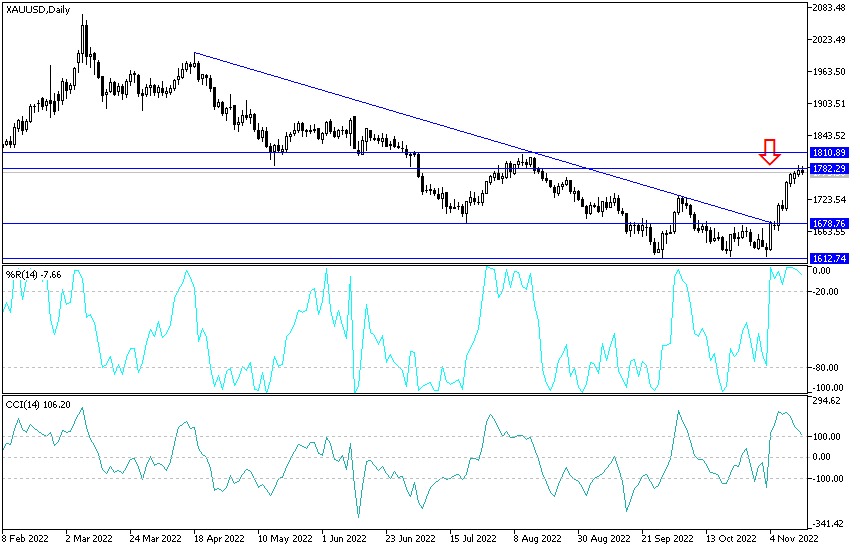

XAU/USD gold price forecast today:

- With the XAU/USD gold price failing to move towards the psychological resistance level of $1800 an ounce.

- As expected before, selling operations may start as a result, which is what is happening now.

- According to the performance on the daily chart, the gold price may give up its bullish outlook in the event that prices return towards support levels 1745 and 1720 dollars, respectively. On the other hand, the return of the stability of the XAU/USD gold price above the resistance at $1785 an ounce will be important to confirm the control of the bulls. I still prefer selling gold from every ascending level.

Today, the gold market will be affected by the level of the US dollar and whether or not investors are willing to take risks, following the announcement of the British budget, inflation figures in the eurozone, and more statements by US Federal Reserve officials.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.