Gold futures are looking to start November higher, buoyed by a weak US dollar and expectations by the Federal Reserve to slow the pace of US interest rate hikes.

Can the XAU/USD gold price stay above $1,650 throughout the remainder of 2022?

In general, the price of gold is coming out of its seventh consecutive monthly loss, adding to its year-to-date loss by about 10%. Silver, the sister commodity to gold, is targeting $20. Overall, the white metal suffered a decline in October of more than 5%, bringing its decline in 2022 to nearly 16%.

The main driver of the metals gains was a weak dollar. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, took a breather on Tuesday, dropping 0.05% to 111.48, from an opening at 111.53. The index recorded record gains in 2022, rising more than 16%, which was bearish for the metals market because it makes dollar-denominated commodities more expensive for foreign investors to buy.

Meanwhile, a sense of calm prevailed throughout financial markets on Tuesday as investors braced for the US central bank's decision. Market experts say that XAU/USD gold prices could spark a massive rally if the Fed hints that it is slowing its monetary tightening campaign to break inflation.

Commenting on this, Lukman Otunuga, Director and Market Analyst at FXTM, said in a note: “Given how such a pivot could provide more room for gold resistance, prices will head higher in the near term.”

In other news, the World Gold Council turned around on Monday when it reported that global demand for gold rose 28% year-over-year in the third quarter to 1,181 metric tons. It comes as global investment demand has fallen at an annual pace of 47% to 124 metric tons. In other metals markets, copper futures rose to $3.4725 a pound. Platinum futures were trading at $954.50 an ounce. Palladium futures fell to $1,880.50 an ounce.

XAU/USD Gold Price Forecast Today:

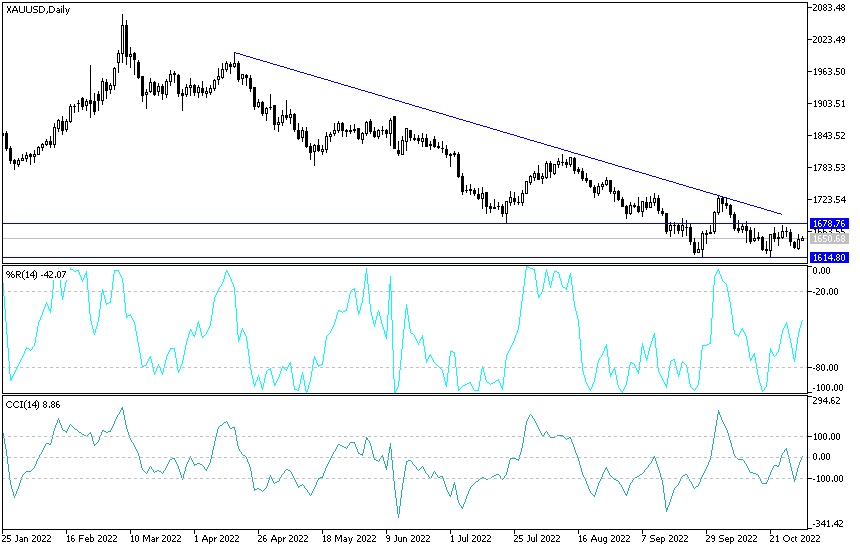

No change in my technical view of the performance of the price of gold.

- With the continued strength of the US dollar, the pressure on the XAU/USD gold price continues for more bearish movement.

- The bears may be watched to test the next most important support levels 1626 and 1600 dollars, respectively.

- The last level is ideal for buying gold again.

On the other hand, according to the performance on the daily chart below, the bulls still need to move towards the resistance levels of 1665 and 1680 dollars, respectively, to end the current bearish outlook, because the last level increases expectations of the next psychological top of 1700 dollars. All in all, I still prefer buying gold from every bearish level considering the reaction from important events and data this week led by Fed monetary policy decisions and US job numbers.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.