The British pound could continue to advance against the US dollar as long as investors remain in an upbeat mood as the bear market recovery expands. Analysts warn that the recent boost in sentiment may soon be over. In general, the price of the GBP/USD currency pair rose by about 4.6% over the past two weeks, with gains towards the 1.2030 resistance level, before settling around the 1.1850 level at the time of writing. The currency pair's gains came as markets bet that the US Federal Reserve would end the US interest rate hike cycle in early 2023, amid signs that US inflation was now peaking.

Commenting on the performance, George Vessey, analyst at Western Union Business Solutions, said: “GBP/USD is still 9% below its 2-year average, but is up over 6% in the past 10 trading days. , supported by weak demand for the US dollar in hopes that the US Federal Reserve will slow down the rate hike cycle.

The pound sterling enters this week's trading supported by the continued recovery in global stock markets and the positive response of investors to the autumn statement last Thursday, as the British government committed to ensuring that the country's financial conditions remain on stable foundations during the coming years. For financial markets, boredom is better. Accordingly, Thaneem Islam, head of forex analysis at Equals Money, says: “In the short term, there seems to be a sense of relief after the recent carnage we witnessed in British assets. As long as risk appetite is there, sterling should be supported.” "Despite the gloomy economic outlook in Britain, some other macro factors suggest that the pound sterling may continue to recover, albeit slowly," the analyst added.

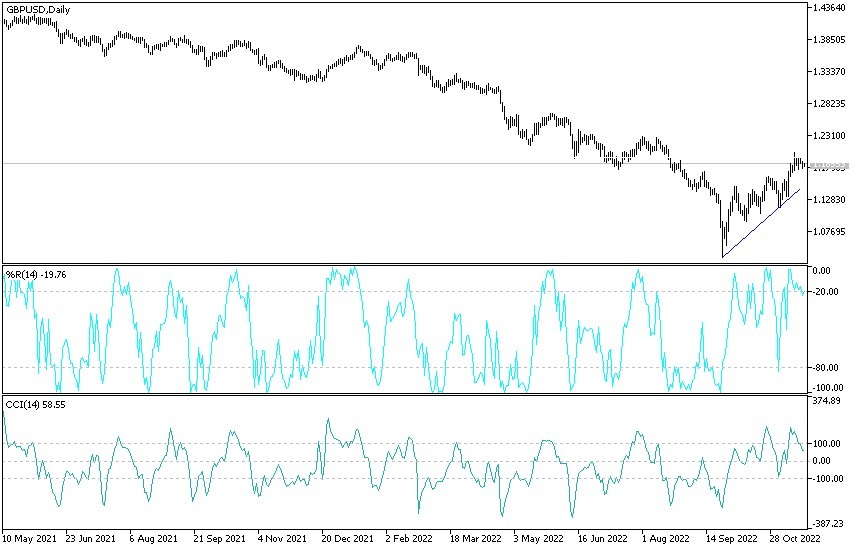

Western Union analysts say support for GBP/USD can also be found in improved terms of trade in the UK compared to the US, the improvement in global risk appetite that underpins risk-sensitive currencies such as the British pound, and the fact that markets UK prices are set to be higher than US rates by the beginning of 2024. Looking at the GBP/USD technical setup, GBP/USD is still below its key 200-day moving average – located around $1.22 – which indicates that the long-term downtrend is still valid for the time being.”

However, Sean Osborne, Senior Forex Analyst at Scotiabank, said that the GBP/USD technical indicators in the short term are neutral/bullish and this could lead to more upside over the coming days. The analyst added, “Cable's price patterns look generally positive on the short-term charts, as the market is consolidating the recent push of the pound by resisting the main bearish trend (now 1.1468 on the daily chart). However, Sterling needs to push further - above 1.20 - for gains to develop in the near term and create a 1.20-1.25 range.”

Sterling forecast against the dollar today:

- According to the performance on the daily chart, the price of the GBP/USD currency pair is in a neutral position with a bullish bias.

- It lacks the momentum to complete the recent upward rebound, and it seems that the currency pair is in waiting mode until the markets react to the minutes of the US Federal Reserve meeting.

- The tightening tone means activating selling operations profit-taking that may be exposed to the currency pair, which may collide with the support levels 1.1740 and 1.1630.

- The last level confirms a break in the general trend.

On the other hand, testing the psychological resistance 1.2000 again will be important for the bulls to take control. The currency pair does not await important and influential economic data, but there will be statements by US Federal Reserve officials.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.