- Amid the US dollar's decline against the other major currencies, the share of the GBP/USD was the strongest, as it recently jumped to the 1.2153 resistance level, its highest in three months.

- This happened before closing last week's trading, around the 1.2092 level.

- The British pound has risen over the past week, with analysts saying that part of the rally can be attributed to the stabilization of interest rate hike expectations from the Bank of England.

Last week, policymakers at the Bank of England emphasized that more rate hikes were needed to control inflation, raising investor expectations about the number of rate hikes yet to be issued by the central bank. In this regard, Deputy Governor Dave Ramsden said in a speech last Thursday that he would "continue to vote to respond forcefully" to signs of persistent inflationary pressures.

As there are no credible signs that UK inflation is ready to calm down materially, further spikes are therefore likely. Most economists polled by Reuters expect the Bank of England to raise interest rates by another 50 basis points in December, although there is a large minority saying it is likely to raise rates by 75 basis points.

According to the fundamental analysis, the GBP/USD currency pair is trading affected by the announcement that the preliminary UK PMI for the month of November outperformed the S&P Global/CIBS forecast services by 48 with a reading of 48.8. The manufacturing PMI and the composite PMI beat expectations at 45.8 and 47.5, respectively, with readings of 46.2 and 48.3. Prior to that, it was announced that public sector net borrowing in Britain for the month of October exceeded expectations at 15.376 billion pounds, with 12.728 billion pounds.

From the US, orders for durable goods for October exceeded expectations at 0.4% with a change of 1%. On the other hand, defense ex-durable goods orders exceeded the forecast by -0.1% with a change of 0.8%, while the durable goods orders excluding transportation exceeded the estimated change by 0% with a change of 0.5%. Elsewhere, orders for non-defense capital goods from aircraft exceeded the forecast change of 0% with a change of 0.7%.

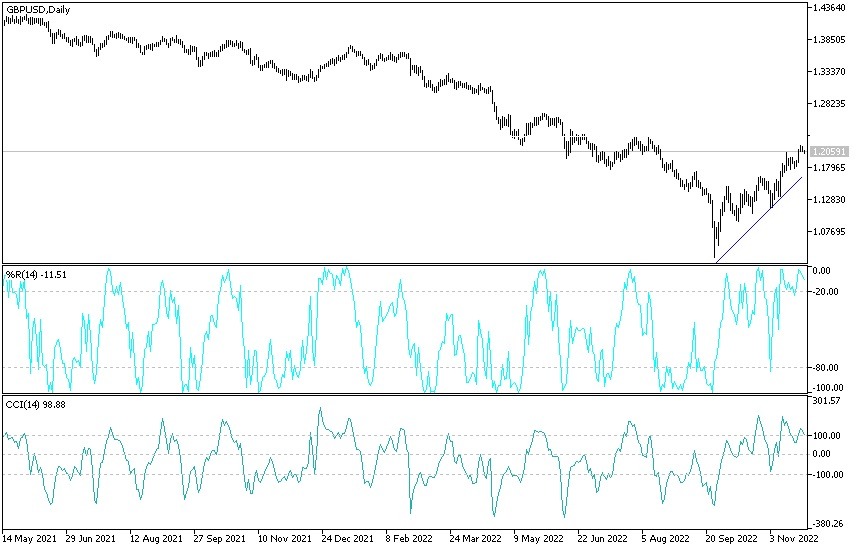

GBP/USD Forecast

In the near term and according to the hourly chart, it appears that the GBP/USD is trading within a sharp bullish channel formation. This indicates a strong short-term bullish momentum in market sentiment. Therefore, the bulls will target short-term profits at around 1.2118 or higher at the 1.2169 resistance. On the other hand, the bears will target potential pullback profits at around 1.2012 or lower at the 1.1961 support.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within an ascending channel formation. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls will target long-term profits at around 1.2249 or higher at the 1.2494 resistance. On the other hand, the bears will look to pounce on profits at around 1.1794 or lower at the 1.1536 support.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.