The current bullish rebound in the performance of the EUR/USD currency pair with gains towards the 1.0096 resistance level caused a noticeable decline in the US dollar since the US job numbers were announced. Expectations emerged that the euro could remain below the dollar as long as natural gas prices remain high. In this regard, one of the major banks on Wall Street said that the euro is on its way to stay below the parity rate with the US dollar for some time if gas prices do not drop significantly. The currency used by the 19 countries that make up the eurozone is set to fall to $0.94, according to Goldman Sachs.

The Euro closed last week with a shade below par with the Dollar.

Goldman predicted in a note to clients over the weekend that the currency could stay there for years if gas prices rise above their historically low levels. The Wall Street giant said: “The deterioration of the eurozone’s external balance is a direct manifestation of the deteriorating terms of trade in light of the rise in prices of energy products and manufactured goods, and this will have important repercussions for the euro if it continues.”

The Russian invasion of Ukraine has shaken international markets, driving up the prices of basic commodities. High gas prices have put pressure on the economies of Germany and Italy due to their historical dependence on energy supplies from Moscow. Since European countries pay exorbitant prices for energy, their business centers have deteriorated significantly. Germany has gone from a decades-old trade surplus to a deficit. A trade deficit increases the supply of a country's currency in international financial markets, weakening it against its competitors.

Goldman also noted that sharp interest rate hikes by the US Federal Reserve have supported the US dollar by enhancing the attractiveness of US assets. “If a looming recession prompts to take a more cautious approach, as we expect, even as the Fed aims for a higher interest rate,” the euro could continue to crash, the bank added.

The Fed, for its part, has raised borrowing costs by 375 basis points since March, a cycle of raising interest rates much faster than the ECB's 200 basis points.

Today’s Economic Outlook

Eurozone retail sales rebounded in September despite record inflation denting purchasing power and consumer confidence, data released by the Eurostat statistics office yesterday showed. According to the advertiser, retail sales rose 0.4 percent from August, when they were in the doldrums, which was revised from a decline of 0.3 percent. The increase was in line with economists' expectations. Commenting on the figures, economist Bert Cullen said the slight rise in retail sales in September was unlikely to be a turning point in consumption. The economist expects consumption to contract in the current and next quarters, followed by a very modest recovery. The data showed that sales of food, beverages and tobacco grew by 0.4 percent after declining by 0.7 percent in the previous month. Sales of non-food products, excluding motor fuels, rose 1.0 percent after a 0.2 percent increase in the previous month.

Postal orders and Internet sales rebounded with 2.6 percent growth after a 4.1 percent decline in August. Meanwhile, auto fuel sales fell 0.6 percent after rising 2.1 percent in the previous month. Compared to the same month last year, eurozone retail sales declined for the fourth consecutive month in September.

Forecast of the euro against the dollar today:

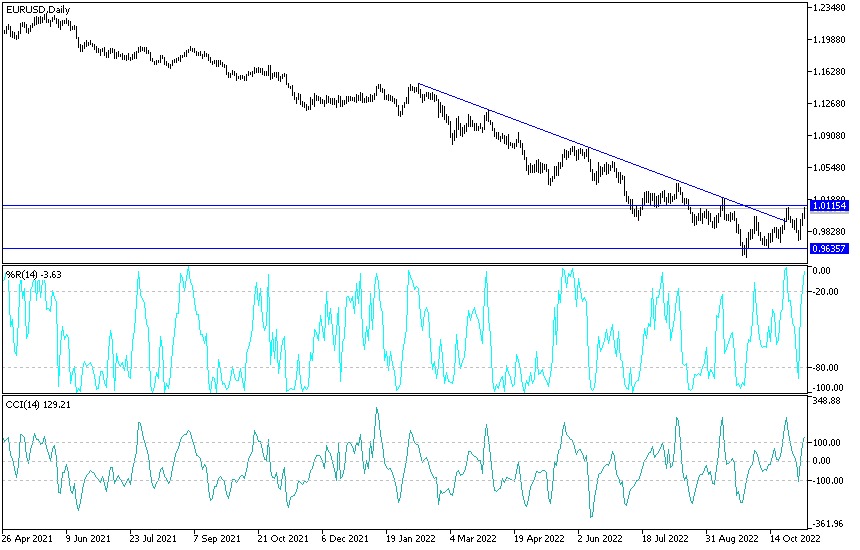

- The stability of the price of the EUR/USD currency pair, above the parity price, still supports the bulls' domination of the trend.

- According to the performance on the daily chart below, the trend will be strongly bullish if prices move towards the resistance levels 1.0110 and 1.0200, respectively.

- These levels are sufficient to push the technical indicators towards overbought levels.

The euro-dollar currency pair will continue to carefully monitor the results of the US elections, as well as the announcement of US inflation figures, to determine the future of this week's closing.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.