The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are very strong trends in the market right now, which can be easy to exploit profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 9th October that the best trades for the week were likely to be:

- Short of the AUD/USD currency pair. The price fell by 2.61%, , producing a large win.

- Long of the USD/JPY currency pair. The price rose by 2.31%, producing a large win.

These trades produced a large overall averaged win of 2.46%.

The news is dominated by the release last Thursday of higher-than-expected U.S. CPI (inflation) data, which showed a month-on-month increase of 0.4% when an increase of only 0.2% was expected. This caused markets to expect a more hawkish approach from the Fed, which has boosted the US Dollar in expectation of higher rates, with the 2-year Treasury Yield rising to a new 15-year high above 4.50%. The 10-year yield exceeded 4%. The U.S. inflation news also sent stocks lower initially, with the key S&P 500 Index falling to a new 2-year low at 3500 before it recovered quite strongly on Thursday, before falling again on Friday and ending the week lower.

The Japanese Yen continued to weaken for a ninth consecutive week. Although intervention by the Bank of Japan to prop up the Yen was expected above ¥145, the USD/JPY currency pair ended the week sharply higher at almost ¥149 drawing no response except some mild words from the Japanese Finance Minister. It may well be that the Bank of Japan decided that the market movement would be driven by U.S. inflation data and a fall by the Yen against the Dollar could not be stopped anyway. Alternatively, it may be that the Bank is hoping the move will naturally run out of steam at or close to the big round number of ¥150.

The U.K. was in the news this week, as the British government performed a dramatic U-turn after very negative market reaction to its tax cutting plans which were announced recently. The Bank of England needed to intervene to prop up the Pound and British markets by purchasing gilts. Prime Minister Truss has fired Chancellor (Finance Minister) Kwarteng after little more than one month in the job and announced that the plan to cut taxes has been abandoned, which sent the Pound a little higher over the week.

The details of the important economic data releases last week can be summarised as follows:

- US CPI (inflation) data – although the annualized rate fell slightly to 8.1%, the month-on-month data showed an increase of 0.4% when only 0.2% had been expected, leading to a more pessimistic outlook on inflation.

- FOMC Meeting Minutes – Fed members reiterated their determination to keep hiking rates as hike as it takes to reverse high inflation.

- UK GDP – no monthly change had been expected in economic growth over the month, but the British economy underperformed, contracting by 0.3%.

- US Producer Price Index data – like the CPI data, the month-on-month data showed an increase of 0.4% when only 0.2% had been expected.

- US Retail Sales data – this underperformed, showing no monthly change when an increase of 0.2% was expected.

- US Preliminary UoM Consumer Sentiment – this was slightly higher than expected.

The Forex market saw relative strength in the US Dollar and British Pound last week. The weakest currencies were the Japanese Yen and the Australian Dollar.

Rates of coronavirus infection globally decreased last week. The only significant growths in new confirmed coronavirus cases overall right now are happening in Austria, Germany, Italy, and Singapore.

The Week Ahead: 17th October – 21st October 2022

The coming week in the markets is likely to see a lower level of volatility, as although there are several releases of inflation data from major economies, there is only one central bank release due, and it is not a major one. Scheduled items are, in order of likely importance:

- UK CPI (inflation)

- Canadian CPI (inflation)

- New Zealand CPI (inflation)

- Chinese GDP

- Reserve Bank of Australia Monetary Policy Meeting Minutes

- Australian Unemployment

- US Empire State Manufacturing Index

- US Philly Fed Manufacturing Index

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a weakly bullish near-doji candlestick which closed at a 20-year high closing price. These are bullish signs, and there is no question that the long-term trend is very bullish, but the bullish trend does seem to have slowed down and may be showing some instability.

Bulls may have another reason to be cautious, in that we did see quite a strong sell-off from the 114.00 area two weeks ago.

It may be a good idea to only look for long trades in the US Dollar over the coming week, although focused on the weaker major currencies such as the Japanese Yen and the Australian Dollar. This is a very powerful, long-term bullish trend in the most important currency in the Forex market.

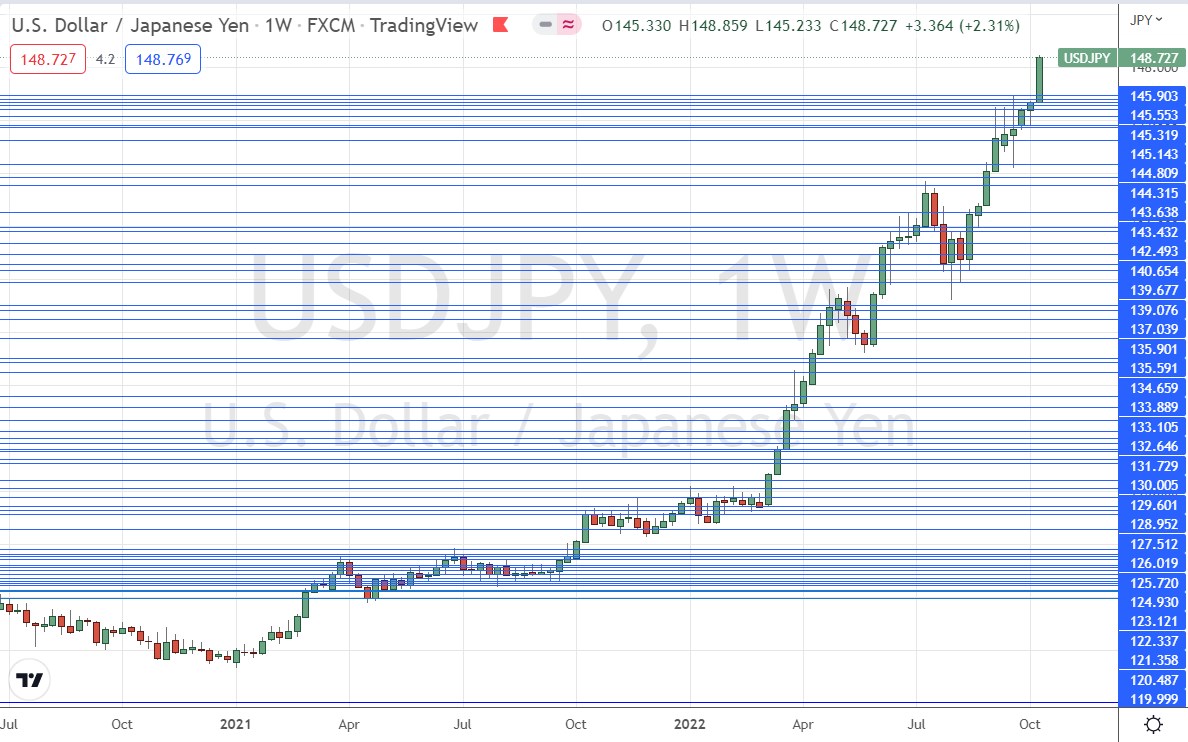

USD/JPY

Last week saw the USD/JPY currency pair print another strong bullish candlestick which again made the highest weekly close since 1998. The closing price was very close to the high of the week on above-average volatility. There have been 9 consecutive up weeks. These are bullish signs.

This currency pair is worth keeping an eye on this week, as the Japanese Yen is notably weak, and the anticipated intervention by the Bank of Japan at this level has yet to materialize. A look at the price chart below shows that this pair is in a very strong long-term bullish trend. The problem for bulls is that the Bank of Japan may intervene at any moment, especially if the price reaches the big round number and psychological level at ¥150. We may well also see a lot of natural profit-taking at that level, so if it is reached, the price may not manage to rise much higher than that.

Whether an intervention by the Bank of Japan to prop up the Yen would succeed is an open question.

AUD/USD

Last week saw the AUD/USD currency pair print a large bearish candlestick which saw the currency pair again reach its lowest price since the coronavirus panic of May 2020. The candlestick closed quite near its low. These are bearish signs.

The bearishness is supported fundamentally as the Australian Dollar was already weak when the Reserve Bank of Australia announced a lower-than-expected rate hike two weeks ago, which helped to trigger a further fall in the currency’s value. This is a bearish tailwind.

The fact that the price got established quite easily below the former key support level at $0.6327 is a very bearish sign.

The Australian Dollar is currently the weakest major currency in the Forex market after the Japanese Yen, but unlike the Yen is extremely unlikely to get any supportive intervention from its central bank.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short of the AUD/USD currency pair and cautiously long of the USD/JPY currency pair which remains prone to intervention from the Bank of Japan, especially at ¥150.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.