Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

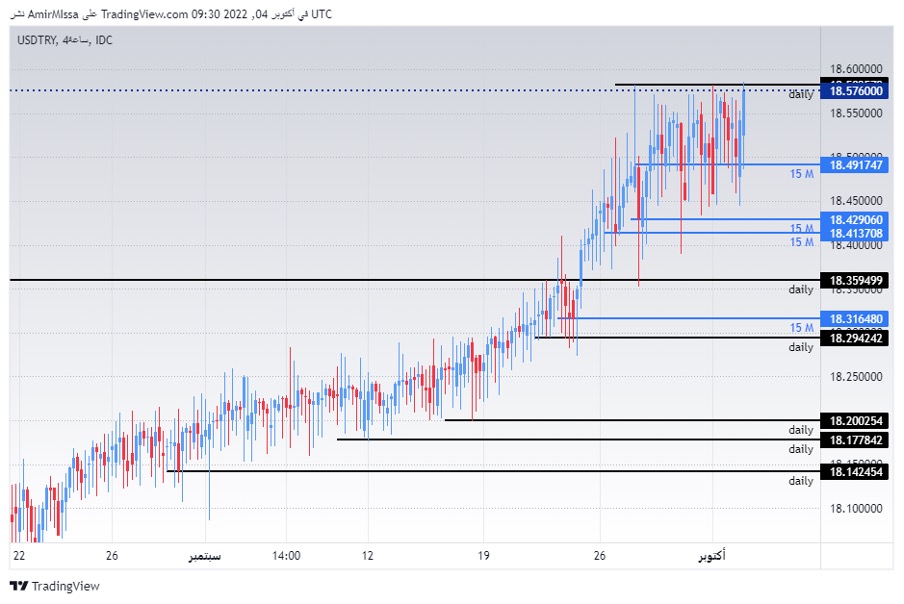

- Entering a long position with a pending order from levels of 18.49

- Set a stop-loss point to close below the 18.35 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best selling entry points

- Entering a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

Inflation has risen by 186.27%. Other data showing the country's trade deficit jumping 298% year-on-year in September also contributed to the pressure on the local currency. The calculated decline of the lira comes under the control of the Turkish Central Bank, which prevents a strong fall in the price of the Turkish lira. It is noteworthy that the statements of the Turkish president, who already controls the decisions of the Central Bank of Turkey, all emphasized the continuation of reducing interest rates in order to control the inflation rate, contrary to the opinions of economic experts.

USD/TRY Technical Analysis

On the technical level, the price of the Turkish lira against the dollar settled without much change at its highest levels ever, as the US dollar pair traded against the Turkish lira at levels of 18.58. The pair is trading above the 50, 100 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, maintaining the bullish trend strongly. The pair is also trading the highest levels of support, which are concentrated at levels of 18.50 and 18.40, respectively.

On the other hand, the lira is trading below the resistance levels at 18.99. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex signals? We’ve shortlisted the best Forex trading brokers in the industry for you.