Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

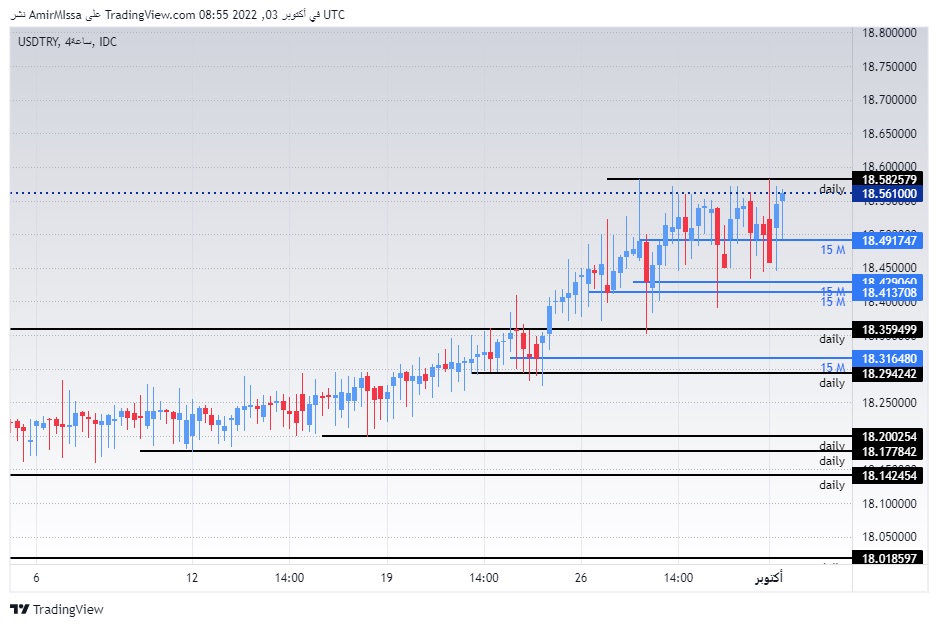

- Entering a long position with a pending order from levels of 18.49

- Set a stop-loss point to close below the 18.35 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best selling entry points

- Entering a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The Turkish lira continued its slow decline against the US dollar, as the intervention of the Central Bank of Turkey prevents its strong collapse. Especially with the successive negative data from the Turkish economy, where reports were published this morning showing a rise in the inflation rate in Turkey to record 84 percent, which is the highest rate since mid-1998. Inflation recorded a rise for the sixteenth consecutive month considering the Turkish Central Bank's adherence to a fiscal policy motivational. Early reports also published the central bank's direction for a new series of interest rate cuts during the upcoming meetings, which added to the pressure on the lira.

USD/TRY Technical Analysis

On the technical front, without much change, the price of the Turkish lira against the dollar settled near its all-time high, as the US dollar pair traded against the Turkish lira at levels of 18.58, maintaining a strong uptrend. The pair is trading the highest levels of support, which are concentrated at levels of 18.50 and 18.40, respectively. On the other hand, the lira is trading below the resistance levels at 18.99. The pair is also trading above the 50, 100 and 200 moving averages on the daily time frame, as well as on the four-hour time frame. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our advanced signals? We’ve made a list of the best brokers to trade Forex worth using.