- The Japanese Yen weakened again despite signs that Japan strengthened its defense of the currency with a second intervention in two sessions.

- The price of the currency pair, the USD/JPY, returned about 400 points, which it lost after selling on Friday, as a result of which the currency pair collapsed from the resistance 151.94, its highest in 32 years, to the 146.20 support level.

- It collapsed at the beginning of the week to the 145.55 support level, but rebounded It went up again.

- It reached the resistance level of 149.70, before settling around the level of 148.80 at the time of writing the analysis, waiting for anything new.

The sharp moves suggest that the Japanese authorities have taken their gloves off in their battle against traders, amplifying the yen's weakness due to the policy divergence between the US and Japan. The Bank of Japan meets later this week and its decision is likely to be another major catalyst for the volatile currency. Japanese Finance Minister Shunichi Suzuki told reporters on Monday that the country is in a tough confrontation with speculators and cannot tolerate excessive currency moves, speaking ahead of the yen's rally. He later insisted that the BoJ make its own policy decisions.

Suzuki declined to confirm whether Japan entered the market again last week. Speaking after Monday's sharp moves, senior currency official Masato Kanda also declined to give confirmation, a stance that helps leave uncertainty and an element of fear in the market. “I will not comment at all on whether or not there was an intervention,” Kanda said. And as I said earlier, we will take appropriate action against excessive movement 24 hours a day, 365 days a year, 24/7. We will continue to do so all the time.”

Yen traders were bracing for another tumultuous week as talk of a suspected intervention on Friday mixed with the potential impact of the BoJ meeting. Economists expect the central bank to keep policy unchanged again at its two-day meeting that ends on October 28. When asked by a reporter if the BoJ should change its policy given the yen's decline, the finance minister stuck to the government's view that it was up to the central bank to make its decisions.

"We have to respect the independence of the Bank of Japan," Suzuki said.

In general, the Japanese currency has fallen this year as investors focused on the widening yield gap between the United States and Japan, with aggressively raising interest rates earlier and the last at their lowest levels to boost the economy. This encourages investors to look for more attractive returns in dollar assets compared to those in Japan. In September, the government intervened to support the Japanese currency for the first time since 1998, after it fell to 145.90 per dollar. It said it spent $20 billion that month on the intervention, a move that came on the day the Bank of Japan reaffirmed its ultra-easy monetary policy. The Financial Times, citing traders' estimates said Japan likely spent more than $30 billion last week to prop up the yen. Some analysts have warned that any intervention will have a limited impact as long as the BoJ maintains its policy.

USD/JPY Forecast

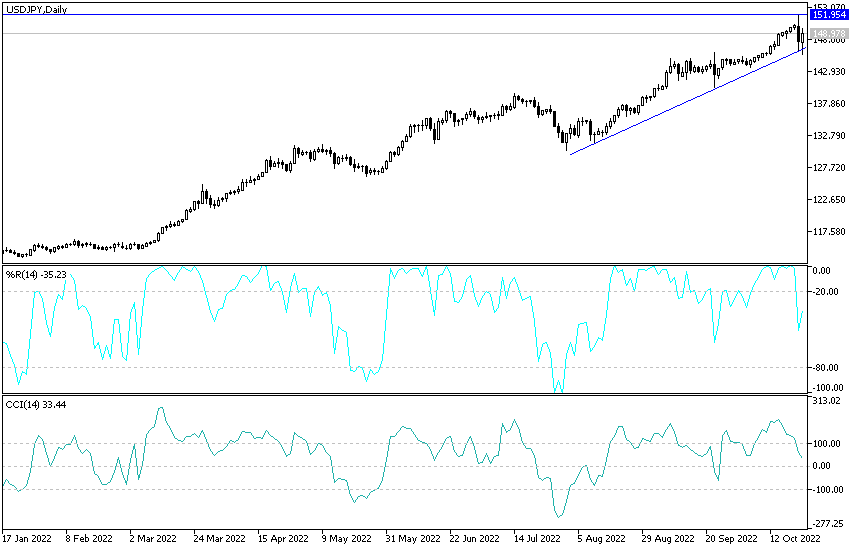

USD/JPY fell sharply to start the week's trading likely due to another round of currency intervention by the Japanese authorities. However, the effect was short term as the pair returned to trading around 149.00. The price has found support at the ascending trend line that has been holding since August, and it looks like the uptrend is ready to resume. The Fibonacci extension tool shows the levels that buyers may target.

The 38.2% extension is at 149.71, then the 50% level near the 151.00 resistance. Stronger upward pressure could lift USD/JPY to the 61.8% extension at a minor psychological mark of 152.50, which aligns with the swing high. The continued bullish momentum could take the pair to the 76.4% level at 154.24 or the full extension at the 157.00 key psychological level. So far the 100 SMA is still above the 200 SMA to confirm that the general trend is still bullish and that the upside is more likely to gain momentum than the reverse. The 100 SMA also held as dynamic support near the ascending trend line. The stochastic appears to have reached its lows without even reaching the oversold zone, which indicates that buyers are eager to return. Similarly, the RSI is turning higher to indicate that bullish pressure is about to rise again.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.