- USD/JPY took another step towards the closely watched 150 historical psychological resistance level, keeping investors on high alert for potential intervention to support the Japanese currency.

- The USD/JPY currency pair is stabilizing around the resistance level of 149.38 at the time of writing the analysis.

- The performance came as Japan's prime minister and head of the country's central bank insisted they would stick to their current policy mix amid criticism that it was contributing to the yen's slide.

- The currency fell again at the beginning of trading this week, even with the loss of the US dollar against all other currencies in the G10 currencies. It has now reached a level last seen 32 years ago, amid swift warnings from authorities trying to persuade traders to test their intervention strategy.

"There is absolutely no change in our position that we will respond appropriately to excessive moves," Japanese Finance Minister Shunichi Suzuki told reporters on Tuesday. “We will be watching the markets with a sense of urgency today as well,” he added.

Watchers of the Japanese yen's performance said that officials are likely focused on the speed of the declines and will not necessarily think about the rate at which they will act again. But some have pointed out that the 150 level is a key psychological level for Japan and a break is likely to increase pressure on the government to act again. Commenting on the performance, Yuji Saito, CEO of the Forex division of Credit Agricole CIB in Tokyo said: “If the dollar-yen rises beyond the 150 token level, the price action will naturally accelerate, so they may want to stop it before that time or buy the time. The price action over the past few days matches its state of the work. They can intervene anytime between 149-150.”

Given multilateral agreements that warn of erratic currency movements, Japanese authorities will find it less difficult to obtain tacit support for intervention if they are considered to respond to "excessive volatility". Speaking in Parliament, Prime Minister Fumio Kishida noted the importance of the G7 statement on currencies last week which acknowledged significant moves in various currencies this year and increased volatility.

His comments and those of Bank of Japan Governor Haruhiko Kuroda signal a renewed commitment to a de facto division of labor that has the central bank keeping interest rates low . The government is taking measures to ease the pain of price hikes fueled in part by a weak yen, while keeping pace with its warnings about intervention. The Japanese currency has slumped this year as investors focused on the widening yield gap between the US and Japan, with interest rates hiked aggressively and the latter at their lowest levels to boost the economy. This encourages investors to look for more attractive returns in dollar assets compared to those in Japan.

Kuroda indicated that he does not expect continued weakness in the yen in the long term, saying that the currency does not move in tandem with interest rate differentials in the long term. He declined a lawmaker's call for resignation as concern grew about the yen's decline. The rapid drop to 145.90 per dollar last month led to the country's first intervention in support of the yen in 24 years.

There was also speculation that Japan might use subtle methods to slow the yen's slide. Masato Kanda, a senior currency official, said last month that covert intervention was among the government's potential options, adding that the finance ministry would not necessarily confirm each intervention when it occurred. Suzuki declined to comment on the possibility of covert interference. Investors are still considering the possibility of hidden intervention in the Japanese yen.

"The dollar-yen at 150 looks to be just a passing blob," said Miura of Nissay Asset “markets are of the view, given history, that the effect of intervention will not last long,” he added.

USD/JPY Forecast

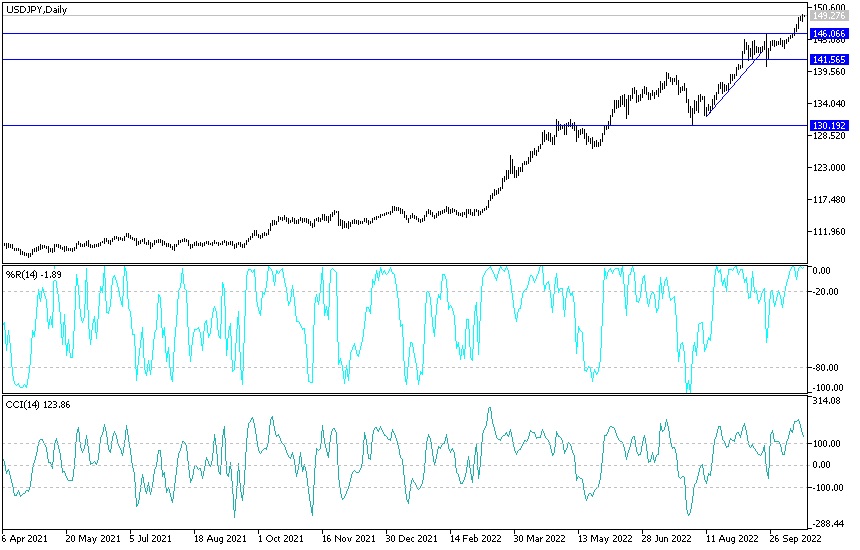

According to the performance on the daily chart below, the USD/JPY currency pair is still in an uptrend and its gains have reached the technical indicators towards sharp overbought levels. Japanese intervention in the market is likely and strongly at any time. The 150.00 psychological top will remain an important barrier for the bulls.

On the other hand, according to the performance on the daily chart, there will be no breach of the trend without moving towards the 142.00 support level, and this may happen in the event of a Japanese intervention.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.