XAU/USD gold futures rose modestly amid swings in the US dollar and lower Treasury yields, as global financial markets continued to slide.

- The gold market tried to take advantage of the weak dollar after slipping into the red during the year.

- The price of gold rose to the resistance level of 1675 dollars an ounce and closed the week's trading stable around the level of 1660 dollars an ounce.

- The XAU/USD gold price was on its way to a weekly loss of about 0.3%, in addition to its decline since the beginning of 2022 to date by 8.5%.

In the same direction, silver prices, the sister commodity to gold, rose again above the $19 barrier at the end of last week's trading. Accordingly, the white metal recorded a weekly decline of 3%, bringing its decline in 2022 to 18.3%. For the month and quarter, the XAU/USD gold price is down 2.5% and 7.9%, respectively.

Gold Prices are on the Rise

The US dollar has settled below a 20-year high. After peaking at 114.78 last week, the US Dollar Index (DXY) has fallen to around 112.00. The index, which measures the performance of the US currency against a basket of major currencies, rose to 112.34 from an opening at 111.75. The DXY Dollar Index will have a weekly loss of 0.75%, a monthly gain of 2.56%, and a quarterly payment of about 7%.

Buying gold is generally considered to be stronger bearish for gold prices because it makes it more expensive to buy it for foreign investors.

The US Treasury market was mixed, with the benchmark 10-year yield dropping 0.7 basis points to 3.74%. One-year bond yields rose 2.1 basis points to 3.992%, while 30-year yields rose 1.9 basis points to 3.712%. The rise rate environment is usually bad for metals because it raises the opportunity cost of holding non-returning bullion. It may seem counterintuitive, as market experts warn that gold may not stabilize until inflation pressures ease and the Federal Reserve begins to slow its quantitative tightening efforts.

Gold Economic Outlook

According to the Bureau of Economic Analysis (BEA), the Personal Consumption Expenditure Expenditure (PCE) price index, the Fed's preferred inflation measure, was 0.3% in August. The core PCE price index, which wipes out the volatile food and energy sectors, rose more than expected by 0.6%.

Relative to other metal commodity prices, copper futures were relatively flat at $3,424 a pound. Platinum futures rose to $860.70 an ounce. Palladium futures fell to $2,189.50 an ounce.

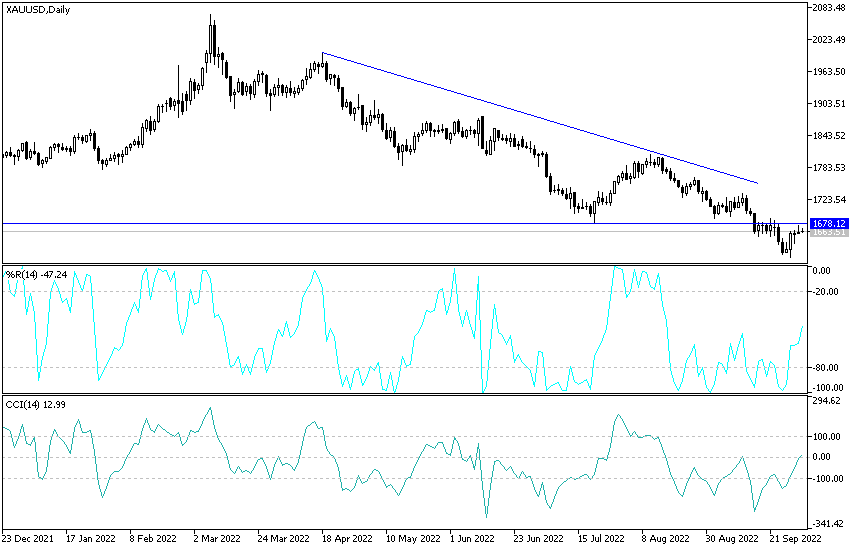

Technical analysis of gold prices:

In the near term and according to the performance on the hourly chart, it appears that the price of XAU/USD is trading within an ascending channel formation. This indicates a significant short-term bullish bias in market sentiment. Therefore, the bulls will look to extend the current rally towards $1,676 or higher to $1,687 an ounce. On the other hand, the bears will target potential pullbacks around $1,650 or lower at $1,638 an ounce.

Over the long term and according to the performance on the daily chart, the price of the yellow metal appears to be swinging within the formation of a sharply bearish channel. This indicates a strong long-term bearish momentum in the market sentiment. Therefore, the bears will target long-term profits at around $1,621 or lower at $1,574 an ounce. On the other hand, the bulls will be looking for a bounce around $1,702 or higher at $1,751 an ounce.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.