- After the strong bullish move last Friday, XAU/USD (gold) price showed no direction throughout the trading day on Monday.

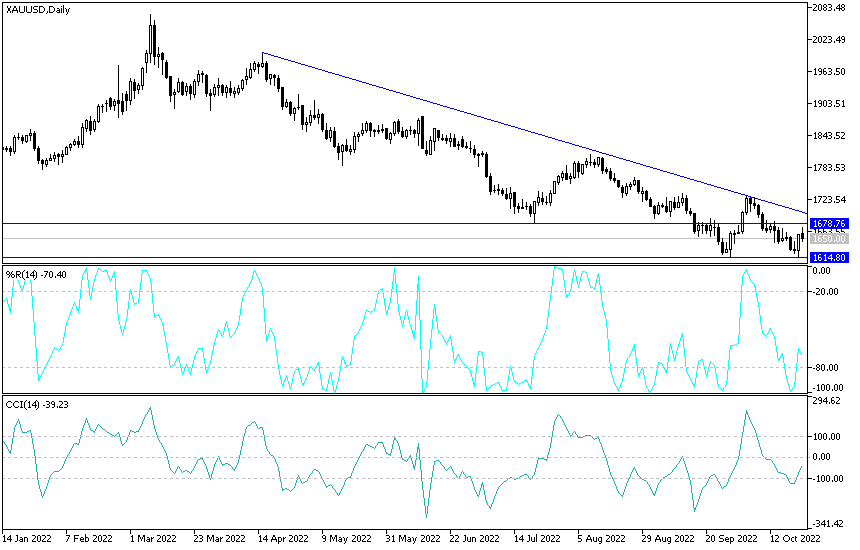

- The price of gold rose towards the resistance level of 1670 dollars an ounce before resuming stability around the 1650 dollars an ounce at the time of writing the analysis.

- The choppy trading of the day came as the value of the US dollar also turned underperform, with the US dollar index currently unchanged at 112.02.

The lack of key US economic data may have kept traders on the sidelines ahead of the release of the Personal Income and Expenditure report which includes an inflation reading said to be favored by the Fed. In the coming days, investors are also likely to watch reports on consumer confidence, new home sales, durable goods orders, and third-quarter GDP.

Trading activity may remain somewhat subdued, however, as investors look ahead to the Federal Reserve's monetary policy next week. With the Fed widely expected to raise rates by another 75 basis points, investors are likely to pay close attention to the accompanying statement for signs of the central bank's plans to slow the pace of monetary tightening.

US stocks rose as investors awaited the next batch of earnings from some of the world's largest companies and pondered whether the Federal Reserve would slow the pace of US interest rate hikes after assessing weak economic data. By performance, the S&P 500 Index rose more than 1 percent, boosted by technology and healthcare stocks. The Nasdaq 100 index, the owner of heavy technology stocks, also rose, to cut losses by more than 1 percent. And Chinese stocks listed in the United States fell after the stock index fell in that country as Chinese President Xi Jinping consolidated his power. Among the big companies that are scheduled to announce earnings this week is Alphabet Inc. and Microsoft Corp. and Meta Platforms Inc.

Earnings remain in focus, with investors still concerned about whether companies that are among the S&P 500's main earnings growth drivers can turn a profit with shrinking inflation margins. Of the nearly 20 percent of companies that have reported so far, nearly 58 percent have posted positive surprises in both revenue and earnings per share, according to data compiled by Bloomberg. As the Fed tries to stamp out inflation, recent earnings that are resilient and showing few signs of stagnation may make some investors uneasy about stocks.

Gold Forecast

The bulls still have more time to turn the general trend of the gold price to the upside, as there is a need, according to the performance on the daily chart, to breach the resistance levels of 1678 and $1700, respectively. On the other hand, and over the same time period, it will be important to break the $1638 support level for more bears’ control over the trend, and I still prefer buying gold from every descending level. Technical indicators are still neutral with a bearish slope.

Ready to trade our Gold analysis today? We’ve shortlisted the most trusted Gold brokers in the industry for you.