Sterling’s rebound depends on how far the market rally can extend.

- The recent recovery of the pound may extend if the improvement in global investor sentiment continues.

- Analysts warn that this market is recovering from oversold conditions and that the comeback will not last.

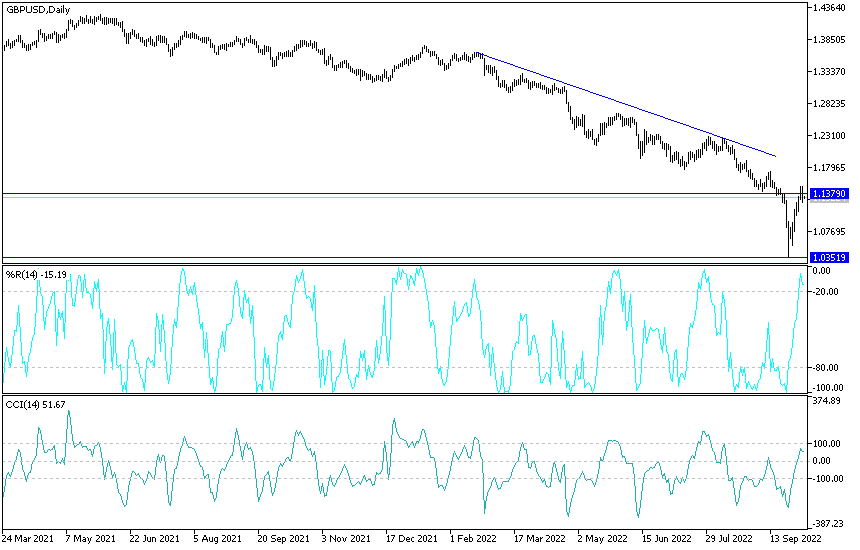

- The recent rebound gains of the GBP/USD pair, which reached the resistance level of 1.1496, evaporated.

- The profit-taking selling took the currency pair towards the support level 1.1227 before settling around the 1.1330 level at the time of writing the analysis.

The British pound has risen sharply in recent days, with a major focus on the British government's domestic fiscal policy shifts. However, there is evidence that this is a declining factor for the UK currency. We were told that sterling had another strong showing following reports that Chancellor Kwasi Koarting will present his "financial plan" from November to October, signaling to financial markets that he is committed to sustainable state-account management. But reports surfaced on Tuesday that that wasn't actually the case, and the date hasn't changed. Channel 4 news anchor and journalist Andrew Neal said: “The chaos at Truss is getting comical. The massive confusion over important financial data is meant to reassure the markets.”

Sterling Maintained Gains Against USD

Markets may not be alarmed by the emerging nuances in UK domestic politics. Instead, global factors appear to be critical again: It put the benchmark S&P 500 index on its strongest two-day winning streak since 2020.

Sterling is boosted by its “high beta” mode, which means it tends to rise in tandem with the stock markets and fall when they are in decline. Accordingly, Kamal Sharma, currency analyst at Bank of America, says: “A currency is referred to as a 'high beta' if it is sensitive to global risk appetite. “The sensitivity of the British pound to the global stock market has increased... About 35% of currency fluctuations can be explained by changes in the stock index.”

However, 2022 saw global equities enter a bear market, a development that confirms a 16% loss for the pound against the US dollar and a loss of 3.60% against the euro. This sensitivity is caused by the pound's reliance too heavily on foreign investor capital inflows to maintain its valuation, due to the UK's longstanding current account deficit of 5.3% of GDP. And if foreign investors are not buying UK stocks and bonds, the British pound is at risk of falling, exposing it to bear markets such as the 2022 markets.

Thus the near-term outlook for sterling can depend on how long the current rally in September can continue, is it permanent or will it inevitably be sold off?

“Don't expect the risk upside to continue for very long," says Anders Eklöf, an analyst at Swedbank. "Investors will remain cautious going forward to avoid less liquid and less volatile assets/currencies." He believes that the risk uptick in the past two days should be seen primarily as a temporary correction to the oversold market. "The return of sterling is built on weak foundations," the analyst added.

In general, the markets are still driven by the fear that global central banks will continue to tighten monetary policy to the point that a global recession will occur. “Negative pressures on global economic growth continue with leading indicators pointing to a recession in Europe in the second half and in the US in early 2023,” says Las Olsen, chief economist at Danske Bank. He adds: “Continued rate hikes by the Federal Reserve will significantly tighten financial conditions, which will increasingly take effect in 2023. Headwinds to growth in China also remain strong from the policy of non-spreading of the Corona virus, the continuation of the real estate crisis, and the weakening exports now.

Meanwhile, the dollar is the ultimate beneficiary from this combination of higher US interest rates and strong demand for safe haven assets as markets drop.

Today's forecast for the GBP/USD pair:

With the technical indicators reaching overbought levels, the GBP/USD pair did not get enough momentum to complete the rebound higher.

- As mentioned in the recent technical analyses, the gains of the currency pair may collapse quickly.

- Factors of the US dollar's strength are continuing, and it may remain the strongest until the job numbers are announced.

- The US dollar, which will draw a picture of the dollar's closing against the rest of the currencies for this week's trading.

- The return of the sterling dollar towards the support level 1.1085 will end the recent bullish rebound expectations.

On the other hand, and over the same time period, the bulls will need to breach the resistance levels 1.1520 and 1.1785, respectively, to confirm the change in the general trend.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.