Last week's trading was somewhat good for the pound sterling against the rest of the major currencies, as the Bank of England intervened to fix what was spoiled by the British government's plans. This caused the GBP/USD pair to plunge to its lowest level ever.

- The gains of the rebound last week brought it to the level of 1.1234 and closed the exciting week's trading around the level of 1.1153.

- The sterling got some momentum from Britain's economic growth figures.

- The Office for National Statistics said the UK economy grew in the second quarter of 2022, with initial estimates revised for a 0.1% contraction, however revisions for the decline during the pandemic were revised much less.

A growth of 0.2% means Britain will have to post quarterly declines in the third and fourth quarters to enter a technical recession. The slight uptick in growth followed an increase in services production, which is estimated to rise 0.2% in the second quarter, the Office for National Statistics added.

However, there was continued weakness in the wholesale and retail trade, and the health industries. The Office for National Statistics also added that its estimates show that UK GDP contracted by a downwardly revised 11.0% in 2020 (previously 9.3%), reflecting the effects of coronavirus (COVID-19) restrictions. So Paul Dills, chief UK economist at Capital Economics, says: “The good news is that the economy is not really in a recession. The bad news is that, contrary to previous thinking, it has not yet returned to pre-pandemic levels.”

The UK's GDP is now estimated to have grown by an upwardly revised 7.5% in 2021, previously being 7.4%. The real GDP level is now estimated to be 0.2% lower than it was before the coronavirus in the fourth quarter of 2019. The analyst added, “Real consumer spending is now believed to be 2.7% below the pre-pandemic peak compared to 0.6% lower from the previous. This is partly because the reviews show that families have saved more during the pandemic and have spent less since then.” “The contraction in economic activity during 2020 looks worse than previously thought, and the subsequent recovery is weaker, after the latest set of national accounts reviews,” says Samuel Tombs, chief UK economist at Pantheon Macroeconics.

The revision comes as the National Statistics Office refines its methodology by bringing in new data sets, improving its estimates of the GDP deflator, and reconciling the three separate measures of GDP - output, expenditures, and income - for 2021 for the first time. Accordingly, GDP in the second quarter of 2022 was 0.2% lower than its peak in the fourth quarter of 2019, rather than 0.6% higher than it, indicating that the damage to the economic supply side by Covid and Brexit is greater than it was previously believed.

British economy will fall into a recession

According to experts, despite the good news about the economy's performance in the second quarter, the overall picture is that the economy is in worse shape than we previously thought. This was before we felt a complete pullback from rising inflation and a jump in borrowing costs.

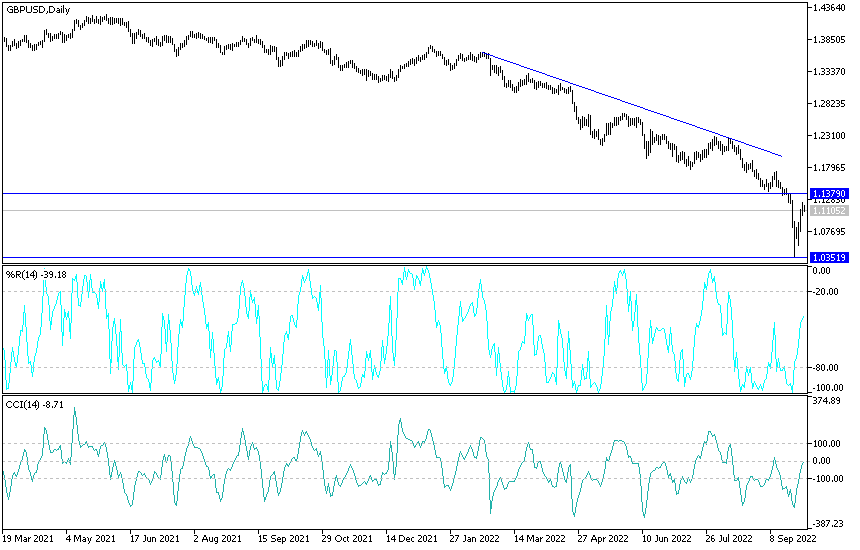

Technical analysis of the GBP/USD pair:

In the near term and according to the hourly chart, it appears that the GBP/USD is trading within a sharply bullish channel formation. This indicates a strong short-term bullish momentum in market sentiment. Therefore, the bulls will look to extend the current rally towards the 1.1273 resistance or above to the 1.1391 resistance. On the other hand, the bears will look to pounce on a potential pullback around 1.1033 or lower at 1.0902.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.0821 or lower to the 1.0360 support. On the other hand, the bulls will target the long-term bounces around 1.1538 or higher at the 1.1999 resistance.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.