- The strong movement of the British pound came to a trembling halt in recent trading sessions, after some new uncertainty in the UK bond markets. British bonds fell and the yield they offered rose after the Bank of England was forced to deny that it would further delay its quantitative tightening programme.

- This is the process by which you sell the gold bonds that you acquired as part of the QE process to the market.

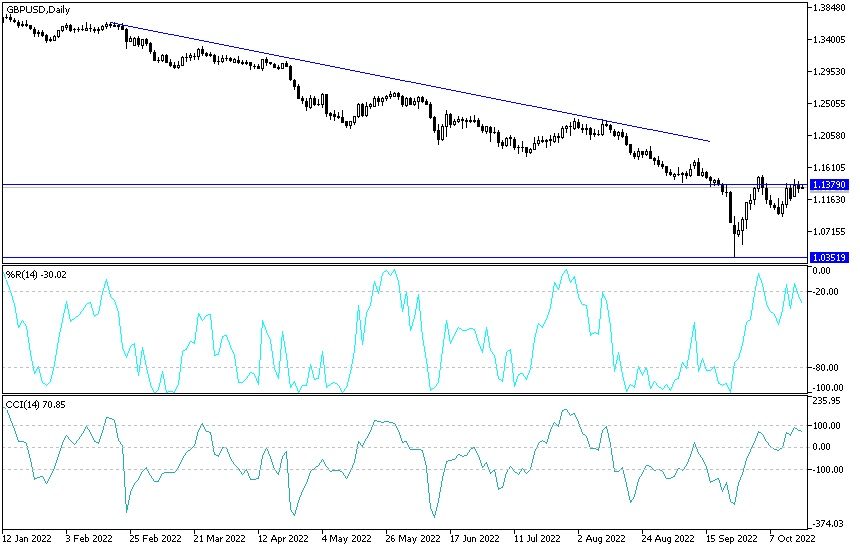

- In the case of the GBP/USD currency pair, we noticed a strong fluctuation in performance between the resistance level of 1.1440 and the support level of 1.1255, and it is settling around the level of 1.1320 at the time of writing the analysis, waiting for anything new.

Quantitative tightening is a major component of the bank's policy of monetary policy normalization as it combats inflation. The Financial Times reported on Tuesday that the bank is ready to delay the program to ensure bond markets remain flat after the volatility of recent weeks. It is alleged that the bank fears an increase in the bond supply will drive down their value and increase yields at a time of heightened tension over the future of debt sustainability in the UK.

The bank had already postponed the start of the bond sale program from October 6 until the end of this month. The Financial Times says further delays are now likely as the bank sees UK bond markets as "extremely tired". The pound has proven highly sensitive to developments in the bond market recently, which explains why the pound fell after the news on Tuesday morning said that the FT's claim that quantitative tightening will be delayed further is false.

The yield on the UK's 10-year bond rose to 4.05%, after falling 3.911% earlier in the day. By all means, the moves aren't huge, but the slight increase in returns may indicate that the recent shift in returns may be over. It also means that bond yields have not fallen to pre-"budget" levels, indicating an element of scarring in the market.

Could this therefore indicate that the recent recovery in the pound is also over?

What is certain is that the bond market is now firmly in control of the British government and the currency. So Antoine Buffett, global markets expert at ING, says the bank will eventually realize that now is not the time to engage in quantitative tightening (QT). Trading conditions in gold have deteriorated throughout the year, and since summer it has become clear that QT will throw more fuel on the fire.” And ING adds after Hunt's financial turnaround, what was needed for the rally to below 4% was a delay in QT sales, and less re-pricing of the rally forecast. So far, only one of these terms has been delivered.

GBP/USD Forecast

I anticipate strong instability in the performance of the GBP/USD currency pair, as confidence remains fragile towards the pound benefiting from the quick measures provided by the British government and the Bank of England. According to the performance on the daily chart below, the bulls will control the direction of the stronger GBP/USD pair if prices move towards the 1.1530 and 1.1700 resistance levels, respectively.

On the other hand, breaking the 1.1180 support level will negatively affect expectations of a rebound upwards, and as a result, selling operations may increase. Today, the pound will await the announcement of British inflation figures.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.