- After the continuation of risk appetite and a temporary halt to the sharp gains of the US dollar the price of the currency pair EUR/USD is still reacting positively.

- However, its gains stopped at the resistance level of 0.9875, and as I mentioned before, the pair’s gains will remain limited and vulnerable to collapse at any time.

- The consequences of the Russian-Ukrainian war are still Negative for the future recovery of the eurozone economy.

- The euro-dollar pair is stable around the level of 0.9830 at the time of writing the analysis, waiting for anything new.

Danske Bank downgrades its forecast for the EUR/USD exchange rate, saying that the US dollar has not yet reached new highs and the trade shock in the Eurozone is likely to continue. In a new forex research briefing, analysts at one of Scandinavia's largest lenders say the eurozone is expected to experience an extended terms-of-trade shock, which will undermine its currency.

“We have lowered our forecast file for EUR/USD and expect a crossover of 0.93 at 12M on the back of a major shock in the terms of trade between Europe and the United States,” said Jens Nærvig Pedersen, Senior Analyst at Danske Bank.

The Eurozone has seen its trade surplus, driven by the German export engine, which is completely reflected in the 2022 deficit. This is with rising prices for imported gas and oil, driving up the cost of imports, and dealing a blow to a region that is a net energy importer. Meanwhile, the global slowdown and rising production costs have shocked Germany's industrial export earnings, creating a substantially negative trade balance for the euro.

China is an important destination for high-value German goods, but the ongoing slowdown in the world's second-largest economy has hit export earnings hard. Indeed, the Chinese slowdown is so significant that officials seem unprepared to release their latest GDP data. Moreover, Danske Bank economists warn that the risks to growth in the Eurozone are strongly tilted to the downside.

Regarding the dollar, further strength is expected. “One of the key assumptions behind our FX forecast is a stronger US dollar and tightening global financial conditions,” says the analyst. The global economy is expected to continue to slow as central banks raise interest rates and consumers pull back in the face of rising inflation. This cyclical deflation plays into the dollar's favour, and Danske Bank says this time is no different. Crucially, the deflation extended further, providing support for the US currency.

The US Federal Reserve, which continues to fight high and rising inflation, is leading the march towards higher central bank interest rates, which in turn creates an interest rate advantage for the dollar.

“Essentially, the US should continue to be a market for high interest rates and stocks continue to attract foreign investors. This means that the United States is more likely to attract capital, which helps the dollar in general," added the analyst.

Danske Bank expects the EUR/USD exchange rate to be around 0.97 in one month, 0.96 in three months, 0.95 in six months and 0.93 in twelve months.

A major risk of this view, which could see the EUR/USD recover to 1.15, is fading global inflation pressures and increasing industrial production.

“Upside risks also include a renewed focus on Chinese credit policy and an increase in global capital expenditures, but neither appears to be materializing at the moment,” added the analyst.

EUR/USD Forecast

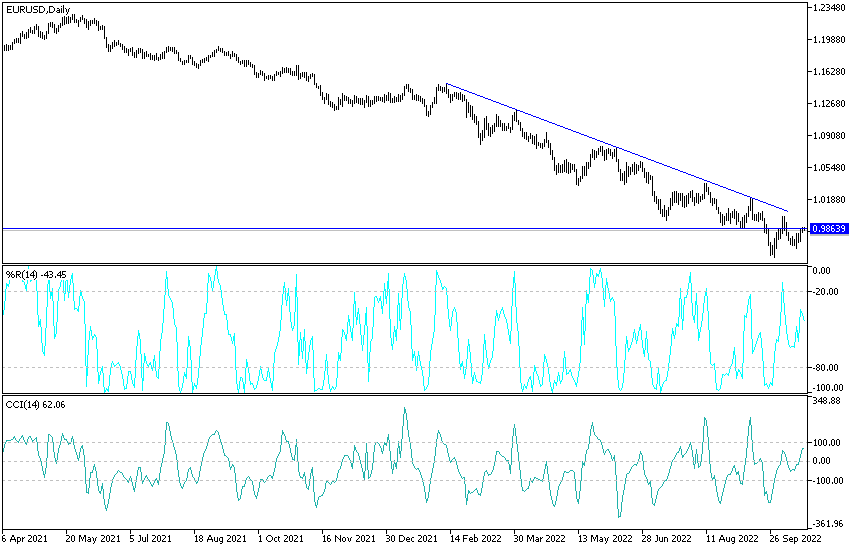

According to the performance on the daily chart below, the price of the EUR/USD currency pair is still in a bullish retracement range that needs more bullish momentum. Breaking the bearish outlook which is still valid and the first breakout of the trend may be by testing the 1.0000 parity price, which may stimulate the bulls to further advance .

On the downside, the breach of the 0.9730 support level will motivate the bears to control the performance. Today, the euro will be affected by the announcement of the inflation rate in the euro zone, and the dollar will be affected by the announcement of the US housing market figures.

Ready to trade our Forex technical analysis? Here are the best Forex brokers to choose from.