Today's recommendation on the USD/TRY

- Risk 0.50%.

- Yesterday's sell recommendation was activated and it is still trading

Best buying entry points

- Entering a buy position with a pending order from the 18.24 level

- Set a stop-loss point to close below the 18.05 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 18.31.

Best selling entry points

- Entering a short position with a pending order from the 18.50 level.

- The best points for setting stop-loss are closing the highest levels of 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 17.85 support levels.

The Turkish lira stabilized near its all-time low, which was recorded yesterday, as the price breached the top recorded during the last year, which the pair declined immediately after reaching it.

The Turkish currency continues its slow decline against the US dollar as investors await the Federal Reserve's announcement later in the day regarding a rate hike after the country's latest inflation reading revealed a higher-than-expected rise. The US Federal Reserve is expected to raise the interest rate by about 75 basis points, amid other expectations to raise the interest rate by about a full percentage point.

It is noteworthy that the difference in monetary policies is one of the biggest reasons for the decline of the lira. While the US Federal Reserve tightens monetary policy as it raises the interest rate, the Turkish Central Bank adheres to a stimulus monetary policy based on lowering the interest rate. It is noteworthy that the slow movement of the lira is mainly due to the intervention of the Turkish Central Bank in the markets, as it prevents the decline of the strong lira by injecting more foreign currencies into the markets.

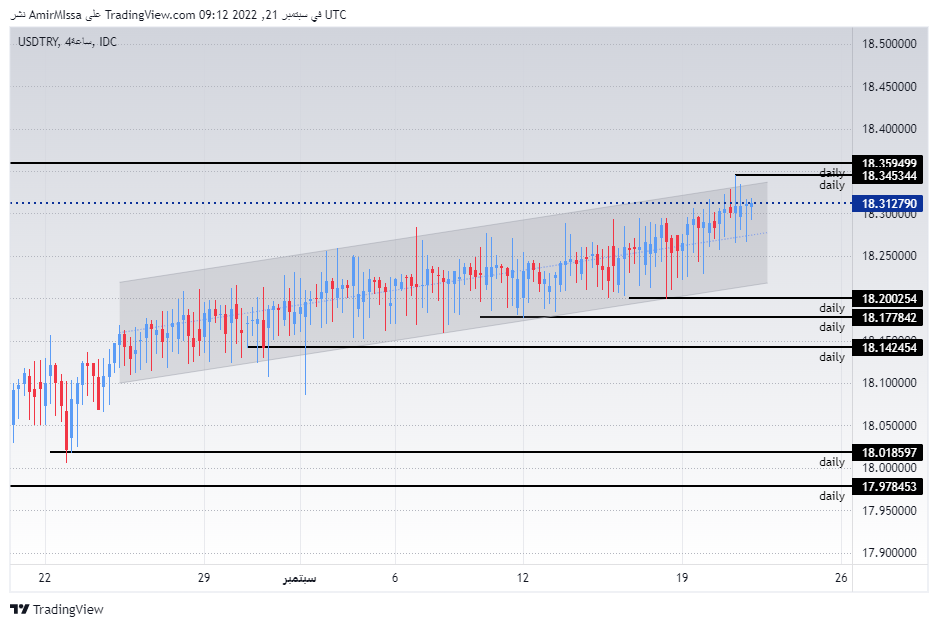

USD/TRY Technical Analysis

On the technical front, the Turkish lira maintained its decline against the dollar at the same slow pace during today's trading, as the pair recorded record levels at 18.33. This happened before the pair returned to trading in a narrow range of movement as shown on the chart. The pair is still trading within an ascending channel on the four-hour time frame. The pair is still trading above the 50, 100 and 200 moving averages on the daily time frame, as well as on the four-time frame, where the pair maintained the bullish trend.

The pair is also trading the highest levels of support, which are concentrated at levels of 18.24 and 18.20, respectively. On the other hand, the lira is trading below the resistance levels at 18.34 and 18.36. Any drop for it represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free currency signals? Here are the best Forex brokers to choose from.

Ready to trade our free currency signals? Here are the best Forex brokers to choose from.