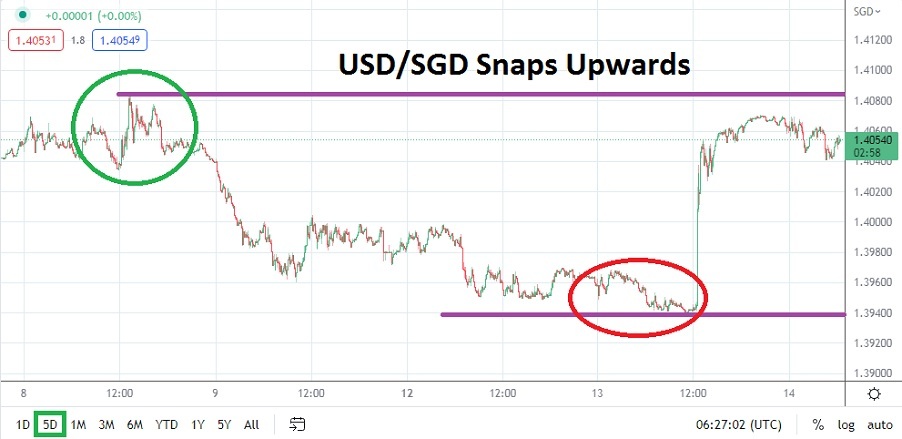

The USD/SGD is again near long term highs after U.S inflation data caused a tidal wave of reactions throughout the global financial markets yesterday.

Bearish USD/SGD speculators may have been quite relaxed yesterday before U.S inflation data was printed. The USD/SGD currency pair was traversing lower depths near 1.39400 on Tuesday, and some speculators may have believed a potential drop to 1.39300 was a solid target for wagers downward. However, these speculative goals were shattered when U.S Core Consumer Price Index data came in with a whooping increase of 0.6% compared to the estimated gain of ‘only’ 0.3%.

Upon the release of the inflation data being much stronger than anticipated, global financial markets shattered. Equity markets internationally sudden displayed vast selling and in turn the USD gained momentum. The USD/SGD snapped higher and suddenly instead of support levels looking vulnerable, it was resistance up above that appeared weak.

Higher Values from the 7th and 8th of September may be Targeted by Bullish Traders

As of this writing the USD/SGD is near the 1.40500 realm. Early trading today has actually been consolidated when compared to recent price action. The value of the USD/SGD is within sight of higher junctures seen on the 7th and 8th of September, when the Forex pair actually traded near the 1.40800 to 1.41000 ratios. However, selling did occur after those apex marks were seen, likely by institutions which thought they had the U.S Federal Reserve and its outlook figured out.

However, yesterday’s U.S inflation data not only wrecked short term technical perceptions of the USD/SGD, it may have destroyed the fundamental viewpoints of some financial houses betting on the U.S Fed to become more dovish over the next few months. In a heartbeat U.S Core CPI data underscored the notion the U.S Fed has a tough road ahead, as they try to fight inflation with higher interest rate hikes.

- The U.S Federal Reserve will increase its interest rate again next week certainly, and its outlook likely has to remain hawkish considering yesterday’s inflation data results.

- If the U.S central bank has to continue to speak about additional interest rate hikes, this could continue to strengthen the USD/SGD until better clarity exists.

Resistance Levels near 1.40600 to 1.47000 should be monitored in the Near Term

If the USD/SGD sustains its current higher range above the 1.40500 level, speculators may believe additional bullish behavior may develop in the currency pair. Technical traders should monitor support levels and if they have buying sentiment, they may want to ignite long positions when small reversals lower have occurred to aim for upwards price action with realistic targets. Global markets may continue to prove nervous today and traders are warned to remain cautious under the present conditions.

Singapore Dollar Short Term Outlook:

Current Resistance: 1.40750

Current Support: 1.40375

High Target: 1.41300

Low Target: 1.40400

Ready to trade Natural Gas in Forex? Here are some excellent commodity trading platforms to choose from.

Ready to trade Natural Gas in Forex? Here are some excellent commodity trading platforms to choose from.