The bulls controlled the direction of the USD/JPY currency pair, the strongest with the highest gains for the currency pair in 24 years. The currency pair tested the resistance level of 140.80, which is stable near it at the time of writing the analysis. The performance was limited at the beginning of trading this week in light of the American holiday. The currency pair gains primarily due to the clear contrast in the future of policy tightening between the Federal Reserve sticking to more rate hikes and the Bank of Japan, which has negative interest rates.

Avoiding Interest Rates

The Bank of Japan should avoid raising interest rates for now while preparing for eventual policy normalization, according to a former Bank of Japan official seen as a potential candidate for the position of deputy governor. “This is not the time to raise interest rates dramatically, so there is a limit to what the Bank of Japan can do now,” said Yuri Okina, a former official and head of the Japan Research Institute, in an interview.

She said monetary policy still had to be gradually normalized over the long term as a range of policy side effects were becoming increasingly important. Okina's comments are likely to reinforce the market's view that any tightening in policy will come after Governor Haruhiko Kuroda steps down in April. By that time, a new governor and two new deputies will be able to take the lead in politics. Kuroda, for his part, has repeatedly said that he wants to see evidence that inflation will persist before it backs off. He also made clear that policy should not be modified to address the weak yen.

She added that if wage growth exceeds inflation amid a positive economic cycle that would provide an adequate justification for canceling the stimulus, but it is not clear that these conditions will be met soon. "I'm not sure we're on a path toward a virtuous economic cycle," Okina added. She said there were "significant downside risks" to the economy, including a global slowdown as central banks abroad raise interest rates at an accelerated pace to cool inflation.

Large increases in US interest rates from the Federal Reserve are likely to keep the yen under downward pressure after it crossed the 140 level against the dollar last week for the first time in 24 years.

"It is right not to adjust monetary policy on the basis of foreign exchange rates," Okina said, echoing the BoJ's stance. But she added that the bank should be careful not to stir up too much consumption by emphasizing this position. "It's hard to say that the yen's weakness at this level is generally positive," Okina added, referring to the comment Kuroda has made frequently. "There is a huge gap between those who have had it and those who don't."

Japanese corporate earnings jumped to their highest level since 1954 in the last quarter, thanks in part to a weak yen. At the same time, the currency contributes to a decrease in the purchasing power of households by raising the prices of imports. It also burdens small businesses by increasing input costs. However, the longer prices remain very low, the more fiscal discipline the government will have, she said. It added that other increasing side effects include the deteriorating performance of markets in the economy and weak profitability in the banking sector.

"The need for normalization is becoming increasingly important," she added. "Any steps must be taken very carefully."

Prime Minister Fumio Kishida is widely expected to nominate candidates for the three leadership positions at the end of this year or early next.

Forecast of the dollar against the Japanese yen:

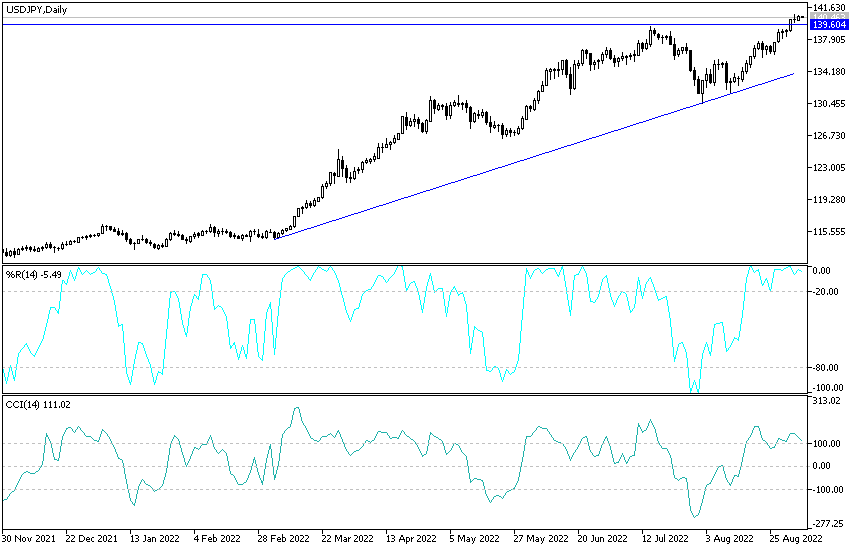

- There is no change in my technical view of the USD/JPY currency pair.

- The general trend is still bullish.

- Stability above the 140.00 psychological resistance confirms this and pushes the technical indicators towards strong overbought levels and expects profit-taking sales at any time.

- This is especially if a Japanese move was made to stop the sharp collapse of the Japanese yen.

- The currency pair will be affected this week by the statements of US monetary policy officials led by Jerome Powell, as well as the extent to which investors are taking risks or not.

In the event of a natural correction, the currency pair may test the support levels 139.80 and 138.80, respectively.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.