Despite the recent profit-taking sell-off, the USD/JPY currency pair remained within the ascending channel range. The pair may maintain the current trend until the US Federal Reserve announces the decision to raise US interest rates later this week. The dollar-yen pair will start this week's trading, stable around the resistance level of 143.00, and the currency pair's gains last week reached the resistance level of 144.95, the highest in 24 years.

The dollar temporarily retreated from fresh highs ahead of the weekend, after a University of Michigan (UoM) survey indicated that US consumers' expectations for short- and medium-term inflation in September, although this may not be the most important detail of the survey. The University of Michigan's gauges of consumer inflation expectations over both the 1- and 5-year horizons for September slipped in what may or may not come as relief to the Federal Reserve (Fed).

The results of the university’s survey stated, “With the continuing decline in energy prices, the average expected inflation rate for the next year decreased to 4.6%, which is the lowest reading since last September. At 2.8%, average long-term inflation expectations have fallen below the 2.9-3.1% range for the first time since then. July 2021".

Inflation Uncertainty

There's uncertainty about whether that's as good news as it may sound, however, because while consumers' expectations of inflation fell in September, consumers themselves are becoming less confident that they are right to see inflation develop in line with their expectations. "Consumers continue to display significant uncertainty about the future course of prices," the statement said. Uncertainty about short-term inflation reached levels last seen in 1982, and uncertainty about long-term inflation rose from 3.9 to 4.5 this month, well above the 3.4 level seen last September.

It is likely that Fed policy makers will not view this heightened uncertainty favorably, as it could be interpreted as a loss of confidence in the bank's ability to maintain or otherwise restore price stability. Overall, it's not just Fed Governor Powell who recently expressed concerns about the inflation outlook because it has been a central topic in nearly all public remarks made by all FOMC officials in recent weeks. For his part, Federal Reserve Governor Christopher Waller said last Friday: “Another factor that I will be watching closely is the long-term inflation outlook, which I think has a major impact on inflation.”

Inflation expectations may be of greater concern to Federal Reserve officials since data from the Bureau of Labor Statistics showed core inflation began reversing a multi-month decline during August. This was when the numbers were released on Tuesday and barely a week after the September Fed rate decision. Core inflation is more significant because it excludes volatile energy and food from the basket of goods whose prices are measured and is therefore believed to be the best reflection of domestically generated inflation pressures. "Time is ticking, and as I mentioned the longer inflation stays much above target, the greater the concern that the public will naturally begin to incorporate higher inflation into economic decision-making and our job is to make sure that doesn't happen," Powell said.

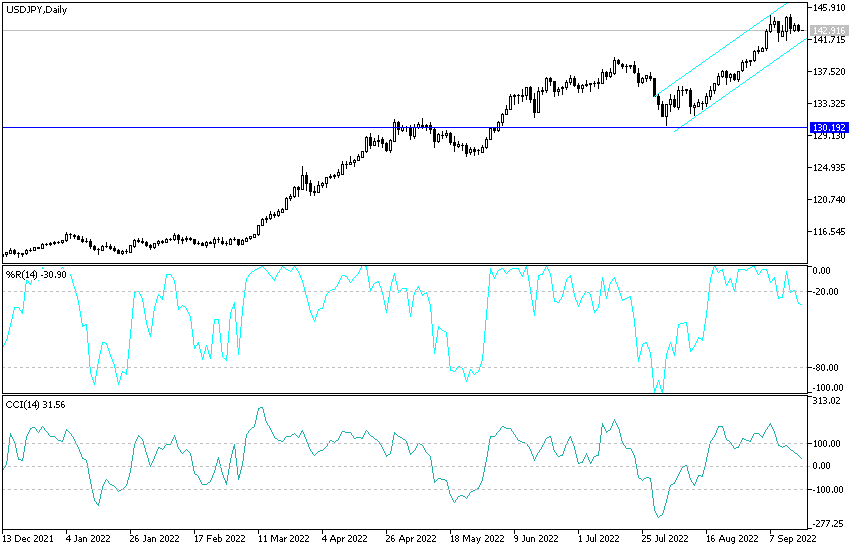

USD/JPY Technical Analysis:

- In the near term and according to the performance of the hourly chart, it appears that the USD/JPY currency pair is trading within a neutral channel formation.

- This indicates that there is no clear directional bias in market sentiment.

- The bears will target the potential downside channel breakout profits at around 142.24 or lower at 141.58 support. On the other hand, the bulls will look to pounce on profits at around 143.54 or higher at 144.21.

In the long term on the daily chart, it appears that USD/JPY is trading within an ascending channel formation. This indicates a significant long-term bullish momentum in market sentiment. Therefore, the bulls are looking to extend the current rally towards 146.26 or higher to 149.54 resistance. On the other hand, the bears will target long-term profits at around 140.04 or lower at the 136.58 support.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.