The USD/CAD is moving with swift price action in early trading this morning as financial houses brace for the Bank of Canada’s anticipated interest rate hike later today. As of this writing the USD/CAD currency pair is near the 1.36700 vicinity, but conditions are fast and price changes should be expected by speculators. Short term traders with limited funds need to practice risk taking tactics with extreme care.

The Bank of Canada is expected to Hike its Overnight Rate by 0.75% to 3.25%

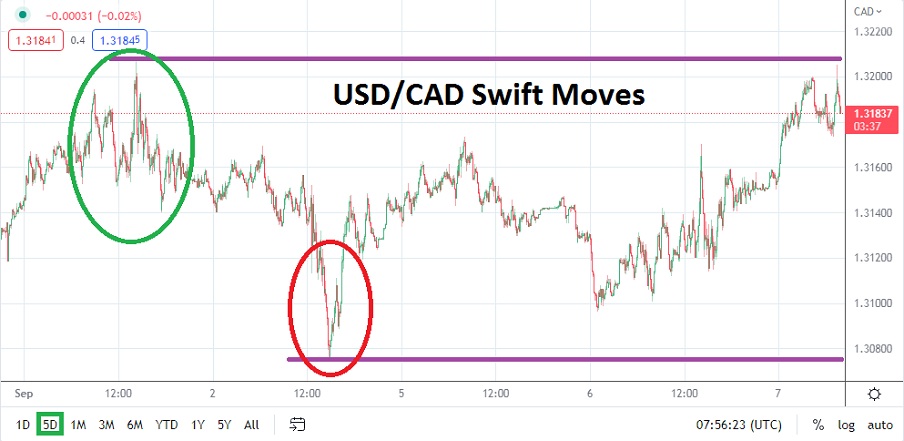

Financial institutions are anticipating an interest rate hike today which will match the move made by the U.S Federal Reserve in July. The move by the BoC is widely expected to try and keep pace with the U.S, and make sure Canada also keeps its central bank outlook in line with its neighbor below. The USD/CAD is continuing to bounce up against important resistance. In July the USD/CAD did trade above the 1.32000 mark, and on the 1st of September the Forex pair again hit the 1.32000 mark.

- Again in early trading today, the 7th of September, the USD/CAD hit the 1.32000 mark, but then reversed lower.

- Trading conditions will remain fast and volatile before and after the Bank of Canada Rate Statement today.

Speculative Traders need to be ready for Dynamic Price Action in this Higher Range

Traders should monitor the short-term ratio of 1.31700 as support. If this level continues to prove durable it may act as a launching pad for potential buying positions that seek quick-hitting moves higher and try to take advantage of the volatile USD/CAD today. However, traders need all of their risk management working and it may prove to be a wise idea to use entry price orders when engaging the USD/CAD so fills meet expectations.

Bullish speculators may want to be conservative today; the USD/CAD is trading near important long-term resistance as it trades sincerely within a higher price range not challenged for a sustainable time since October 2020. The incremental trend higher within the USD/CAD may not be ready to reverse quite yet and long-term outlooks remain bullish looking.

However, short-term conditions are bound to be very challenging today for speculators and they should be ready to get in and out of trades quickly. Simply put the near term the USD/CAD is likely to produce sharp price action which could prove difficult. Traders are advised to use take profit orders which are closer to the market price than their stop losses, but if this is practiced, very conservative leverage should be used.

Canadian Dollar Short Term Outlook:

Current Resistance: 1.31880

Current Support: 1.31670

High Target: 1.32125

Low Target: 1.31430

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.