The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 28th August that the best trades for the week were likely to be:

- Short of the EUR/USD currency pair, which fell by 0.12%.

- Short of the GBP/USD currency pair, which fell by 1.95%.

- Short of the NZD/USD currency pair, which fell by 0.39%.

This produced an average win of 0.82%.

The news is dominated by last Friday’s very solid US jobs data, which showed a healthy creation of non-farm payrolls new jobs last month, beyond the consensus forecast of 300k. This is seen as positive for the US Dollar, as it shows strength in the US economy, and increases the likelihood that the Federal Reserve will hike rates by a full 0.75% at its next policy meeting. A 0.50% rate hike at the Fed’s next meeting is all but certain, while analysts now see a real chance of a 0.75% as an alternate possibility.

We saw clear risk-off movement in the markets last week, with money flowing out of almost all currencies and into the US Dollar as a safe haven. The US stock market has technically been in a bear market for some time, with the US yield curve inverted for several weeks now. The US is also arguably in a recession, having seen two successive quarters of GDP contraction, although wages growth and the job market remain buoyant.

To recap there were two other important economic data releases last week apart from non-farm payrolls data. The results were as follows:

- US Average Hourly Earnings and Unemployment data – average earnings rose by 0.3% month on month when only 0.4% had been expected, while the unemployment rate rose to 3.7%, higher than the forecasted 3.5%.

- German Preliminary CPI data – the month-on-month change was 0.3%, as had been expected.

- US JOLTS Job Openings data – this came in considerably higher than expected, at 11.24 million.

- US CB Consumer Confidence – the survey showed consumer confidence remains quite buoyant, considerably higher than had been expected.

- US ISM Manufacturing PMI data – this came in very close to the estimate.

- Swiss CPI (inflation) data – this came in slightly higher than had been expected, with inflation showing a month on month increase of 0.3% compared to the 0.2% which had been expected.

The Forex market saw relative strength in the Euro and the US Dollar last week. The weakest currencies were the British Pound, the Japanese Yen, and the Swiss Franc.

Rates of coronavirus infection globally dropped last week for the seventh consecutive week. The most significant growths in new confirmed coronavirus cases overall right now are happening in Niger, Russia, and Taiwan.

The Week Ahead: 5th September – 9th September 2022

The coming week in the markets is likely to show a slightly higher level of volatility than last week, with Friday’s higher level of market activity following Powell’s speech likely to continue. Releases due are, in order of likely importance:

- ECB Main Refinancing Rate and Monetary Policy Statement

- BoC Overnight Rate and Rate Statement (CAD)

- RBA Cash Rate and Rate Statement (AUD)

- Australian GDP data

- Announcement of new UK Prime Minister

- UK Monetary Report Hearings (GBP)

- US ISM Services PMI data

- Speech by Fed Chair Powell

- CAD Employment Change & Unemployment Rate

- Speech by RBA Governor Lowe

It is a public holiday this Monday 5th September in the USA and Canada.

Technical Analysis

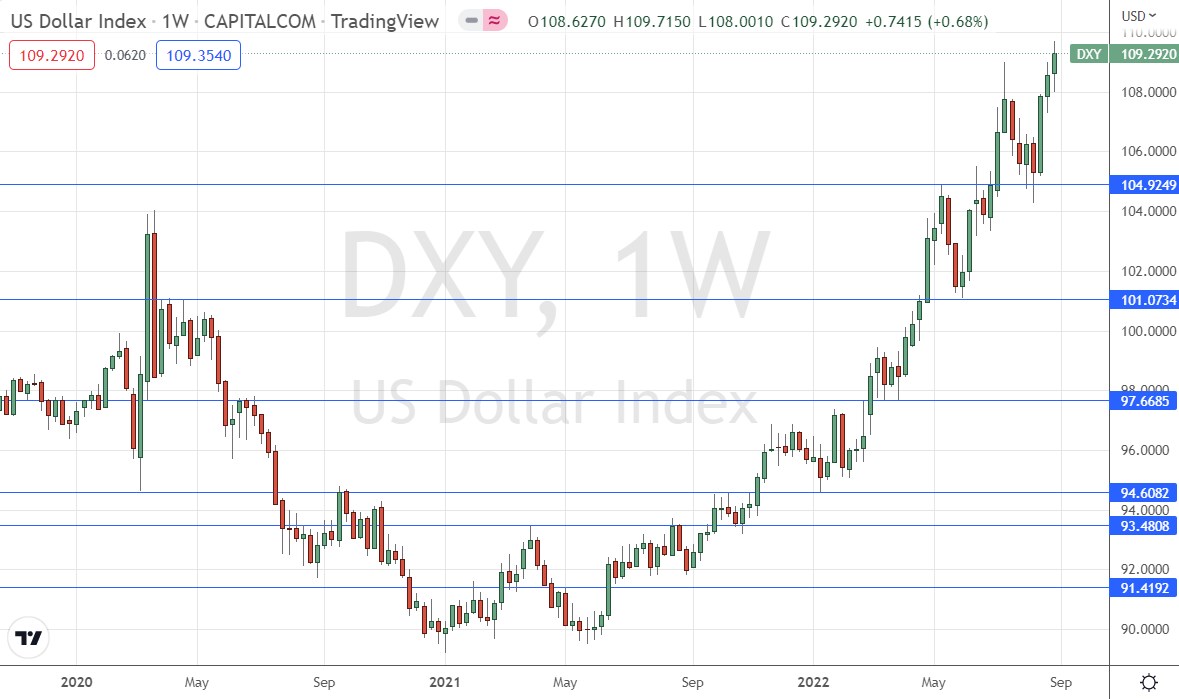

U.S. Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish candlestick which closed up, in line with the long-term trend, which is bullish. The weekly closing price is again at a new 20-year + high, and the week’s rise came after the price rejected the support level below just under 105.00 a few weeks ago. These are all bullish signs, and with the chair of the Fed giving a very hawkish speech the week before last about the need for more rate hikes to fight US inflation, and the fact that the US economy is still generating new jobs at a healthy rate, the bullish technical picture is supported by sentiment and monetary policy fundamentals.

It will probably be a good idea to look for long trades in the US Dollar over the coming week. This is a very powerful, long-term bullish trend in the most important currency in the Forex market, and it remains likely to continue if sentiment remains driven by the fear of ongoing interest rate hikes negatively impacting risky assets, with the US Dollar acting as a primary safe haven.

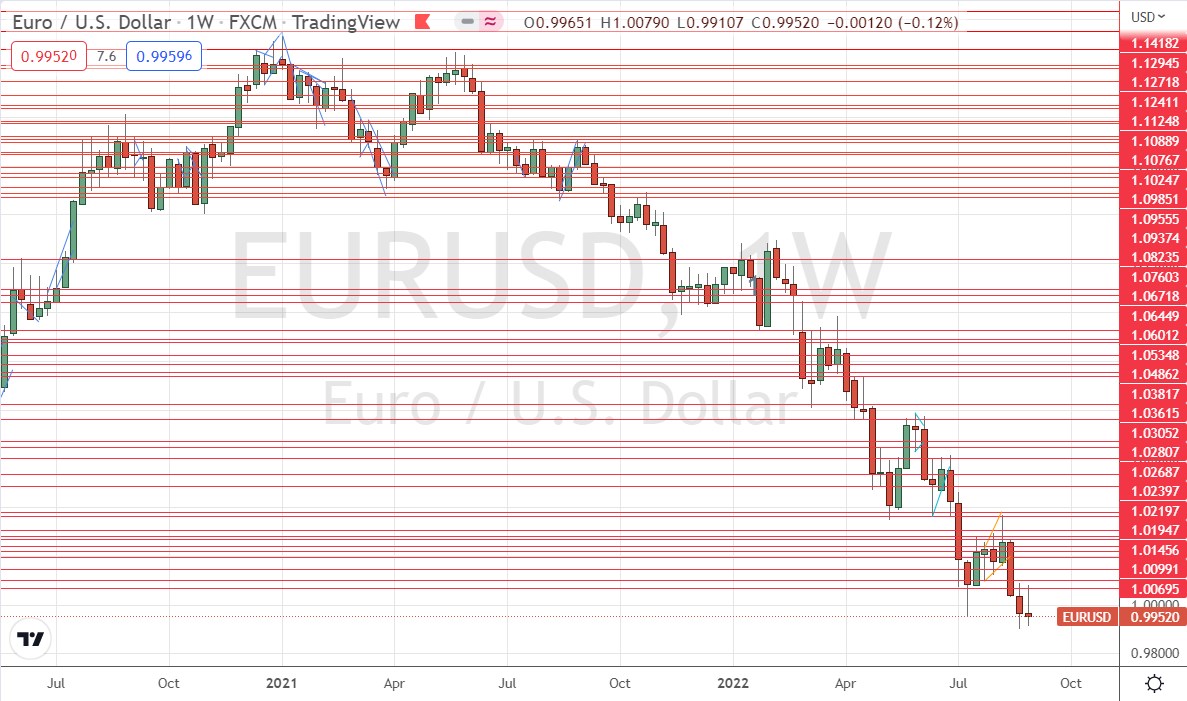

EUR/USD

Last week saw the EUR/USD currency pair print a bearish inside bar which closed slightly lower over the week. This pair is technically interesting as it looks prone to a bearish breakdown to blue sky which has not been reached in almost 20 years.

The Euro is beset by worry over the impact of ECB rate hikes which have begun and must continue. These hikes are going to put a severe strain on government bond markets in southern Europe, notably Italy. The ECB is meeting this week and is widely expected to raise its interest rate by 0.75%.

The strength of the US Dollar and the technical breakdown we see here, plus fundamental headwinds against the Euro, see a short trend trade opportunity continue in this currency pair. However, it is probably helpful to use relatively wide trailing stop losses for this pair, as using ATR 3 has over the years produced better results than ATR 1.

GBP/USD

Last week saw the GBP/USD currency pair print a large bearish candlestick which closed right on its low, suggesting strong bearish momentum. This pair is technically interesting as it has the lowest weekly close seen since the coronavirus panic in March 2020 and is close to its lowest price is 37 years.

The British Pound is troubled by fundamental woes, including new increased inflation figures above 10%, and a Bank of England forecast of a coming recession which will last for five quarters and see GDP shrink by 2.2%.

The strength of the US Dollar and the technical breakdown we see here, plus fundamental headwinds against the Pound, see a short trend trade opportunity continue in this currency pair. However, it is important to use relatively tight trailing stop losses for the British Pound, as using ATR 1 has over the years produced much better results than the more typical ATR 3.

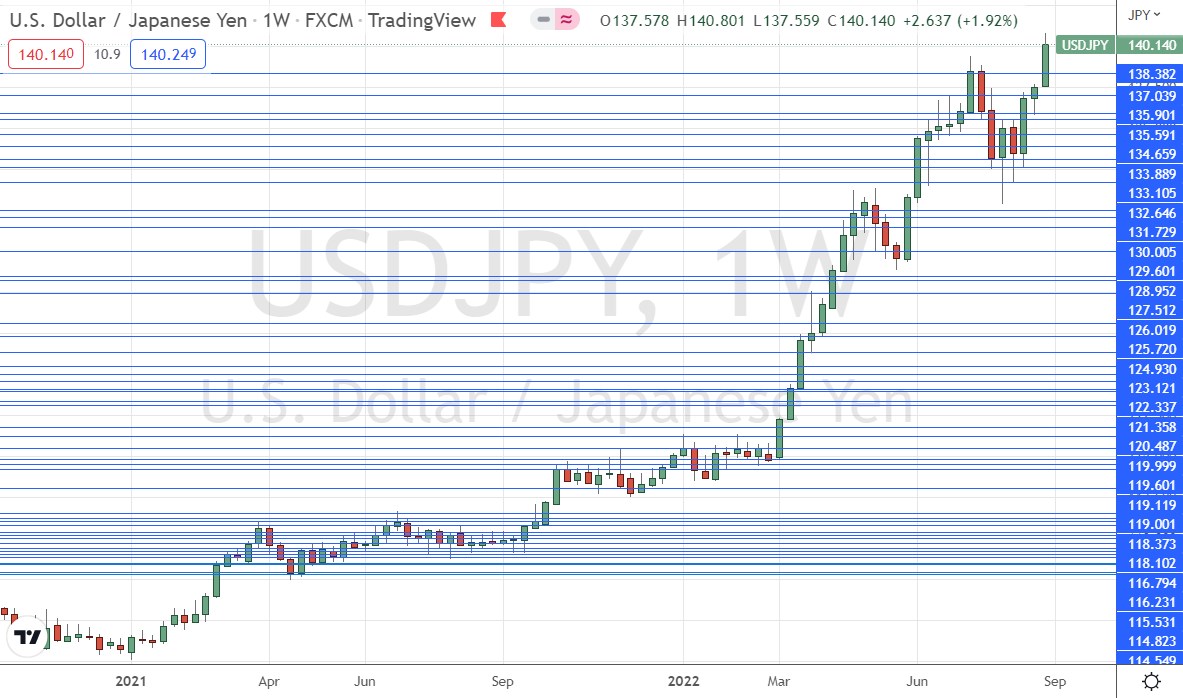

USD/JPY

The USD/JPY currency pair was a huge gainer last week, and at one point the Yen had lost more value against the Dollar than any other currency over the week, but the price pulled back significantly as the week ended.

This strong movement is driven mostly by the US Dollar, although the Yen retains weakness as Japanese policymakers are still trying to inflate their economy, with Japanese inflation remaining well below its 2% target. This puts the Bank of Japan on a very divergent course to every other major central bank.

What is most interesting about last week’s move is that the price has now breached the psychologically important ¥140 level for the first time in decades. So, the price is trading in blue sky, and nobody know where it will be likely to face resistance.

Trend traders will be looking to be long of this currency pair on its strong bullish breakout to new high prices.

Bottom Line

I see the best opportunities in the financial markets this week as likely to be short of the EUR/USD and GBP/USD currency pairs, and long of the USD/JPY currency pair.

Ready to trade our Forex weekly analysis? We’ve shortlisted the best Forex trading brokers in the industry for you.