Gold futures fell after a higher-than-expected US inflation report in August. Despite gold being a safe haven amid an inflationary environment, expectations of additional tightening financial markets weighed on metallic commodities. The price of XAU/USD gold fell to the support level of $1697 an ounce, collapsing from the resistance level of $1732 an ounce before the results of the US data. In general, gold prices have added to their loss since the start of the year 2022 to date by more than 6.3%.

Silver, the sister commodity to gold, halved its meteorite gains. Silver futures fell to $19.425 an ounce. The white metal is still up about 8% over the past week, but silver prices are down about 17% so far this year.

Inflation Rates Decline

The US Consumer Price Index report for August was the key data point on Tuesday. According to the results, the annual inflation rate declined to 8.3%, higher than market estimates of 8.1%. Core inflation, which is decimating the volatile energy and food sectors, rose to 6.3%. The CPI rose 0.1% on a monthly basis, while the core CPI jumped 0.6%. While the Energy Index slipped to 23.8% last month, just about everything rose across the board. Where the food index rose 11.4%, the new vehicles index jumped 10.1%, used cars and trucks fell to 7.8%, the clothing rate rose 5.1%, and the shelter jumped 6.2%. The prices of medical care goods and services increased by 4.1% and 5.6%, respectively. Transportation services increased by 11.3%.

Stock Indices Collapse

The news shook the financial markets, with the collapse of major US stock indices. The Dow Jones Industrial Average lost nearly 900 points, the S&P 500 lost a total of 125 points, and the Nasdaq Composite lost nearly 500 points.

Investors are concerned that the latest numbers will probably force the Fed to move past its rate hike. Next week, the FOMC will hold its policy meeting in September, with the expectation that the US central bank will pull the trigger on a 75 basis point rate hike.

These expectations led to a rise in the dollar and US Treasury yields. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 109.66, from an opening at 108.33. The index is up more than 14% since the start of the year. A stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

The same performance in the bond market had the benchmark yield of bonds for ten years rise 6.9 basis points to 3.431%. One-year bond yields rose 23.3 basis points to 3.906%, while 30-year yields were flat at 3.51%. The spread indicating a recession between the two-year and ten-year yield has widened to -35 basis points. Gold is sensitive in an appreciation environment because it increases the opportunity cost of holding non-return bullion.

In other metals markets, copper futures fell to $3.5535 a pound. Platinum futures fell to $882.00 an ounce. Palladium futures fell to $2,099.50 an ounce.

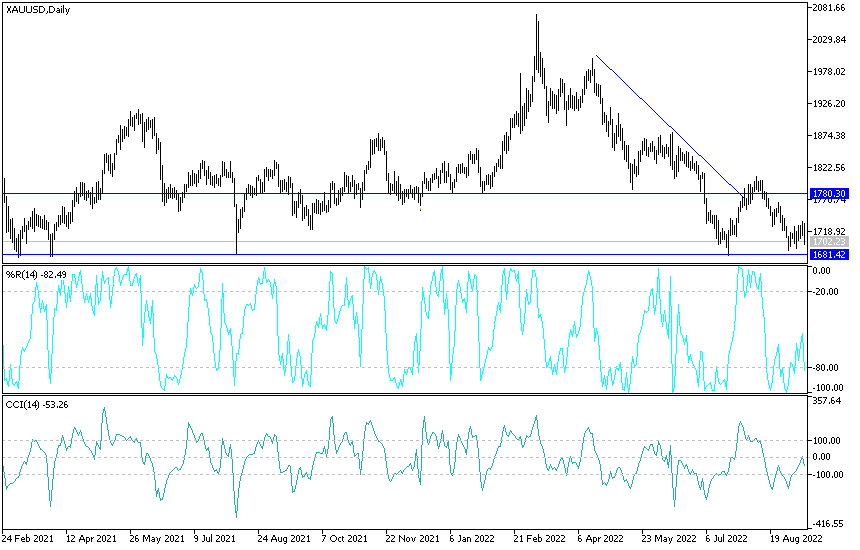

XAU/USD gold price forecast today:

- The decline in the XAU/USD gold price below the $1700 support level supports more bears' control of the trend.

- It is an opportunity to think about buying gold again, and we see that the support levels of 1688 and 1660 dollars are the most appropriate to do so.

- According to the performance on the daily chart, the psychological resistance test of 1800 dollars per ounce will be important to change the general outlook for gold to the upside.

- This requires a rebound towards the resistance levels of 1735 and 1765 dollars, respectively, for the possibility of moving towards that top.

The gold price may remain under pressure until the release of the remaining important US economic data for this week.

Ready to trade our Gold prediction today? Here’s a list of some of the best XAU/USD brokers to check out.