GBP/USD seems poised to test new lows against the Euro, Dollar and other major currencies amid poor investor sentiment towards the UK and continued weakness in global stock markets. According to the trading, the pound sterling fell 1.33% against the euro this week already. If these losses are incurred, it is on its way to the largest weekly decline against the single European currency since May. Meanwhile, the British currency continues to experience a relentless sell-off against the dollar, losing another 0.83% since the beginning of this week. The 2022 loss is now 14%. The GBP/USD pair tumbled to its lowest support level of 1.1600, after the markets collapsed during the year 2020, and settled around the 1.1620 level at the beginning of trading today, Thursday.

GBP Loses Value Against Competitors

With August closing, we can now confirm that the GBP is the worst performing major currency of the month, losing its value against all of its G10 competitors. The drop in the British pound reflects negative sentiment among global investors, which appears to be stable and therefore further losses are likely. Given its current performance and trends, the British currency is on track to be the worst performing major currency in 2022, in a matter of weeks.

Sentiment toward sterling was dealt another blow with the release of new forecasts and a research note from the influential investment bank Goldman Sachs, which showed that inflation in Britain is likely to peak at 14.8% in January 2023. Goldman Sachs says consumption is likely to decline significantly Big with rising inflation and sharply lowering growth forecasts, the UK is expected to enter a recession starting in the fourth quarter.

The British economy is now expected to contract by 0.6% in 2023.

Gary Stein, chief European economist at Goldman Sachs, said: “We see risks skew towards a more severe and prolonged recession. Gas prices may remain high for a longer period, households may dispose of their excess savings to a lesser extent and the amount of additional financial support to households may turn out to be less than assumed in our “baseline”. Under these scenarios, UK real GDP is likely to shrink 2.5% to 3.4% over the next year. Goldman Sachs' current baseline forecast assumes that the recent rise in gas prices in Europe and the UK will not continue.

They view persistently high gas prices as an upward risk to their forecasts.

“The pound is trying to hold, but there is no great outlook here and calling a bottom will be difficult,” says Neil Wilson, chief market analyst at Markets.com. Recession sentiment from GS in yesterday's well-traded note warning that inflation could reach 22%." Meanwhile, Sterling is also suffering amidst another sell-off in global stock markets and the weakness is unlikely to end until the sell-off ends. The British currency is traditionally in line with global investor sentiment, rising when investors are positive and buying financial assets and declining when the opposite is true.

Therefore, the recent sell-off in global stocks has brought the GBP/EUR exchange rate down to 1.1630 and the GBP/USD exchange rate to 1.1600.

Only when market sentiment finally improves and markets start to rise again, will the pound begin to regain lost value. Meanwhile, the sharp drop in natural gas prices has proven to support euro exchange rates. European and UK gas prices contracts for future delivery have seen a sharp decline this week, helping the euro back above parity against the dollar and extending its multi-week gains against the pound.

Sterling dollar forecast:

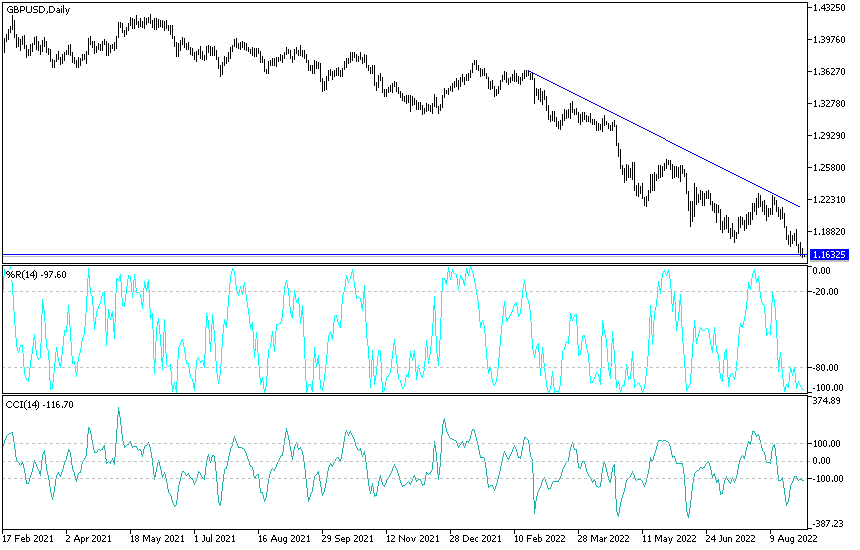

- The downside trend of the GBP/USD pair has reached its peak.

- Following the recent losses, the technical indicators have moved towards oversold levels.

- There may be opportunities for forex traders to think about buying the currency pair, waiting for the moment to rebound higher.

The support levels 1.1580 and 1.1490 may be the most important to think about that. On the other hand, breaking the resistance 1.2000 - the psychological support previously - a breach of the current sharp bearish trend may occur.

Sterling dollar gains may remain subject to selling for quite some time.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.