The US dollar continued to maintain its gains against the rest of the other major currencies since the announcement of US inflation figure.

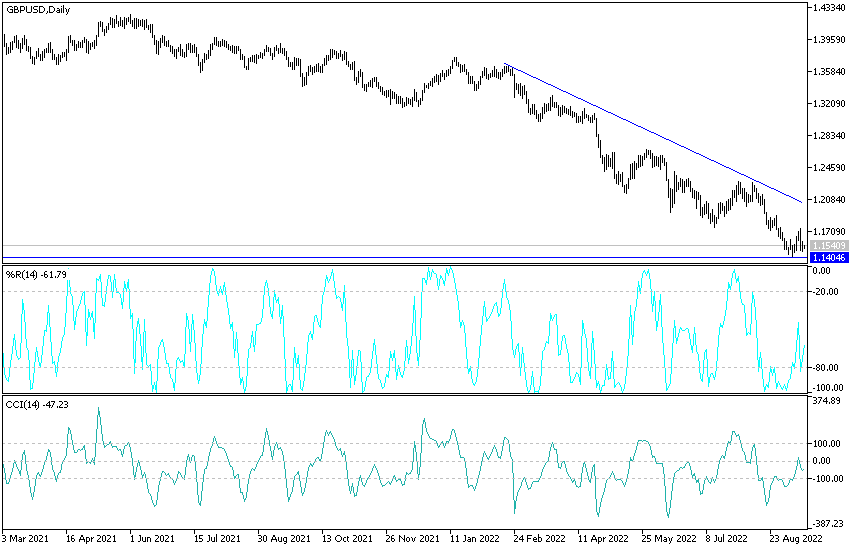

- The GBP/USD currency pair did not find an opportunity to rebound higher.

- The currency pair returned to its lowest surroundings since March 2020 before settling around the 1.1530 level at the time of writing,

- The results of the recent US economic data are in favor of the strong and sharp tightening of interest by the Federal Reserve to contain the record US inflation, which recorded its highest level in 40 years.

Risks need to be taken

UK headline inflation eased in August, but core inflation hit a new high as price pressures spread across the economy, raising the risks of the Bank of England's Monetary Policy Committee (BoE) voting on something like its own modern-day fee. The charge of the Light Brigade has been described in some parts as "a disastrous British cavalry charge against heavily defending Russian forces" during the Crimean conflict, but there are parallels between this and what would be the more likely next step for the Bank of England's September 22 interest rate setting.

This is partly because of where most of Britain's recent inflation has originated, now overwhelmingly the Russian invasion of Ukraine and its effects on energy prices, but also because of the lengths the Bank of England may have to go and the risks it may take. While most inflation in Britain originates from elsewhere, there is a risk that high levels of inflation will become a permanent feature of life in the UK economy without action by the Bank of England, although this would be one that could have negative effects. on the economy in the short and medium term.

The lengths the BoE may go to is increased by Wednesday's inflation data for August, which is part of the reason why markets are wrong to expect the BoE to raise rates by just 0.5% or 0.75% next Thursday , which could raise the benchmark index to either 2.25% or 2.5%. The risk may be that the BoE announces a larger rate move and forecasters who don't realize it may ignore how restrictive the BoE has so far due to information delays caused by the energy "price ceiling" system and the recent absence of a fully functional government.

Neither of these matters is any longer discouraging to the Bank of England's interest rate setters.

Bank of England Governor Andrew Bailey told the House of Commons Treasury Select Committee last week: “I very much welcome the fact that, as I understand it, there will be announcements this week because I think that in some sense will help frame policy and that is important. And I think it's important to have a clear path forward in politics." Meanwhile, new Prime Minister Liz Truss's government has drawn up plans to use public funding to reduce energy bills to £2,500 a year, protecting families from further increases that would have pushed the typical energy bill to more than £6,000 each year.

This limits the scale of the upcoming winter economic disaster, but it will also deepen the budget deficit and could have the effect of preventing inflation from falling back to the 2% target in the coming years, hence the risk of the BoE responding in a very aggressive manner next week. This may surprise economists and markets because many are accustomed to the Bank of England's slow and steady interest rate moves, although they may overlook that the Bank has acted aggressively.

Sterling dollar analysis today:

I expect the continuation of the downward trend for the GBP/USD currency pair in the remainder of this week's trading, in preparation for the important events next week, the policy of the Bank of England and the Federal Reserve. The currency pair may move to achieve some cautious gains if the results of the US economic data today come in less than expected. Currently, the closest retracement levels are to 1.1620 and 1.1745, respectively.

On the other hand, according to the performance on the daily chart, stability will remain below the 1.1500 support level, which is important for more bears' control over the trend.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.