The US dollar rose sharply after data showed that inflation in the US is heating up more than the markets expected. This means that the Federal Reserve will be encouraged in its desire to raise US interest rates. The most prominent after the announcement of the data was the rapid decline of the GBP/USD currency pair, with losses to the support level of 1.1490. This is after its recent gains, down to the resistance level of 1.1738. The place of yesterday's daily performance was the worst for the currency pair during one trading session in months.

In reaction to the data, stocks fell, and the safe-haven US dollar jumped after the main US consumer price index rose 8.3% on an annual basis in August, defying expectations of a reading of 8.1%, yet it remained below 8.5% in July. But the measure on a monthly basis was up 0.1% according to the BLS reading, up from the July reading of 0% and defying expectations of -0.1%.

Core inflation reading will be the most concerning

According to the results, the core CPI rose 0.6% in August, doubling the 0.3% market expectations and the July results of 0.3%. Core CPI inflation is domestically generated inflation and thus excludes exogenous variables such as energy prices; In short, it's the kind of inflation that the Federal Reserve can contain through higher interest rates. The annual increase in core CPI inflation was 6.3%, up from 6.1% the market was looking for and 5.9% in July.

The surprise inflation in the US came despite the significant drop in gasoline prices, which still indicates that the energy shock is passing, but the delay seems to surprise everyone. The Fed will be keen to raise interest rates in case this delay becomes more apparent as workers demand higher wage settlements and companies raise rates.

Trying to Beat Inflation

Wages in Britain were reported to have risen at a faster pace than expected while UK unemployment fell to its lowest level since 1974, developments that will continue to pressure the Bank of England to continue raising interest rates. The data on balance was supportive of the pound, as the currency rose against the euro, dollar, and most other major currencies in the wake of the release. In this regard, the Office for National Statistics said that the unemployment rate in Britain fell to 3.6% in July, down from 3.8% in June, beating expectations of 3.8%. From a forex market perspective, the wage data is probably the most important: Average wages rose 5.5% in July, beating expectations of 5.4% and a figure that's up from 5.2% in June.

The Bank of England is particularly interested in inflation, which is driven by domestic developments. In particular, wage settlements and price-fixing intentions by firms. Markets are expected to raise interest rates by 75 basis points on September 22nd as it tries to beat inflation, and as we note here, if they fail to do so, the GBP will likely fall.

Thus, Tuesday's labor market data reinforces the narrative that the bank must act quickly and decisively to deal with inflation, and thus expectations for a 75 basis point hike will be bolstered. There are nevertheless signs of a slowdown in the labor market as the number of jobs added in the three months to July rose to 40 thousand, well below the 128 thousand and 160 thousand expected in June.

Sterling dollar forecast today:

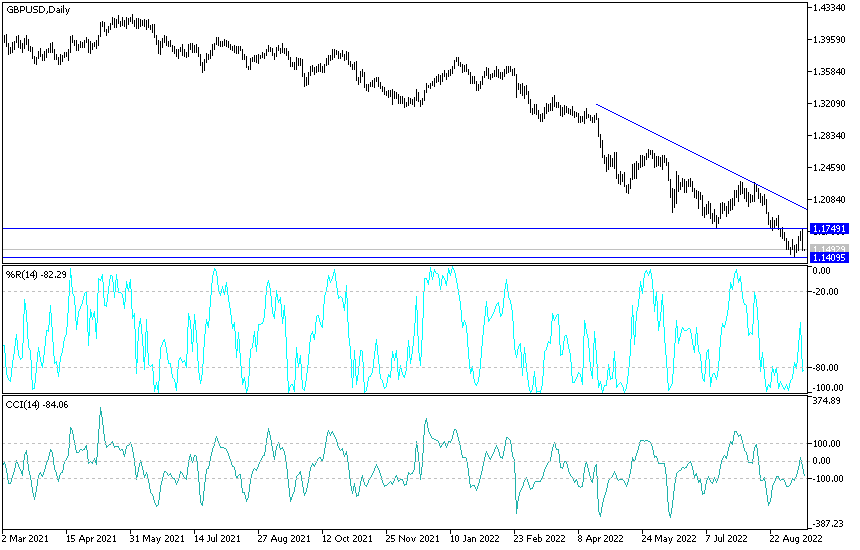

- The return of the stability of the GBP/USD currency pair below the 1.1500 support will move the technical indicators towards oversold levels.

- Breaking the 1.1410 support is catastrophic for the pound, as it may deal with a bearish currency for a longer period, which allows testing new record levels of support.

- The GBP/USD will not have a chance to change the current outlook without breaching the 1.2000 resistance.

Today, even if the British inflation numbers come in stronger than expected, the sterling dollar gains will still be subject to sale.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.