This week will be full of influential British economic data. Before the announcement of the growth rate of the British economy, the price of the GBP/USD currency pair is settling around the resistance level 1.1625. This is after the rebound gains after the collapse to the cusp of the 1.1400 support recently. After the strong demand from investors to buy the US dollar amid strong expectations to raise the US interest rate, and the demand to buy the dollar as a safe haven, the sterling is following the same path as the pessimism of the global stock markets.

The comfortable rise in the GBP/USD exchange rate came amid an improved tone of global market sentiment, but caution remains the norm. Commenting on the performance, Joe Manimbo, chief analyst at Convera, said: “The pound's highly volatile week was about to end with gains against the dollar, its first in four weeks. In a historic week, the pound fell to its lowest levels in 37 years against the dollar, Liz Truss was installed as the new British Prime Minister, and the world is now mourning the death of Queen Elizabeth II.”

Queen’s death has no market impact currently

The Queen's death had not a single noticeable impact on the market that next week the Bank of England no longer sees meeting to offer widely expected interest. Accordingly, Manimbo added: “Amid the period of mourning, the Bank of England has postponed its next meeting by a week to September 22, allowing policy makers more time to look at the data while they consider how to raise interest rates to combat double-digit inflation.”

Gains in the pound were also seen against the second best-performing currency in 2022, the Canadian dollar, confirming that there may be an element of deal squaring in the works as previous trends have been somewhat offset. Meanwhile, the Swedish Krona and the Japanese Yen are also advancing against the Pound, which confirms this theory, given that they both did the worst performing in 2022. We are therefore seeing some retaliation by the laggards of 2022 and therefore the gains will be considered technical and temporary in nature. Highlighting the currency market reversal is a more constructive mood in global markets with all major stock indices rising as investors pick up some risk.

This is of course unhelpful for the dollar, which tends to benefit when stock holdings and cash demand are liquidated.

Pierre Verrett, ActivTrades Technical Analyst, said: “The bullish correction continues after the sell-off after Jackson Hole recorded in late August, as investors now broadly accept the current low liquidity environment triggered by tighter monetary policies. However, even if the hawkish turn of the European Central Bank and the Federal Reserve, which is now seen as almost fully priced, the risk sentiment remains fragile and under threat from other remaining major concerns such as the slowing Chinese economy, the energy crisis in Europe, as well as the Continuing geopolitical problems.”

Investors can reduce holdings

In general, the US dollar rose sharply during 2022 with the Federal Reserve raising US interest rates to calm inflation in the US, but it drains liquidity from the global economy as the cost of borrowing becomes more expensive. Higher interest rates lower the stock's future earnings potential, forcing investors to reduce their holdings.

With the Fed's message now well and truly being received, and amid signs that inflation is peaking, that's an old story. Put simply, the dollar cannot continue to rise unchecked in an old story. But to say that the GBP/USD bounce is the start of a whole new recovery would be premature at this point: we've seen bear market bounces in the past.

Therefore, caution should be exercised by those who wish to have a stronger pound to buy the US currency. However, the outlook for the Pound changed for the better last week with decisive action on UK energy bills by the new Liz Truss government. The energy ceiling lowers UK inflation expectations while raising growth expectations, giving hope to a currency that has been penalized by UK stagflation expectations. If the pound loses its status as a hedge against stagflation, it may recover further.

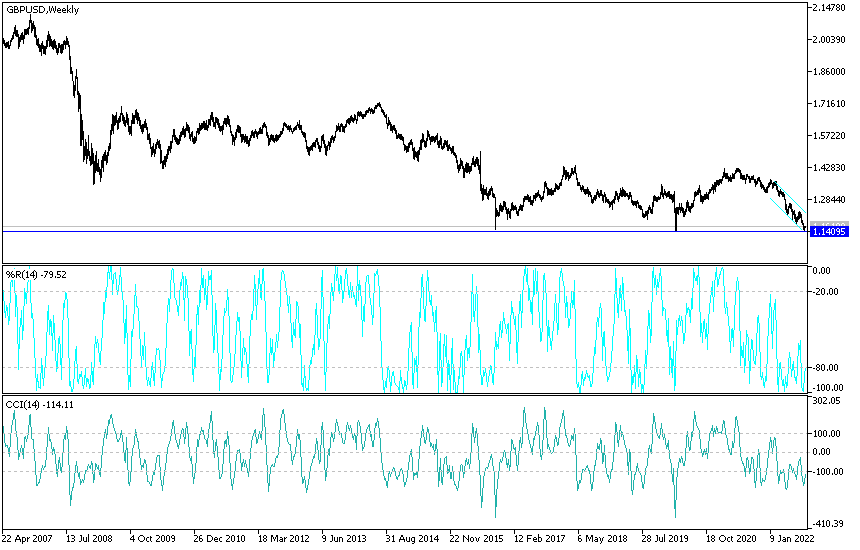

GBP/USD technical analysis:

- In the near term and according to the performance on the hourly chart, it appears that the GBP/USD is trading within the formation of a limited ascending channel.

- This indicates a significant short-term bullish momentum in market sentiment.

- The bulls will look to extend the current gains towards the 1.1634 resistance or above 1.1693.

- On the other hand, the bears will target short-term profits at around 1.1534 or lower at 1.1473.

In the long run, according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within a descending channel formation. This indicates a significant long-term bearish bias in market sentiment. Therefore, the bears will look to extend the current series of declines towards the 1.1401 support or lower to the 1.1185 support. On the other hand, the bulls will target long-term profits at around the 1.1826 resistance or higher at the 1.2042 resistance.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.