- The collapse of the sterling pound has become the talk of markets and investors, along with the collapse of the Japanese yen.

- The most prominent sterling losses were represented by the performance of the GBP/USD currency pair, as it fell to the 1.1235 support level before settling around the 1.1272 level at the time of writing the analysis.

- Sterling continues to teeter on edge as the Bank of England is asked to move significantly in rates.

- The successive 75 basis point gains that markets are expecting from the Bank of England, set the stage for an epic disappointment for the Pound Sterling.

Money markets are now priced at 200 basis points of hikes over the next three decisions, which means the bank will need to raise rates by 75 basis points in two of those meetings. This is more than any other central bank in advanced economies is asking for. Markets are pointing to a 60% chance of a 75 basis point increase Thursday, which would be the largest rate increase since its 100 basis point move in 1989.

The pressure on the bank to raise interest rates with such increases comes with other central banks raising interest rates continuously. We have already seen the European Central Bank raise interest rates by 75 basis points this month while Sweden's central bank raised interest rates by 100 basis points on Tuesday and today the US Federal Reserve raised the US interest rate by 75 basis points. The BoE must at least match market expectations if it is to defend the current valuations of the GBP. This applies not only to the dollar but also against the euro and a host of other currencies. Commenting on this, Nick Pennenbrook, international economist at Wells Fargo Securities, said: “We expect the BoE to raise its policy rate by 50 basis points to 2.25% in this week's monetary policy announcement, and then follow up with a 50 basis point rate increase in November and a 25 basis point increase. basis points in December.

Maintaining GBP/USD Support

Such a default at the September policy meeting would be quite bearish for the pound, and those looking to protect their international payments balance could consider stabilizing current rates or placing an order to protect payment balances. This is the era when economies prefer currency appreciation in order to minimize the impact of imported inflation: with a strong dollar, the cost of imports of energy and goods for non-producing countries has become surprising.

Central banks that are not seen to be tough enough in such a competitive environment risk further devaluations and higher inflation for longer. Therefore, maintaining GBP/USD support will be a policy consideration for the BoE in upcoming meetings. Sterling has struggled over the course of 2022 as the bank has established itself as a reluctant wanderer, often moving in smaller increments than the market had expected.

When it meets market expectations - as was the case in August it has a knack for issuing such dismal directives regarding expectations that the market is selling the pound anyway. Accordingly, analyst Valentin Marinov at Credit Agricole says: “The pound is still collapsing.” Among the reasons for the disconnect between the foreign exchange and interest rate markets appears to be the skepticism of foreign currency investors that the Monetary Policy Committee will be able to meet hawkish market expectations.

The recent trading witnessed the decline of the pound to its lowest level since 1985 against the dollar and its lowest level since February 2021 against the euro amid fears of disappointment in the Bank of England, and the continued demand for the dollar amid bleak market conditions and expectations of a marked economic slowdown in the United Kingdom. Meanwhile, the Bank of England is expected to provide more details about its plans to sell the bonds it bought under the quantitative easing program to the market, which could raise the cost of government borrowing.

The government's debt position will be fully understood by Friday when Chancellor Kwasi Quarting issues a "mini-budget," detailing the cost of the energy price cap and additional measures to be taken on taxes and spending intentions. And the “mini-budget” label should be treated as a traditional British cutback. The UK's borrowing trajectory appears to be another concern for international investors and helps explain why the GBP has virtually no support from higher bond yields.

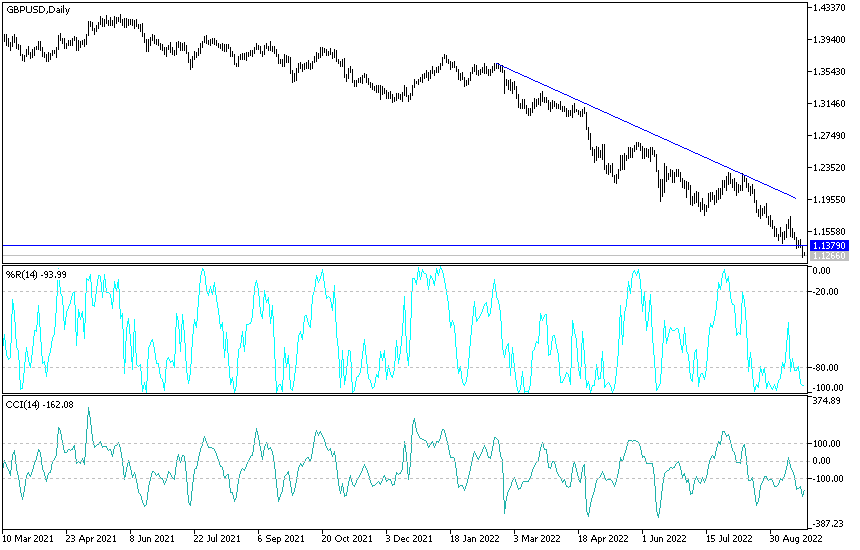

GBP/USD technical analysis today:

The downward trend of the GBP/USD pair is getting stronger and on all time frames, technical indicators have reached oversold levels, and forex traders may take advantage of the recent collapse opportunity to think about buying the currency pair. I see that the support levels 1.1240, 1.1180 and 1.1090 are the most appropriate to think about that. On the other hand, and as I mentioned before, there will be no break for the current trend, according to the performance on the daily chart, without breaching the 1.2000 resistance.

The sterling dollar pair will be affected today by the market's reaction to the decisions of the US Federal Reserve and what will be released from the Bank of England today.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.