Forex investors are trying to take advantage of the recent collapse of all currencies against the dollar, which jumped to its highest level in 20 years due to expectations of a US interest rate hike. Those currencies lack the momentum to change direction. In the case of the EUR/USD currency pair, which collapsed to the 0.9552 support level, it tried to rebound higher, but its gains did not exceed the 0.9780 resistance level. Pressures are increasing on the European Central Bank to further tighten its policy to prevent the euro from further collapse.

In this regard, according to ECB board member Martins Kazak, the ECB should raise interest rates by another 75 basis points when it sets its next policy in October, and the steps are likely to be reduced after that. Kazak said yesterday in an interview in Vilnius: “In the current situation, we can still take big steps, and the next step still has to be big because we are still far from rates that correspond to a 2% inflation rate.” and “I would agree on 75 basis points – let’s take a bigger step and raise prices faster.”

The Latvian official added that this does not mean that "75 basis points is a standard thing from now on", and that it is possible that once rates are more in line with the inflation target, future steps "will need to become somewhat more cautious". His calls for strong action are likely to be echoed by other officials from the Baltic region as they meet at a conference in the Lithuanian capital, Vilnius, on Thursday. The inflation rate in the Eurozone is currently 20%.

The price hike, driven by the Russian war in Ukraine and the resulting energy crisis, has prompted European Central Bank officials to begin raising interest rates for the first time in more than a decade — this month by three-quarters of a historical point. They are now considering how to proceed at a time when higher prices are accompanied by rising predictions of a recession.

Investors are now setting the odds of a move of another 75 basis points next month at 40%. Increasing this size would double the deposit rate to 1.5% - the highest rate since 2009. The US Federal Reserve, for its part, has rapidly tightened monetary policy this year in an effort to bring inflation down from its highest levels in four decades. Higher interest rates in the United States helped put upward pressure on the dollar, which contributed to the turmoil in global markets. On September 21, the Federal Open Market Committee (FOMC) raised the benchmark federal funds rate by three-quarters of a percentage point for its third consecutive meeting, bringing it above 3% for the first time since before the 2008 financial crisis.

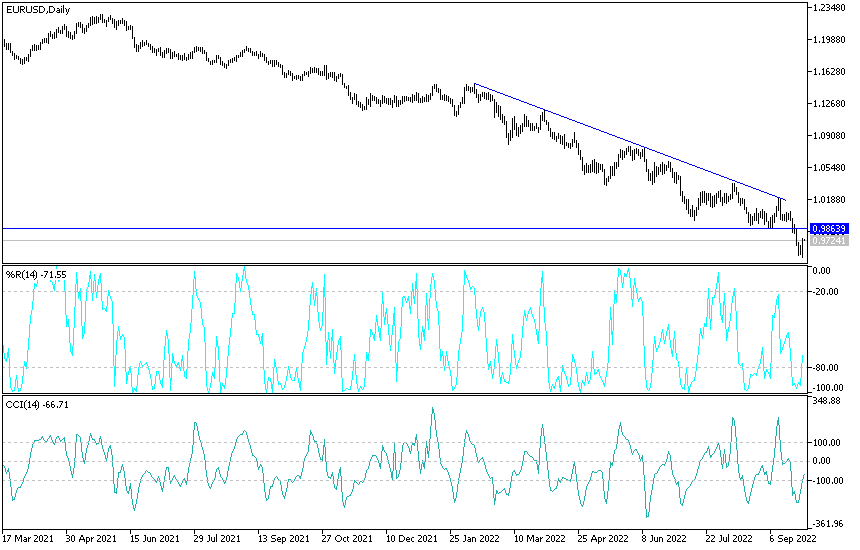

Forecast of the euro against the dollar today:

- The recent rebound attempts of the EUR/USD did not get the pair out of the sharp bearish channel.

- The general trend will remain to the downside as long as the prices are below parity.

- Breaking the resistance 0.9885 may give the bulls some momentum to launch higher, but the euro still lacks strength factors.

- The energy crisis in the euro area is exacerbating and the Russian-Ukrainian war is taking strong and sharp turns, so any gains for the euro dollar will remain a target for sale again.

According to the performance on the daily chart below, a break of the 0.9560 support will be important for the bears to launch further downward. It should be noted that the technical indicators have reached sharp oversold levels.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.