The euro against the dollar took heavy losses after sharp increases in some US inflation surprised the market. Its previous recovery from two-decade lows may have been merely a delay, rather than a derailment, in part due to the evolution of Fed policy expectations. The EUR/USD currency pair's recent gains tumbled, starting from the 1.0198 resistance, with heavy losses, reaching the 0.9955 support level, following the strength of the US dollar after the inflation data. The euro dollar is still stable below the parity price so far.

Dollar Rises Strongly

The European single currency fell more than one percent against the dollar, a more than 50% reversal of the recovery that began the previous Tuesday amid market optimism about prospects for lower inflation in the United States. Several other factors, including Ukraine's success in defeating the invading Russian army, helped the euro-dollar to nearly 1.02 highs on Monday at the start of the week's trading. The recovery collapsed quickly on Tuesday in a sign that the market may misunderstand price expectations. US interest and therefore the dollar rose strongly.

Core US inflation rose sharply in August while the overall measure fell less than expected in a result that left the Fed in a bind and this central bank was already, and even before that, inclined to do too much and too soon with its adjusted interest rather than risk doing too little. Fed officials have made it abundantly clear in recent speeches that even if US inflation continues to decline in August, there is still a risk of another big 0.75% increase in US interest rates next Wednesday, although the latest data should mean Definitely a risk now for something more important.

For his part, US Central Bank Governor Jerome Powell said last Thursday, “Time is ticking, and as I mentioned, the longer inflation stays well above target, the greater the concern that the public will naturally begin to integrate higher inflation into economic decision-making and our job is to make sure that does not happen.” We believe that the public's expectations of inflation will play an important role in the actual course of inflation. This is kind of the bedrock of our framework, and as I just discussed, it is very important that inflation expectations remain well anchored.”

Concerned about Inflation Expectations

All Fed policymakers have recently expressed concerns about increases in short-term inflation expectations, which risk raising long-term expectations and actual prices, and many have indicated that they may lose patience when it comes to bringing US inflation back to its 2% target. Last Friday, Powell also cited for the second time in recent weeks Paul Volcker's approach to inflation as a model for dealing with current price pressures, and Cleveland Fed President Loretta Mester has since echoed that sentiment. Paul Volcker was the Fed Chairman who became famous for using brutally high borrowing costs to push double-digit inflation rates out of the US economy between 1979 and 1989, which was a volatile period for global financial markets as well as for the US dollar.

Forecast of the euro against the dollar today:

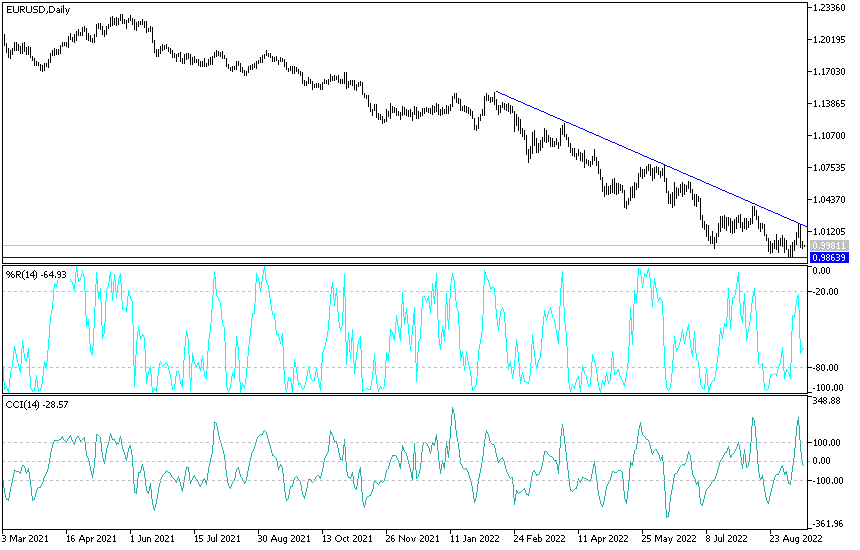

- There is no change in my technical view of the performance of the EUR/USD currency pair.

- The general trend is still bearish and stability below the parity price supports the bears’ control to move further downwards.

- According to the current performance, the closest support levels to performance may be 0.9930 and 0.9845, respectively, which is sufficient to push the technical indicators towards oversold levels.

- On the upside and according to the performance on the daily chart below, the breach of the 1.0200 resistance will be important to break the current trend.

The euro-dollar pair will be affected today by the announcement of the results of a package of US economic data, the most important of which are retail sales numbers, jobless claims, and the Philadelphia Industrial Index.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.