The EUR/USD exchange rate has entered the new week's trading with spring in its stride. It could look to extend its nascent recovery over the coming days unless the temporary rebound is hampered by the potential monetary policy repercussions of the US inflation figures due to be released on Tuesday.

The EUR/USD price rose and tested its 55-day moving average around the 1.0196 resistance after hawkish comments from European Central Bank policy makers over the weekend and amid further success of the Ukrainian army as it seeks to drive Russian forces out of the country.

Reuters cited several officials on Sunday when they reported that part of the European Central Bank's governing council sees an increased risk that European interest rates may need to rise to 2% or more in order to bring inflation down to the 2% target level in the coming years. The report came just days after the European Central Bank announced the largest rate hike yet in the history of the monetary union, which raised the one-time negative deposit rate to 0.75%, although it did little for the euro.

“The G10 central banks are now more in line with the amount of Fed tightening, and spreads have generally moved against the dollar recently,” says Derek Halpenny, an analyst at MUFG. “Add to that the growing expectation that Europe will tackle President Putin’s cut in Europe’s energy supplies head-on with massive financial support, and you have a more risk-appropriate and bearish mix for the US dollar.”

Another factor helping to push the euro higher may be the unfolding disaster for the Russian armed forces in Ukraine as they appear to be mired in a special military quagmire after a Ukrainian military counterattack is said to have overrun many strategically important Russian strongholds.

This came after Russian state television admitted on Friday that its armed forces had suffered major defeats near Kharkiv, Ukraine's second largest city, according to a report by Reuters, with Russian officials even describing the operation as a "big victory" for Ukrainian forces. For his part, President Volodymyr Zelensky said on Saturday, “Since the beginning of September, about 2,000 kilometers of our territory have already been liberated. And these days, the Russian military is showing its best — showing its back.”

Currencies Extra Sensitive this Week

It would probably be very positive for European currencies if the Russian defeats and Ukrainian victories marked the beginning of the end of the conflict in Ukraine, which caused massive economic disruption along with all the human suffering directly caused by the invasion.

However, this is not yet clear, and all currencies will be sensitive anyway this week to details of US inflation figures due on Tuesday, which could shape the Fed's monetary policy stance ahead of the September interest rate decision next week. Inflation in the US has eased in recent months but not enough to convince the Fed that it will ease enough to be able to meet its 2% inflation target anytime soon, while recent commentary from Fed policy makers suggests that interest rate makers, they've gotten tougher in recent weeks.

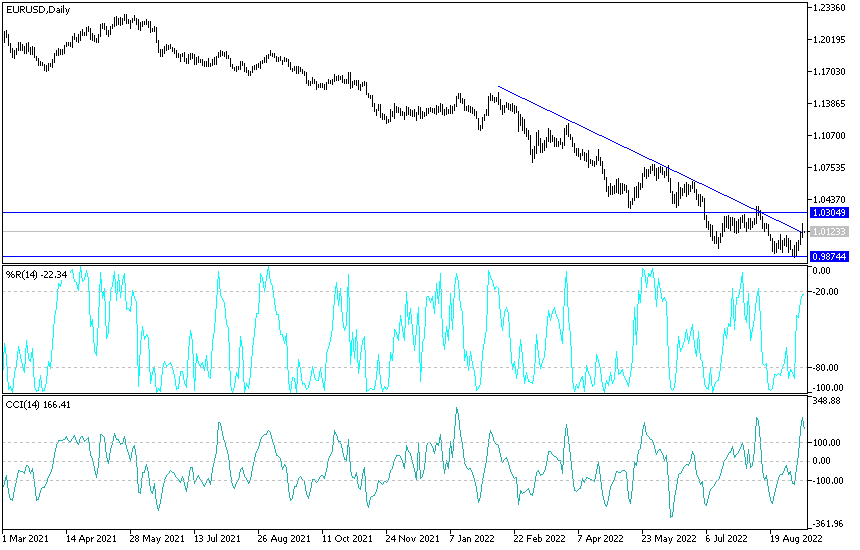

EUR/USD forecast today:

- The EUR/USD pair's bullish rebound gains remain limited and come under more pressure as the dollar remains stronger with rate hike expectations and positive US economic data.

- Accordingly, the gains of the Euro-dollar will remain limited and unstable and may be within the resistance levels of 1.0210 and 1.0300, respectively.

- This is in case the US inflation numbers come in less than expected.

- The German ZEW may remain on a downtrend.

On the downside, the bears will have the impetus to regain control over the performance of the Euro-dollar if it returns to the 1.0055 and 1.0000 support levels again. I still prefer to sell EURUSD from every bullish level.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.