The Dow Jones Industrial Average continued to decline in its recent trading at the intraday levels. It recorded losses by -0.55% in its last sessions, losing 173.14 points and settle at the end of the session at the 31,145.31 level. On the previous session it settled at the 31,318.45 level, after declining by 1.07% last friday, ending its third week of losses.

The Institute for Supply Management said its services index rose to 56.9% in August from 56.7% the previous month, its highest level since April. Economists polled by the Wall Street Journal had expected the index to fall to 55.5%. Market strategists wondered if the market was heading towards retesting its June lows, especially given September's status as the worst month of the year for the markets.

US stocks rebounded at the start of Friday's session after the August non-farm payrolls report. The report was considered not so strong that it would encourage the Federal Reserve to become bolder in raising interest rates.

But news later in the day that Russia would indefinitely shut down its main gas pipeline to Europe, raising the chances of a sharp economic slowdown on the continent, sent markets lower. These fears continued to reverberate in markets on Tuesday, even as the president promised New Minister Liz Truss will provide immediate relief from the UK's high energy bills.

After Tuesday's data, the probability of an interest rate increases of 75 basis points later in September came to 72% on Tuesday, compared to 57% on Friday.

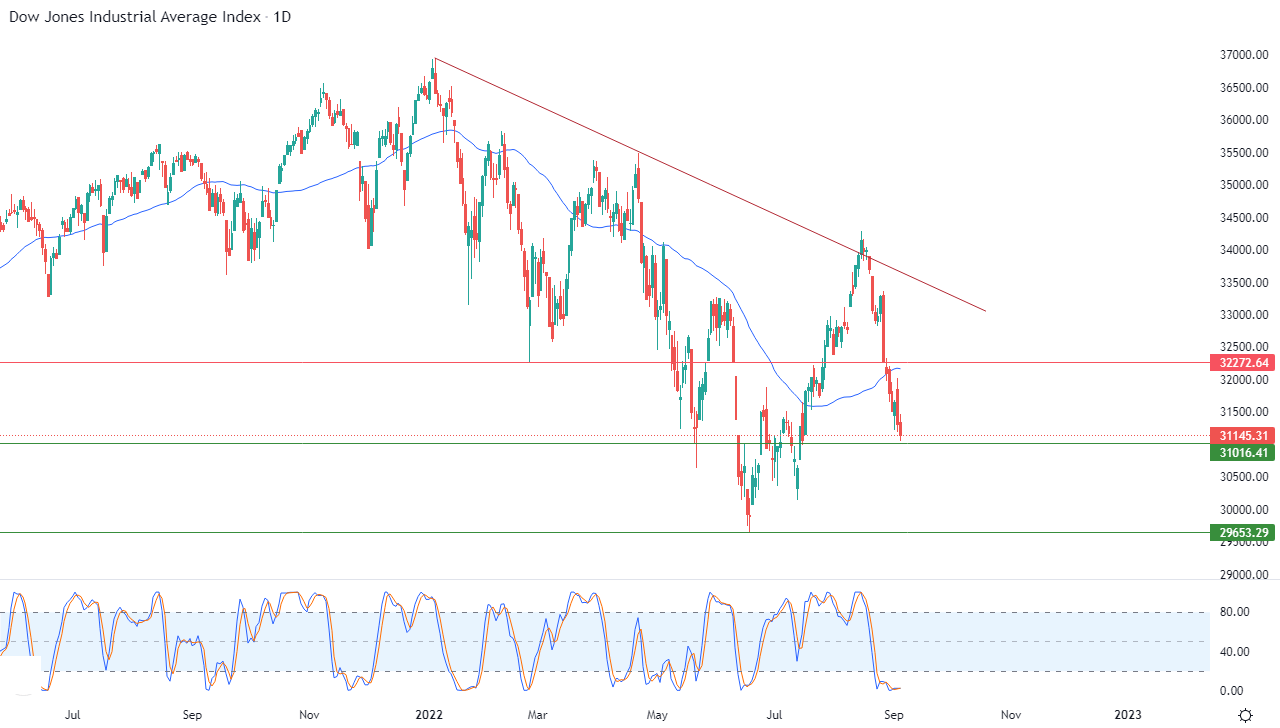

Dow Jones Technical Analysis

- Technically, the index continues to decline along with a bearish corrective trend line, as shown in the attached chart for a (daily) period.

- Negative pressure continued below the simple moving average for the previous 50 days, but in front of that we notice the beginning of a positive crossover on the relative strength indicators.

- This may curb a little from the index's upcoming losses, especially as it approached the main 31,000 support level.

However, this does not seem to prevent it from continuing to decline, on the other hand, negative pressures will continue to affect it. Our expectations indicate the continuation of the index’s decline during its upcoming trading, especially if it breaks the 31,000 main support level, to then target the pivotal support level 30,000, which it reached in last June.

Ready to trade the Dow Jones 30 daily analysis and prediction? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.