- The Dow Jones Industrial Average jumped, rising in its recent trading at intraday levels, to break a series of losses that lasted for six consecutive days.

- The index achieved sharp gains in its last sessions by 1.88%, to add the index to it about 548.75 points to settle at the end of trading at the level of 29,683.75.

- After its decline On Tuesday, trading increased by -0.43%, recording its lowest close since November 12, 2020.

Investors were listening intently to comments from Federal Reserve officials about the trajectory of monetary policy. Atlanta Fed President Rafael Bostic on Wednesday endorsed a further 75 basis point interest rate hike in November.

Chicago Fed President Charles Evans also said the Fed will likely carry borrowing costs back to where they need to be by early next year.

US stocks were hit hard in 2022, on fears that a strong push by the Federal Reserve to increase borrowing costs could push the economy into recession.

Meanwhile, Treasury yields fell sharply, after the Bank of England said it was interfering with the purchase of unlimited amounts of long-term bonds to help stabilize markets. Gold yields rose and sterling fell to a record low in the wake of Britain's budget announcements last Friday. The Bank of England has also postponed a planned gold sale to next week.

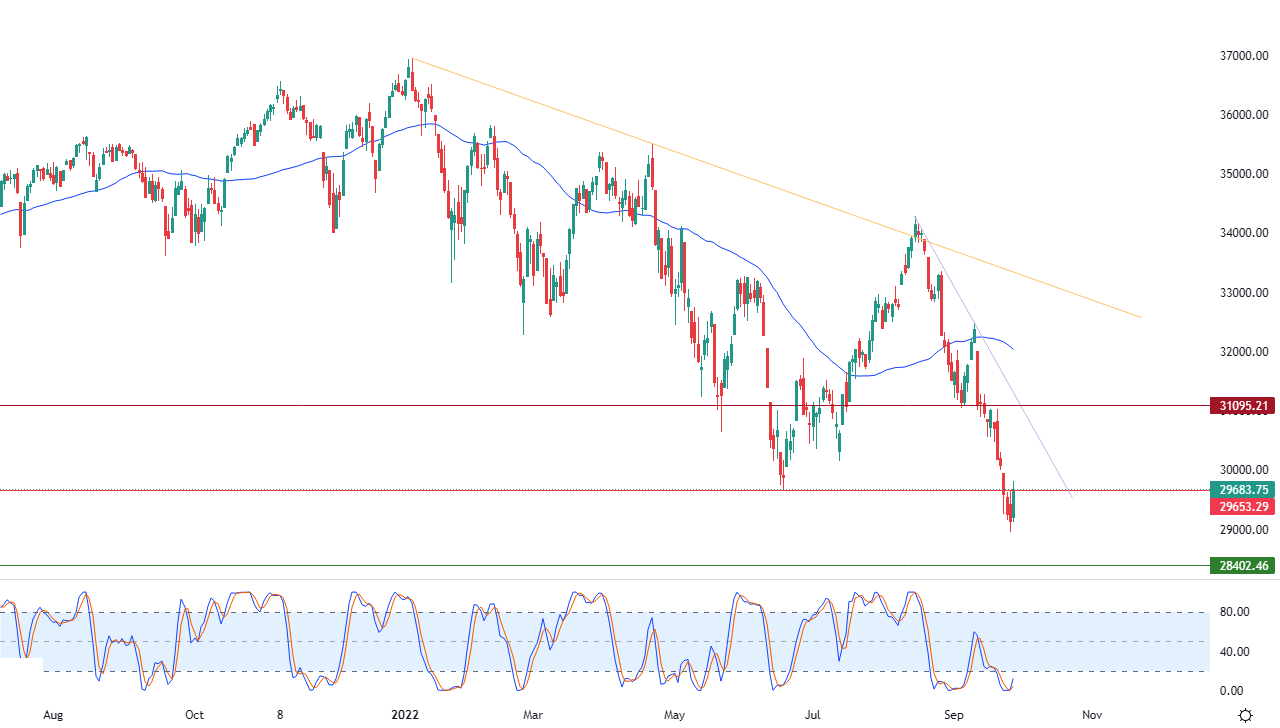

Dow Jones Technical Analysis

Technically, the index, with its recent rise, is trying to compensate for part of what it incurred from previous losses. At the same time, it is trying to drain some of its clear selling saturation with the relative strength indicators, especially with the start of the influx of positive signals in them. This is considering the dominance of the corrective bearish trend in the short term along a slope line, with the negative pressure continued for its trading below the simple moving average for the previous 50 days, as shown in the attached chart for a (daily) period.

Therefore, our expectations suggest a return to the index's decline during its upcoming trading, especially if the 29,653.30 resistance level remains intact, to target the 28,402.50 support level.

Ready to trade the Dow Jones 30 daily analysis and prediction? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.