Today's recommendation on the lira against the dollar

- Risk 0.50%.

- None of the buy or sell transactions of yesterday were activated

Best selling entry points

Entering a short position with a pending order from levels of 18.33

- Set a stop-loss point to close the lowest support levels at 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the strong resistance levels at 17.70.

Best entry points buy

Entering a buy position with a pending order from levels of 17.85

- The best points for setting stop-loss are closing the highest levels of 17.54.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 55 pips and leave the rest of the contracts until the support levels 18.31

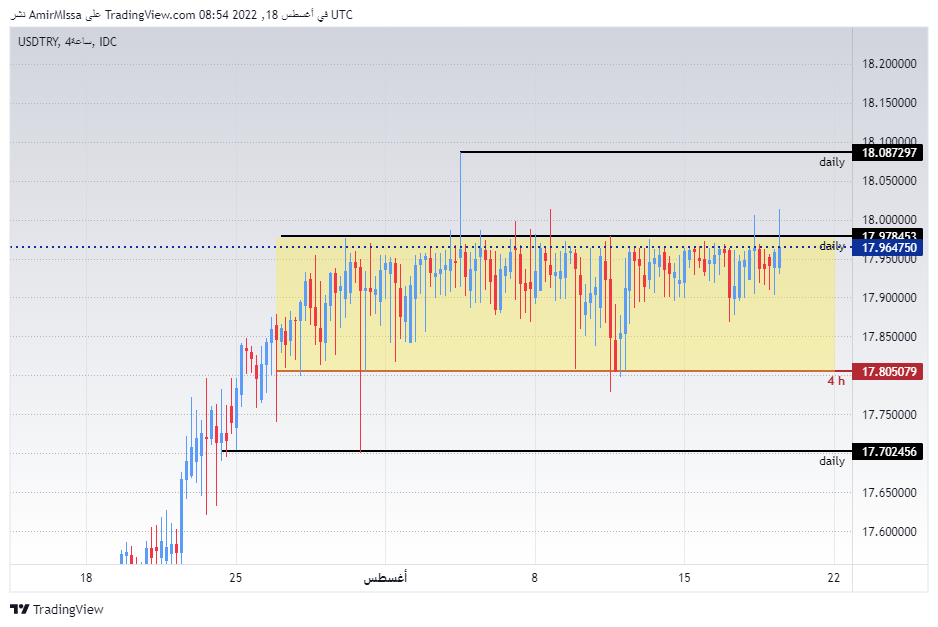

Analysis of the Turkish lira

The price of the USD/TRY only moved slightly during today's early trading, the dollar had risen near levels of 18 lira yesterday, before the pair returned to stability below this level. The dollar rose against the major currencies during yesterday's trading after the announcement of the FOMC meeting minutes, which showed the possibility that the Fed will start moving interest rates at a slower pace depending on the circumstances and economic data. Some Fed members also saw the possibility of keeping the interest rate at elevated levels for a period of time even as inflation began to be brought under control.

Despite the dollar's gains against most major currencies and emerging market currencies, the US currency did not move only slightly against the lira, as observers attributed the intervention of the Turkish Central Bank directly to impose a kind of stability for the lira price. It is noteworthy that the Turkish Central Bank is suffering from a decline in the volume of foreign exchange, but the bank has received support of several billions from Russia within the project to establish a nuclear plant in the country.

Turkish Lira Technical Outlook

On the technical front, the US dollar against the Turkish lira settled without changes within the same narrow trading range shown on the chart. The pair traded the highest support levels, which are concentrated at 17.85 and 17.75 levels, respectively. While the lira is trading below the resistance levels at 18.00 and 18.07, respectively. The pair is also trading above the 50, 100 and 200 moving averages, respectively, on the four-hour time frame as well as on the 60-minute time frame, indicating the long-term bullish trend. The chance of the lira rising against the dollar is still slim as the pair is heading in an overall bullish trend. As each decline of the pair represents a good buying opportunity, please adhere to the numbers in the recommendation, with the need to maintain capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.