A bullish price gap characterized the performance of the price of the USD/JPY at the beginning of this week’s trading. The currency pair moved towards the resistance level 139.00 before settling around the 138.70 level at the time of writing the analysis.

There is an opportunity to move towards the psychological resistance level of 140.00, where the strength factors of the US dollar against everyone are still strong. The US dollar gained strong impetus from the indications and confirmation of the US Federal Reserve governor that the bank is determined to increase US interest rates in a strong and continuous way. The announcement came amid weak bets that the US economy will enter a recession as many had expected before.

Powell said that the size of the Fed’s rate increase at its next meeting in late September - either half or three-quarters of a percentage point - will depend on inflation and jobs data. However, an increase in either size would exceed the traditional Fed-mandated increase by a quarter of a point, which reflects how severe inflation is. The Fed chair said that while the low inflation readings reported for July were "welcome”, adding that "the one-month improvement is much less than what (federal policy makers) will need to see before we can be confident that Inflation is moving down”.

Last Friday, the Fed's inflation data showed that prices fell 0.1% from June to July. Although prices jumped 6.3% in July from 12 months earlier, that is down from 6.8% year-over-year in June, which was the highest since 1982. The drop largely reflected lower gas prices.

In his Friday speech, Powell noted that the history of high inflation in the 1970s, when the central bank sought to counter high inflation by raising interest rates intermittently, shows that the Fed must remain focused. He added that "the historical record strongly warns against cutting interest rates prematurely," and that "we must continue to do so until the job is done."

Of particular concern to Powell and other Fed officials is the potential for inflation to become entrenched, prompting consumers and businesses to change their behavior in ways that perpetuate high prices. If workers, for example, begin to demand higher wages to keep up with higher inflation, many employers will pass on higher labor costs to consumers in the form of higher prices. Many analysts are speculating that Fed officials would like to see lower monthly inflation readings for about six months, like July, before stopping the rate hike.

USD/JPY Forecast:

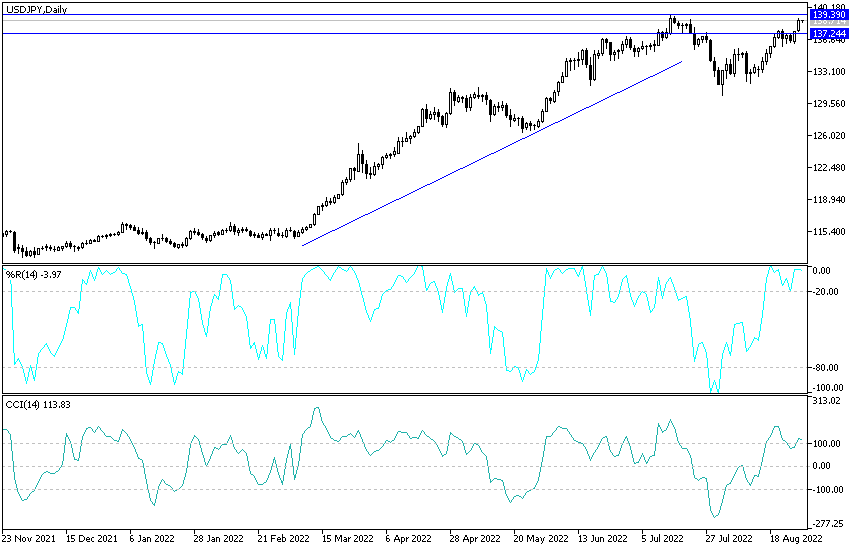

- I expect the USD/JPY currency pair to remain within its ascending channel range until the US job numbers are announced by the end of the week.

- Amid the continuation of the bullish momentum, I do not rule out testing the 140.00 psychological resistance, the highest for the currency pair in 25 years.

- Including and among the highest of them is the event that you can think of concluding selling deals without risk and waiting for sales to take profits, which may occur at any time.

On the downside, it broke the support 136.00, a first breach of the current ascending channel, and it is not considered a change in direction without breaking the 132.90 level. Today, the US Consumer Confidence and the number of US job vacancies will be announced.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.