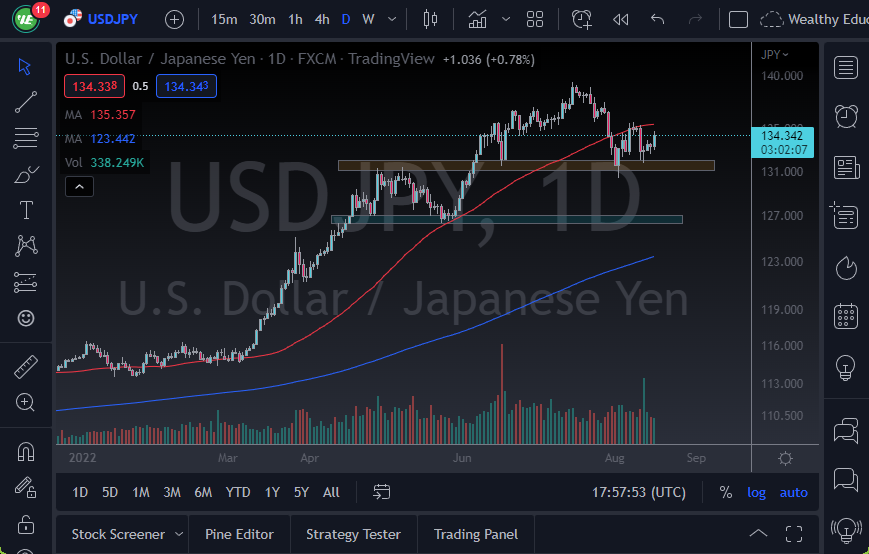

- The USD rallied a bit against the Japanese yen on Tuesday as we see quite a bit of upward pressure longer-term.

- Ultimately, it’s worth noting that the ¥131 level has been massive support from before, and the fact that the USD/JPY currency pair has bounced from there recently suggests that the uptrend is very much intact.

Watch the 10-Year Yield

You should always keep an eye on the 10-year yield in the United States, as it could give you a bit of a “heads up” as to where we are going next. This is because the Bank of Japan continues to buy unlimited bonds, essentially printing unlimited yen. In that situation, traders are likely to continue seeing reasons to push this market higher. The yield differential between the 2 currencies is astronomical and more likely than not going to continue to push this pair higher.

However, if we start to see yields drop in general, then it’s likely that we will see the Japanese yen strengthen a bit, due to the fact that they will not have to print as much currency. At this point, it’s difficult to imagine a scenario where we break away from this correlation, especially as there are so many people paying close attention to the situation with central banks around the world and whether or not the Federal Reserve is going to have to tighten much further than Wall Street is willing to admit.

That being said, if Wall Street finally listens to the Federal Reserve and believes what they are saying when it comes to monetary policy, we will more likely than not see this pair go much higher. Granted, some people are already calling this a bearish black, but I think we have a way to go before you can make that argument. If we were to break down below the ¥131 level, we could go looking to the ¥127 level. The ¥127 level is where I defined the trend as changing, so if we were to break it down below there, then we may have to reevaluate the entire trend. Until then, I suspect that this is a market that continues to be a “buy on the dips” situation, just as it has been for several months. The €140 level above is the price, so we will see whether or not this market can get there.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.