Spot natural gas prices increased in the recent trading at the intraday levels, to achieve slight daily gains until the moment of writing this report, by 0.54%. It settled at the price of $8.429 per million British thermal units, after rising sharply during yesterday’s trading by 8.01%, to compensate for the losses of the previous two sessions.

Natural gas futures prices rose on Wednesday, amid little change in weather forecast or production data, bringing the spot month in NYMEX to $8,266 per million British thermal units, an increase of 56.0 cents a day, and October futures jumped 56.4 cents to $8,262.

NGI's Spot Gas National Avg spot gas prices varied as warm weather spread to the US East Coast, increasing cooling loads across the region, rising about 13.0 cents to $7,940.

A consent agreement was reached between the Freeport terminal and the Pipeline Hazardous Materials Safety Administration (PHMSA), and the news spread like wildfire, as confirmed by the LNG export terminal.

Freeport announced that in addition to the corrective actions outlined by PHMSA in the agreement, several are already underway, and initial operations in October may consist of three liquefaction trains, two LNG storage tanks and an LNG loading dock. The management team said it believed these operations would enable the delivery of approximately 2 billion cubic feet per day of LNG “enough to support existing long-term customer agreements.”

Despite Freeport's potential yield, Thursday's weekly storage report could provide the market with the next bit of data that could push prices sharply in either direction.

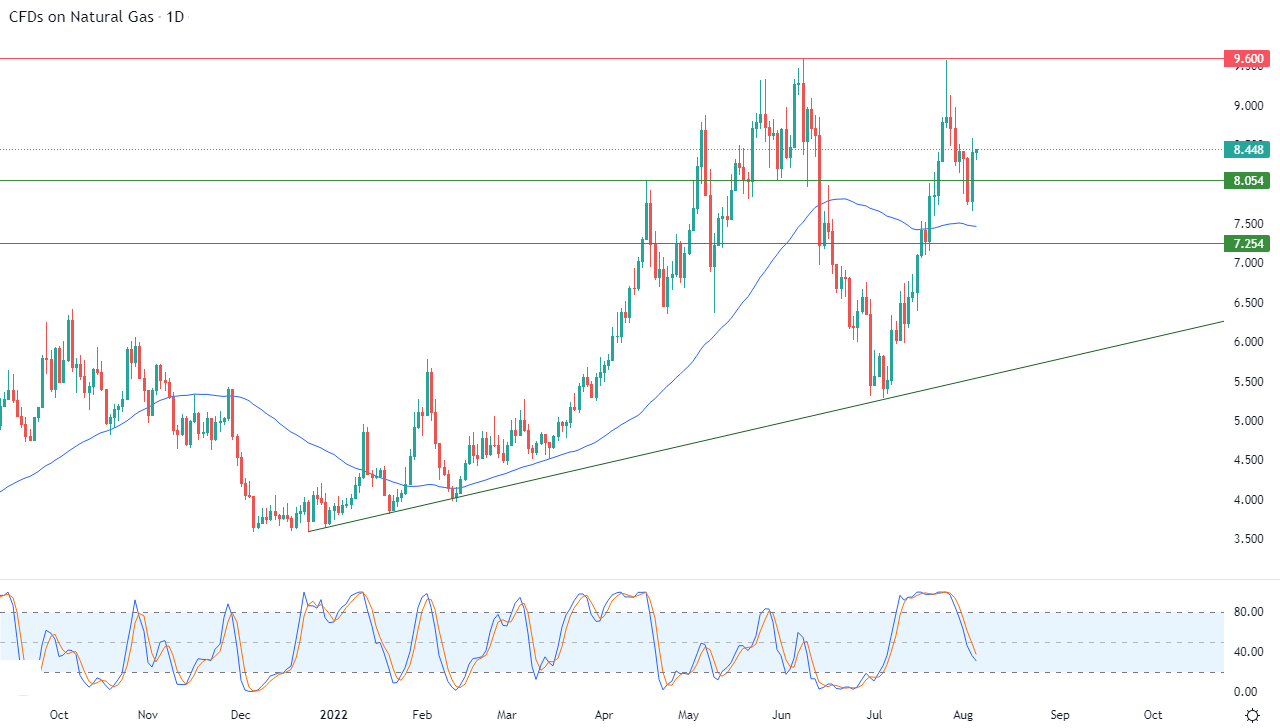

Technical Outlook for Natural Gas

Technically, natural gas managed during its recent trading to return its stability above the level of 8.054. This is in light of the dominance of the main bullish trend in the medium and short term along a slope line, as shown in the attached chart for a (daily) period. The positive pressure continuing for its trading above its simple moving average for a period of the previous 50 days. We notice the continuation of negative signals on the RSI indicators, which might curb the upcoming price gains.

Therefore, we expect more rise for natural gas during its upcoming trading, especially as long as its stability is above 8.054, to target the pivotal resistance level 9.600.

Ready to trade Natural Gas Forex? We’ve made a list of the best commodity trading brokers worth trading with.