Spot natural gas prices (CFDS ON NATURAL GAS) continued to rise in recent trading at intraday levels, to achieve daily gains until the moment of writing this report, by 2.38%. It settled at the price of $ 10.028 per million British thermal units, after rising sharply during yesterday’s trading by reaching 5.04%.

Natural gas stole the spotlight on Monday as prices in the United States rose to a 14-year high, with analysts attributing the gas price move to Russia's decision to halt flows to Europe along the Nord Stream 1 pipeline.

Gazprom announced late last week that the Nord Stream 1 pipeline will be suspended for three days of maintenance, and the real concern for the market is whether flows will resume after this period.

- In the United States, August-September has historically been the strongest season of the year for natural gas, with a combination of potential supply disruptions from hurricanes and the anticipation of the upcoming home heating season.

- Issues related to the supply of Russian natural gas to Europe have also been a factor.

The current tight supply of demand is underlined by US crude stocks in the Strategic Petroleum Reserve (SPR), which are at their lowest level in more than 35 years.

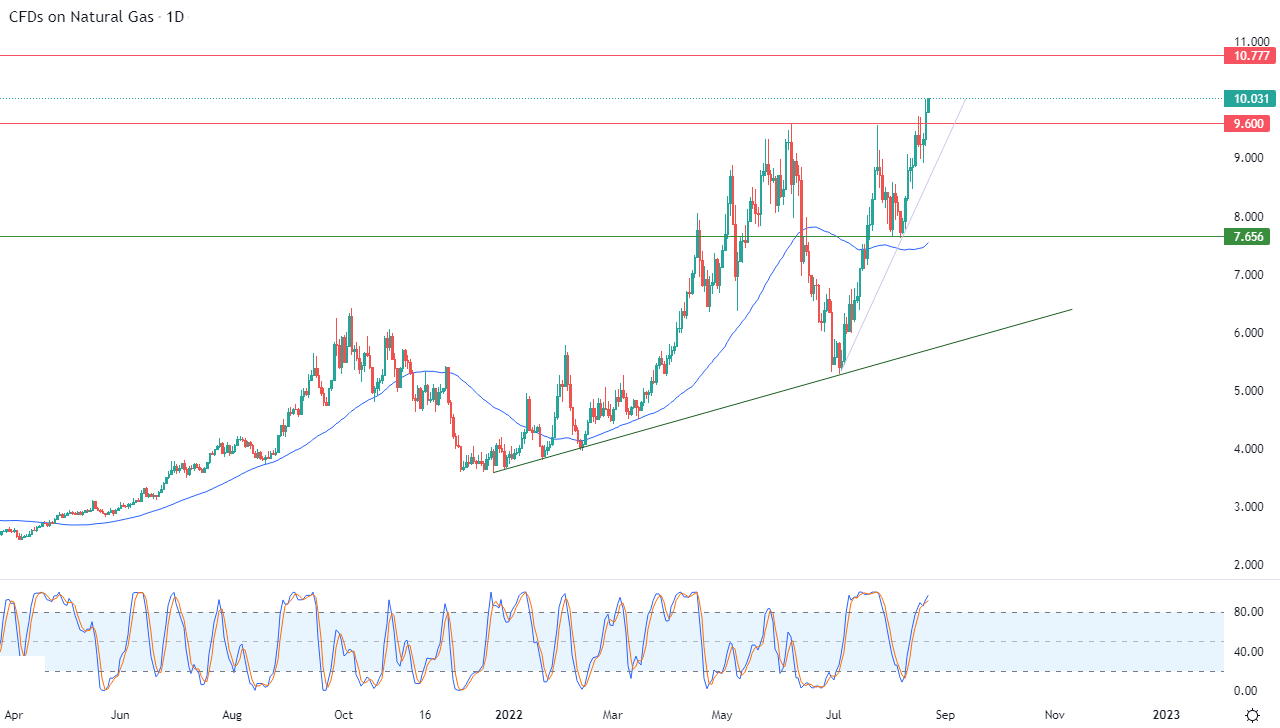

Natural Gas Technical Outlook

Technically, natural gas, with its recent rise, succeeded in breaching the pivotal resistance level 9.600, to settle above it until the moment of writing this report. It is amid complete control of the main bullish trend in the medium and short term along major and minor slope lines, as shown in the attached chart for a (daily) period. The continuation of the positive pressure with its trading above its simple moving average for the previous 50 days. The influx of positive signals on the relative strength indicators is despite reaching overbought areas.

Therefore, our expectations indicate more ascent for natural gas during its upcoming trading, especially as long as its stability is above 9.600, to target the first resistance levels at 10.70.

Ready to trade FX Natural Gas? Here are the best commodity trading brokers to choose from.