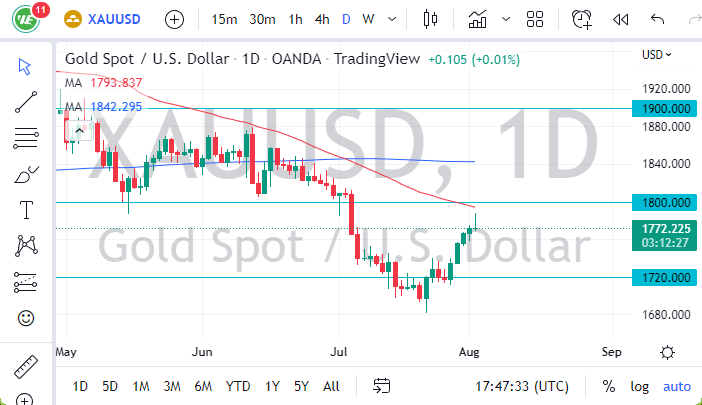

- Gold markets rallied a bit Tuesday only to find a lot of resistance near the 50-day EMA.

- Furthermore, we are sitting just below the $1800 level, so it does make quite a bit of sense that we would see plenty of sellers.

- The $1800 level has been important support in the past, so it’s only a matter of time before “market memory” comes into the picture.

Finding Answers at the $1720 Level

The shape of the candlestick is a shooting star, and that of course is negative. Because of this, it’s very likely that we will continue to see plenty of downward pressure, but I don’t necessarily know that it would be the end of the gold market trying to rally, just that it might be ready to pull back. I think the real question is found answered at the $1720 level. If we break down below there, then we could put a serious attempt into the idea of breaking down below the $1680 level. If we break down below there, then the market will unwind, perhaps going down to the $1500 level.

On the other hand, if we were to break above the $1800 level, we could see a move higher, but I think it’s not necessarily until we get above the $1815 level that it becomes important. At that point, then we might make a move to the 200-day EMA. I don’t know if we can get there but obviously would make quite a statement.

When you trade gold, you need to be aware of interest rates in the United States, which spiked during the trading session, which also works against the value of gold at times. Furthermore, the US dollar strengthened, which doesn’t help gold markets overall. Because of this, I think that at the very least we are going to see a bit of a drop from here. I think the only thing you can probably count on is a lot of volatility, so you will need to be cautious about your position sizing, as it’s likely we continue to see noise overall. Gold markets are notoriously volatile to begin with, so this type of environment is only going to be exacerbated and you need to be concerned about your account more than anything else. The giveback was quite impressive.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.