For three trading sessions in a row, the GBP/USD currency pair is subjected to selling operations, as a result of which it settled around the 1.2105 support level. It is close to testing an important support 1.2045, which supports more bears' control of the trend. The gains of the GBP/USD last week brought it to the resistance level of 1.2277, but as I mentioned many times before, the gains of the currency pair will remain subject to selling as long as the US dollar is strong with the expectations of raising the US interest rate and the investors' demand for it as a safe haven. On the other hand, sterling is in the position of worrying about a strong recession in Britain, as well as worrying about the future of political life in the country.

According to the fundamental analysis, the GBP/USD is trading affected by the announcement that the UK's primary GDP for the second quarter exceeded the expected change (Quarterly) by -0.2% with a change of -0.1%. The Equalizer (YoY) also beat expectations at 2.8% with a 2.9% reading, while June GDP beat expectations (MoM) at -1.3% with -0.6%. On the other hand, Industrial Production for June came in stronger with -0.9% (MoM) change vs. -1.3% expected. Industrial production for June also outperformed both estimates (MoM) and (YoY) at -1.8% and 0.9% respectively with readings of -1.6% and 1.3%.

From the US, the Michigan Preliminary Consumer Confidence Index for August exceeded expectations at 52.5 with a reading of 55.1. Initial jobless claims exceeded 263 thousand with 262 thousand, while continuing claims lost 1.407 million with 1.428 million.

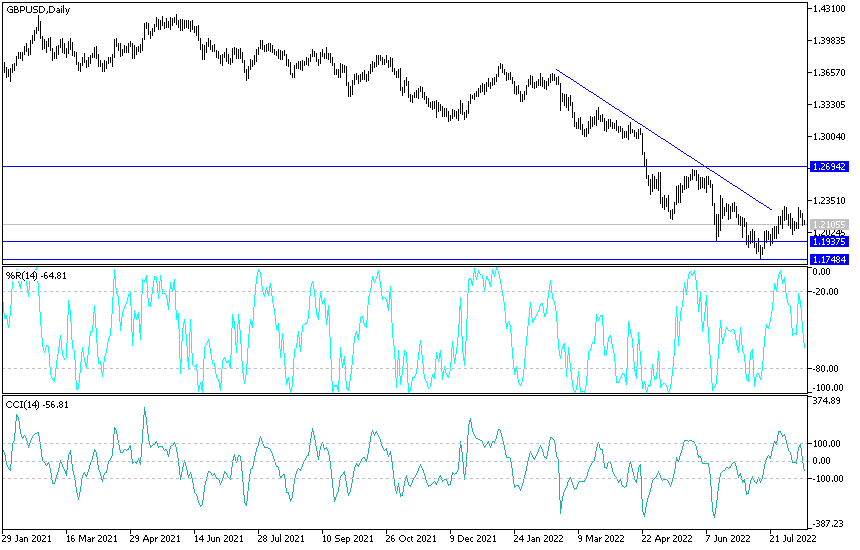

GBP/USD Technical Analysis

In the near term and according to the hourly chart, it appears that the GBP/USD is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to extend the current declines towards 1.2107 or lower to 1.2067. On the other hand, the bulls will target short-term profits at around 1.2164 or higher at 1.2204.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD currency pair is trading within an ascending channel formation. This indicates a long-term bullish slope in market sentiment. Therefore, the bulls will look to extend the current gains towards 1.2294 or higher to 1.2466. On the other hand, bears will look to pounce on profits at around 1.1980 or lower at 1.1806 support.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.