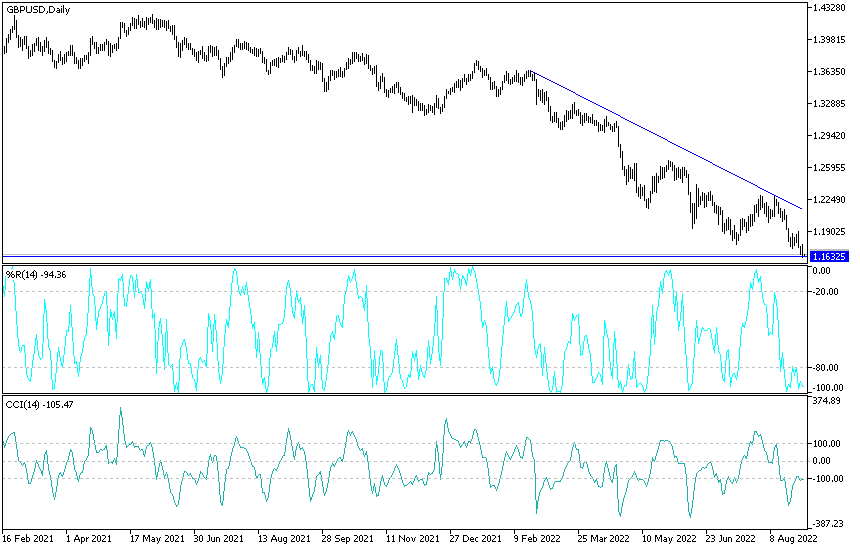

The price of GBP/USD fell to a new low after the pandemic with the beginning of trading this week. It fell to the 1.1621 support level, the lowest for a pair since the collapse caused by the Corona pandemic in prices during the year 2020. It settled around the 1.1660 level at the time of writing the analysis.

The GBP/USD pair could fall further if the Federal Reserve's increasingly stalled approach to inflation continues to dampen risk appetite in another important trading week that weighs on the US economic backdrop. US exchange rates were bought off with sterling selling in bank holiday trading on Monday, sending the pound to a new post-pandemic low under 1.17 after US Federal Reserve Chairman Jerome Powell said on Friday that the US economic slowdown would not prevent the Federal Reserve.

For his part, Fed Chair Powell suggested at a Jackson Hole seminar on Friday that he and others at the Fed look to the 1970s and 1980s for instructions on how to bring down US inflation, evaporating risk appetite in the global market, and pushing the dollar into rising along with US bond yields. US interest rates were raised to levels penalizing a period of economic paralysis in the 1970s and 1980s to cut inflation and led financial markets on Friday to anticipate a similar approach from the Federal Reserve this time when Powell said the US interest rate was likely. It held the expected peak of 3.75% "for some time".

The main question for European currencies is whether the natural gas crisis and its impact on regional price growth is really true. Our sense is that it is already well social, particularly in the UK. Friday's widely awaited speech has lifted shorter-maturity US bond yields and put pressure on those parts of the market that have been betting on Fed rate cuts in the early months. This will be from next year while improving the high yield and safe haven attractiveness in the market led by the US dollar.

Pound Tumbles Further

This has sent sterling down to new post-pandemic lows on Monday. With few technical hurdles remaining on the charts to interrupt any further declines, there is now a risk that the pound could tumble further towards the 1.1412 support next week, the lowest level since March 2020 and April 1985.

Sterling dollar forecast today:

- The general trend of the GBP/USD pair is still bearish.

- Stability below the psychological support 1.2000 motivates the bears to move further down, despite ignoring the movement of the technical indicators on the daily chart to oversold levels.

- There will be no chance for the sterling to recover for a while without sudden indications from the Bank of England that it is determined to raise interest rates with no fear of economic recession.

According to the performance on the daily chart, breaking the resistance 1.2080 is important for the bulls to launch and change the direction, even for a short time.

On the downside, the closest targets for the current general trend are the support levels 1.1610, 1.1550 and 1.1470, respectively. Today, the focus will be on the US ADP data to measure non-farm payrolls and the PMI reading from Chicago.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.