The EUR/USD exchange rate entered the new week's trading once again, determined to break the parity rate. The currency pair actually crashed towards the 0.9926 support level, the lowest for the currency pair in two decades. It settled around the 0.9950 level ahead of the announcement of the PMI readings for the manufacturing and services sectors for the economies of the euro zone amid expectations of a further slowdown in the bloc's economy due to the continuation of the Russian-Ukrainian war and its repercussions.

The euro briefly benefited after ECB Executive Board member Isabelle Schnabel suggested last week that a second 0.50% increase in ECB interest rates for September should not be ruled out, but her relief from selling pressure was temporary. The euro was quick to collapse back toward parity during the latter half of last week after remarks on Wednesday from a string of Fed officials reopened the market debate over whether the Fed might opt for a third 0.75% increase in US interest rates. The next meeting is in September.

Commenting on the performance, Jordan Rochester, FX analyst at Nomura said, “The euro has been very range bound, but we don't think that will last. There has been a huge imbalance of euro shorts since parity was reached, governments began to share high energy costs with consumers, companies will have to start cutting production slowly, while supply lines are being damaged by a lack of transportation options and low water levels on the Rhine.”

“The market could also start the price to fall softer in the US, with an eye on PMIs this week if we bounce back, as seen in the Philadelphia Fed survey, it could keep the euro under pressure as well,” the analyst added. The Analyst's view is a reconfirmation of expectations that EUR/USD will fall back to 0.9750 by the end of September.

EUR/USD Economic Data

The euro recovered from the strength it lost earlier in July after some US economic figures indicated that the economy may be close to recession, while other data indicated that inflation pressures may have moderated in recent months, leading to speculation about a possible slowdown in the economy. This is the rate at which stagnation occurs. The Fed is likely to raise interest rates next year.

US employment figures and other data mocked concerns about the health of the economy earlier this month, while some members of the Federal Reserve's rate-setting committee continued to pay short attention last week to the concept of a slowdown in the pace of policy normalization. In the future, resulting in a simultaneous recovery in US bond yields and the dollar.

- EURUSD will be sensitive this week to the message and implications of the latest S&P Global Manufacturing and Services PMI surveys on Tuesday, especially if they show any signs of bottoming out expectations for European economies.

- Thursday's July ECB meeting minutes are also likely to be poured, although much about the euro's future will depend on the dollar's response to economic figures due out of the US ahead of Federal Reserve officials' comments on Friday.

EUR/USD forecast today:

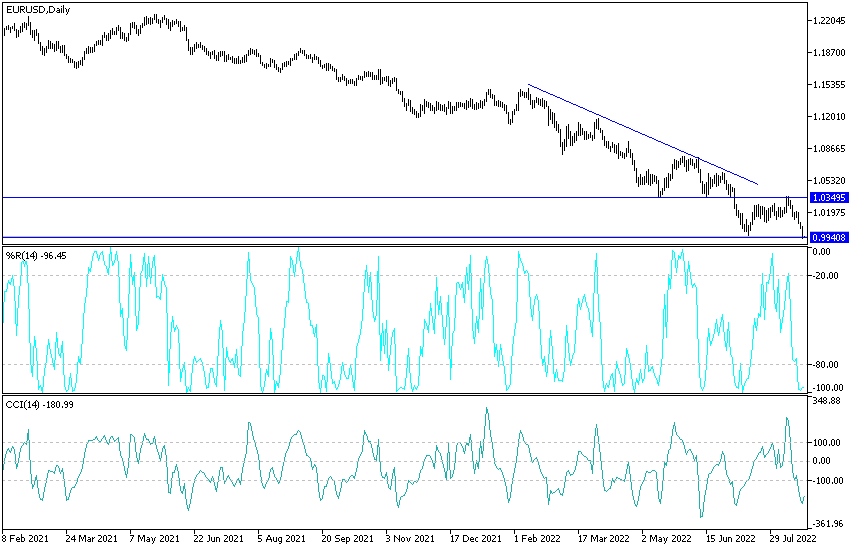

The general trend of the EUR/USD currency pair is still bearish. Stability below the parity price confirms it is stronger. Continuing control of the bears on the trend and is warning of a stronger downward move if the weakness factors of the currency pair persist. The euro may remain under pressure from fears of a complete cut off Russian gas from Europe. Therefore, any attempts for the EUR/USD pair to rebound higher will be subject to selling.

The closest support levels for the euro dollar today are 0.9920, 0.9835 and 0.9770, respectively. On the other hand, on the daily chart, breaking the resistance 1.0200 will be important for an initial break of the current downtrend. The Euro will be affected by the announcement of the PMI readings for the manufacturing and services sectors for the Eurozone economies. From the United States, the PMI reading for the manufacturing and services sectors and US new home sales will be announced.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.